Bill zzp dossier: repeat of moves

Last Friday, outgoing Minister Van Gennip (Social Affairs and Employment) made public the bill "clarifying assessment of labor relations and legal presumption.

Budget Day 2023: what's in store?

Last Tuesday was the third Tuesday of September and that means Budget Day! Because of the outgoing administration, it was a Budget Day in special times.

IRS puts an end to 'free substitution' model agreement

Salaried workers are now almost twice as likely to change employers (external mobility) as in 2015. While a similar number of people change jobs with their existing employer (internal mobility) as in 2015.

The cabinet has fallen, now what?

After the fall of the Cabinet, political parties will be especially busy in the coming weeks:

Opinion piece: The zzp spirit is out of the bottle - let workers choose their own form of contract

Recently, labor market data specialist Intelligence Group released figures showing that the majority of self-employed people are eager to stay in business.

HeadFirst Group organizes knowledge session for SGP parliamentary party

On Thursday, March 16, HeadFirst Group, in collaboration with our partner ONL voor Ondernemers, organized a knowledge session for the SGP parliamentary party.

Frequently asked questions outline 'Progress letter on working with and as self-employed(s)'

Are you already familiar with the three tracks the government has come up with to restore balance to the current labor market? What plans and proposals are there for the future of working as and with self-employed workers?

Flex & politics in 2023: The year of deliberation and (un)clarity

The Netherlands currently has more than 1.6 million zzp'ers. It is the fastest growing group of employed people in the Dutch labor market, accounting for over 17% of the Dutch employed labor force.

Cabinet, consider all workers in the labor market

On Friday, Dec. 16, Minister Van Gennip (SZW) and State Secretary Van Rij (Taxation and Customs Administration) presented the "Progress Letter on Working with and as Self-employed(s)" to the House of Representatives. Numerous topics are addressed in the letter

'Progress letter on working with and as self-employed(s)' - three outlines explained

The minister lays out all the plans along three lines: a more level playing field, clarifying the assessment of employment relationships and improving enforcement on false self-employment.

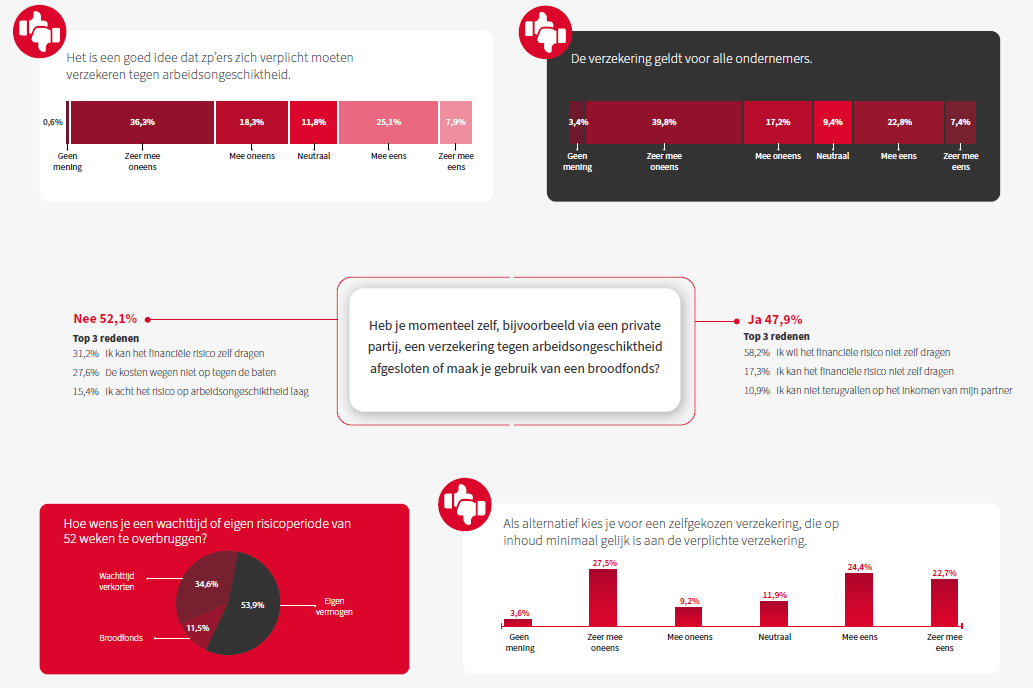

Self-employed must remain flexible with mandatory disability insurance

Wednesday, Dec. 7, during the Committee on Disability debate, mandatory disability insurance (AOV) was discussed. Plans that only a third of highly educated self-employed people support.

Self-employed want flexibility in mandatory disability insurance

A third of highly educated self-employed people support plans for compulsory disability insurance (AOV). However, almost half are in favor if self-insurance is allowed as an alternative.

Authority criterion remains a hot topic in labor market file

The Labor Market Policy Committee debate took place last week. The House Committee on Social Affairs and Employment spoke with Minister Van Gennip (SZW) about the announced plans to reform the labor market.

What will be Minister Van Gennip's next move?

Ahead of the Labor Market Policy Committee debate, Marion van Happen shares her views on the current proposals from political The Hague.

Minister of Social Affairs and Employment puts dot on horizon, follow through now much needed

Minister Karien van Gennip (Social Affairs and Employment) has shared the Labor Market Outline Letter with the House of Representatives. This marks the next step in future-proofing the labor market.

Enforcement, clarification and renewal of DBA law rules must go hand in hand

Minister of Social Affairs and Employment Karien van Gennip and State Secretary of Finance Marnix van Rij responded last week to two investigations into the lack of enforcement on bogus self-employment by the Tax Administration.

"Working together to make change possible."

Hans Biesheuvel, founder of ONL voor Ondernemers, has been an entrepreneur at home and abroad for 35 years. With all the knowledge and experience he has gained in these years, he is committed to one goal: to make the voice of many entrepreneurs heard by politicians.

Overly rigid rules on hiring self-employed not desired

A clear overview of all the different proposals made in recent years to replace the DBA law. More importantly: the pros and cons as well as consequences for the self-employed and clients.

8 variants for replacing the DBA law

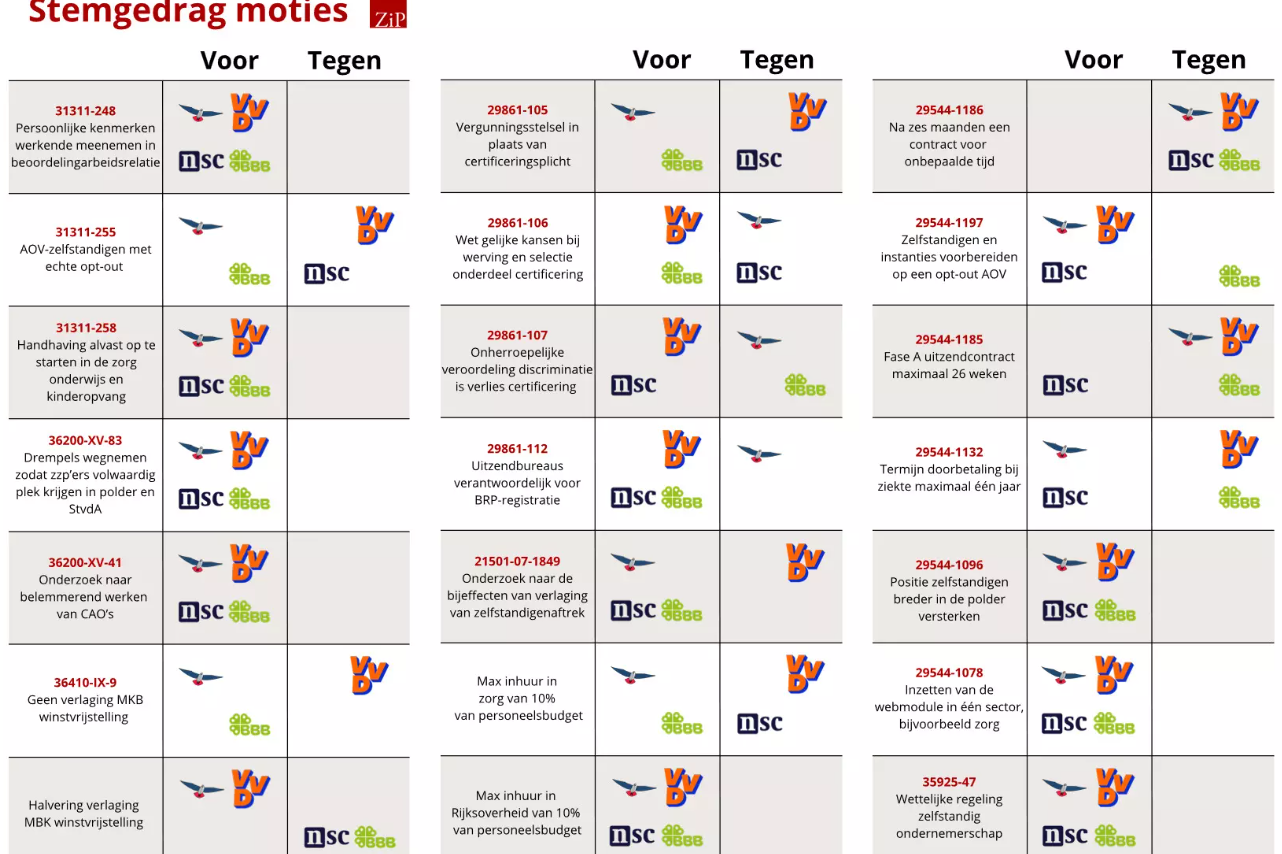

On Thursday, June 30, the Social Affairs and Employment Committee will debate the zzp dossier. Ahead of this debate, ZiPconomy today publishes the report 'Employee, unless ... 8 variants for the replacement of the DBA law'.

Only tens of thousands of 1.2 million self-employed work for hourly rate below 20 euros

Zzp'ers working as store salesmen, childcare workers, teaching assistants, waiters or bartenders work on average at the lowest hourly rates in the Netherlands.

Talent Monitor: Zzp'ers: protect or set free?

We make available each quarter - based on Intelligence Group's recruitment data and HeadFirst Group's hiring data - unique insights on labor market related themes in our 'Talent Monitor'.

Clarity and decisiveness required in the zzp dossier

The Labor Market Policy Committee debate is scheduled for tomorrow afternoon. With 36 topics on the agenda, CEO of HeadFirst Group Marion van Happen expects a scattered debate.

Hague update: directives from the EU and a headline debate on the labor market

The new cabinet has been in place for some time now, there is an ambitious coalition agreement on the table, and the new ministers have settled in reasonably well by now. It is noticeable in The Hague

Deliberate action necessary in implementing coalition agreement

Wednesday, December 15, 2021, the long-awaited coalition agreement "Looking out for each other, looking forward to the future" was presented. For the labor market, the new administration has an important goal:

Internet consultation 'Self-employment minimum wage act' launched

An Internet consultation was announced on Monday, October 28. It concerns two parts of the proposals announced by the Cabinet to replace the DBA Act.

Appeal to all available talent: don't exclude zp'ers

The failure to tailor laws and regulations hinders the labor market. For example, the DBA law is still creating anti-zzp policies among various clients.

Facts and figures self-employed indispensable for making the right policy choices

The European Commission wants the Netherlands to further cut tax credits for self-employed workers. It would be one of two conditions for claiming coronasteun from Brussels.

Stop the web module: time for reform instead of sticking band-aids

Last Monday, Minister Koolmees informed the Lower House by means of the seventh progress letter 'Working as a self-employed person'. This letter focuses on the pilot results of the web module.

Seventh 'Self-employment' progress letter: web module to next cabinet, limited enforcement extended

Last Monday, outgoing Minister Koolmees of Social Affairs and Employment informed the House of Representatives through the seventh progress letter 'Working as a self-employed person'.

Politics trust zzp'ers gone, recognition needed

Organizations have long been able to afford the luxury of filling the shortage of permanent employees with temporary, external professionals. Those days are over: the flexible labor market is also in short supply on all fronts.

HeadFirst Group and ONL foundation for entrepreneurs pull together

HeadFirst Group and ONL for Entrepreneurs are joining forces as of March 1. Both parties will work together for a fair and flexible labor market for hirers and providers.

Period of limited enforcement of DBA law does not end Oct. 1, 2021

In any case, the enforcement moratorium on the DBA law will not expire on October 1, 2021. This is in line with the earlier progress letter "Working as a self-employed person," It continues to wait for a clear and enforceable alternative

Basic social system for all employed gains supporters among self-employed workers

Over 60 percent of highly educated self-employed professionals support a basic social system for all workers in the labor market. This is according to research recently participated in by over 1,700 self-employed professionals (zp'ers).

Zzp'ers miss out on assignments due to dormant DBA issue

With a large majority in favor of the motion, the House announced that it supported the content of the motion and wanted to first have a "reasonable and enforceable alternative to the DBA law" before starting enforcement on false self-employment.

Belastingdienst extends HeadFirst's model agreement under the DBA Act

In June 2016, HeadFirst's model agreement was approved by the Tax Office. It has now been reassessed and the Tax Office has renewed its approval once again for a period of 5 years.

How to move forward with the DBA law?

How to proceed with the DBA law? This is a relevant but complicated question that people in The Hague don't immediately have the answer to either. Rutte III's plans to replace the DBA law have not provided the clarity the market has been waiting for for quite some time.

New minister can get right to work on zzp dossier

HeadFirst Group acquires recruitment service provider Sterksen. The market leader in the organization of external hiring takes the strategic step to full service HR service provider for temporary and permanent work. HeadFirst Group and Sterksen thus respond to the market trend that organizations organize the use of talent increasingly integrally - regardless of contract form.

Sixth progress letter 'Self-employment'

On Nov. 16, 2020, a number of ministers briefed the House of Representatives on the current status of the "self-employment" measures envisaged in the coalition agreement.

Fifth progress letter 'Self-employment'

On June 15, 2020, a number of ministers briefed the House of Representatives on the current status of the measures envisaged in the coalition agreement regarding "self-employment.

Third cabinet web module progress letter postponed again, opt-out maximum one year

Following two progress letters in 2018, Minister Koolmees briefed the House of Representatives again June 24, 2019 on the progress around the replacement of the DBA Act. We summarize the most important for you.

Follow-up investigation into potentially malicious companies

After the start of the company visits in 2018, the Tax Authority has now visited 104 companies from different industries and checked for compliance with the DBA Act.

Continued uncertainty due to 'guidelines on assessment of employer-employee relationship'

The lingering story called 'Wet DBA', got another new chapter in December 2018: the assessment of a relationship of authority. This memorandum was incorporated into the Tax Administration's 'Payroll Tax Handbook' on December 12, 2018.

DBA Scorecard: Risk-free hiring of external professionals

In July 2018, the Cabinet announced the company visits of at least 100 Principals. In the second progress letter in November, they informed that they have made the selection of Principals and have already conducted the majority of the company visits.

Second cabinet progress letter: Replacement of DBA law postponed once again

In early 2018, Minister Koolmees extended the suspension of enforcement on the DBA Act until 2020. That extension still does not appear to be enough.

New cabinet progress letter: tax authorities visit 100 organizations in 2018

On Friday, June 22, Social Affairs and Employment Minister Koolmees informed the House of Representatives of the progress of the replacement of the DBA Act by means of a letter, titled "elaboration measures working as self-employed".

Enforcement of DBA law suspended until Jan. 1, 2020

The suspension of enforcement on the Deregulation Assessment of Labor Relations Act (DBA) has been extended until January 1, 2020. This writes Minister Koolmees of Social Affairs and Employment and State Secretary Snel of Finance in a letter to the Lower House.

Great unrest among ZP'ers over DBA law

Unrest among clients and self-employed workers about the DBA Act remains high, even as the cabinet presented plans to replace the controversial law in the coalition agreement.

At least two more years of uncertainty over DBA law

It will take at least another two years before there will be clarity about when you can and cannot work as a self-employed person. That is what Minister Wouter Koolmees of Social Affairs and Employment told BNR Nieuwsradio.

Whitepaper 'Rutte III: DBA Act disappears' what now?

The Rutte III administration's coalition agreement announced the replacement of the Deregulation Assessment of Labor Relations Act (Wet DBA). In its place is to be a differentiated system in which different types of self-employed workers will have their own approach.