Talent Monitor: Extreme labor market tightness

Talent Monitor: Extreme labor market tightness

At present, Total Talent Management (TTM) and labor market tightness seem to go hand in hand. So after focusing on TTM in the first issue of the Talent Monitor, we thought we might as well focus on labor market tightness in the second issue. In this issue, we provide an in-depth analysis of this trend, as well as unique insights based on Intelligence Group's recruitment data and HeadFirst Group's hiring data.

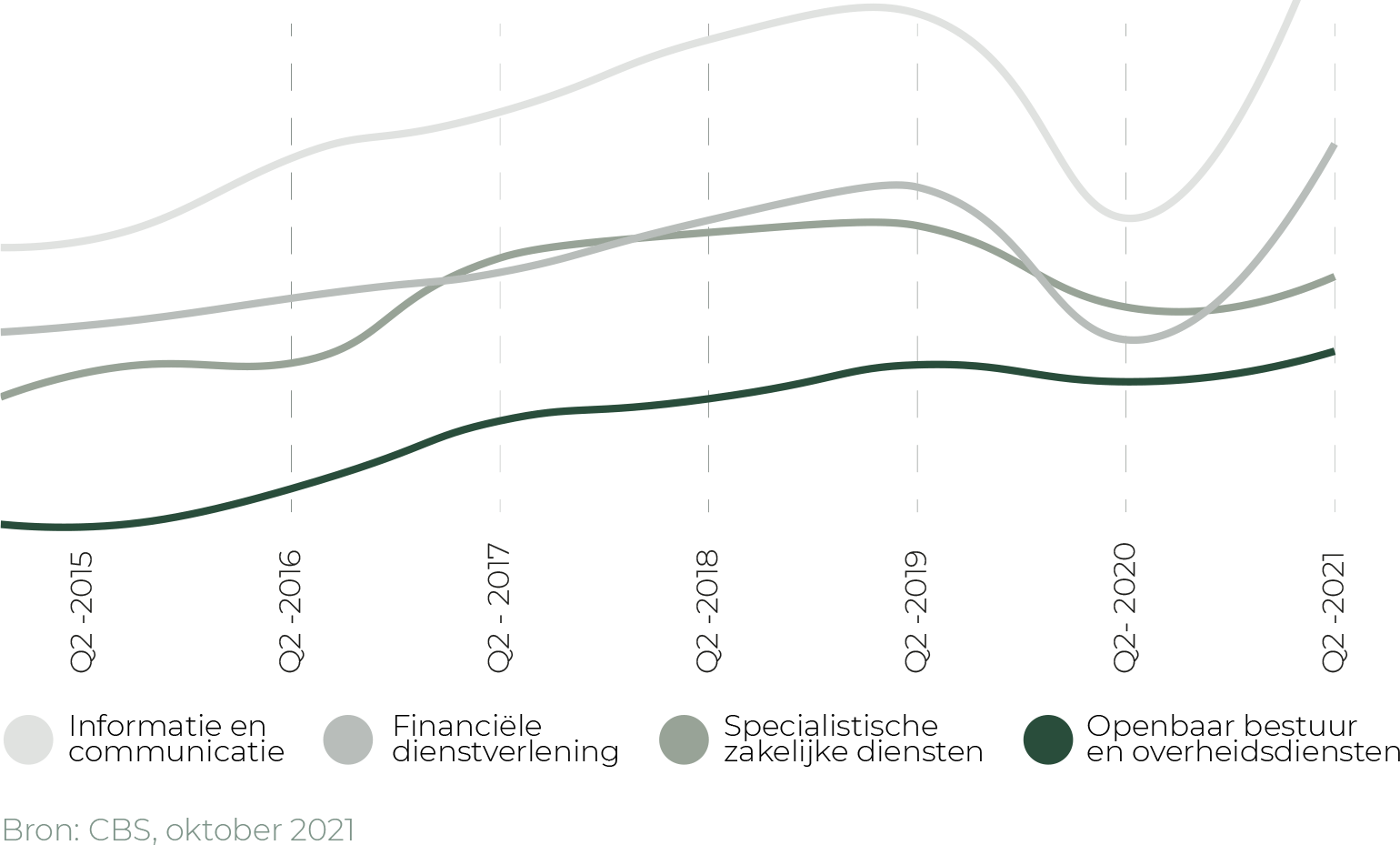

For the first time in history, the flexible work market is extremely tight.

For quite a while, organizations were fortunate in that they could fill any vacancies for staff on permanent contracts with temporary, external workers. That time is over now. The flexible work market, like the rest of the labor market, is subject to pervasive tightness. Read the entire press release here

The fees commanded by self-employed persons without employees are rising, even though inflation is at its highest point.

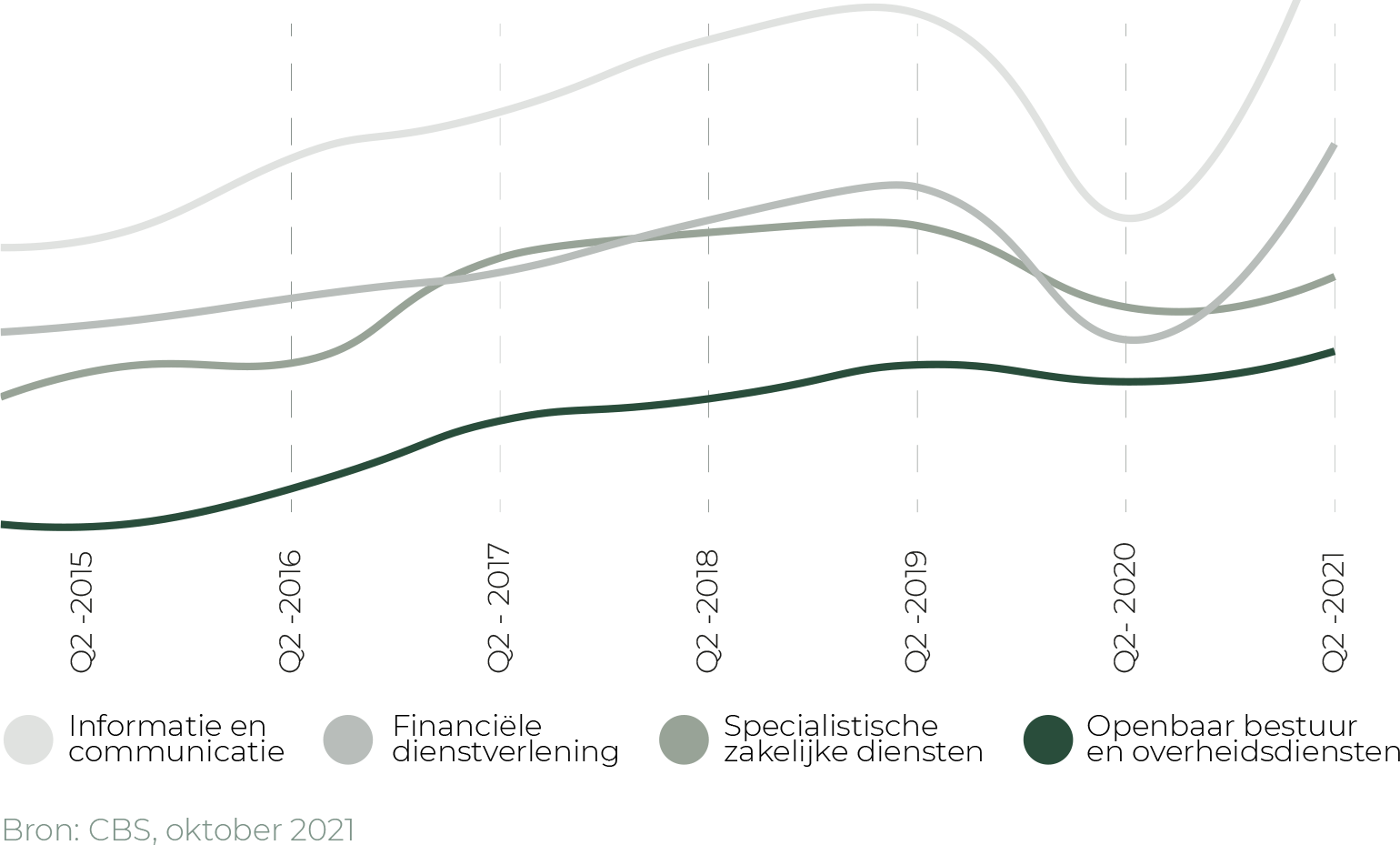

While inflation rates in the Netherlands are at a 20-year high, a sharp distinction can be observed in the wages earned by employees on a contract and the fees charged by self-employed persons without employees. This latter group can significantly raise their fees, while the wages paid to employees on a contract as specified in the applicable collective labor agreements are lagging behind the development of prices.

Key findings

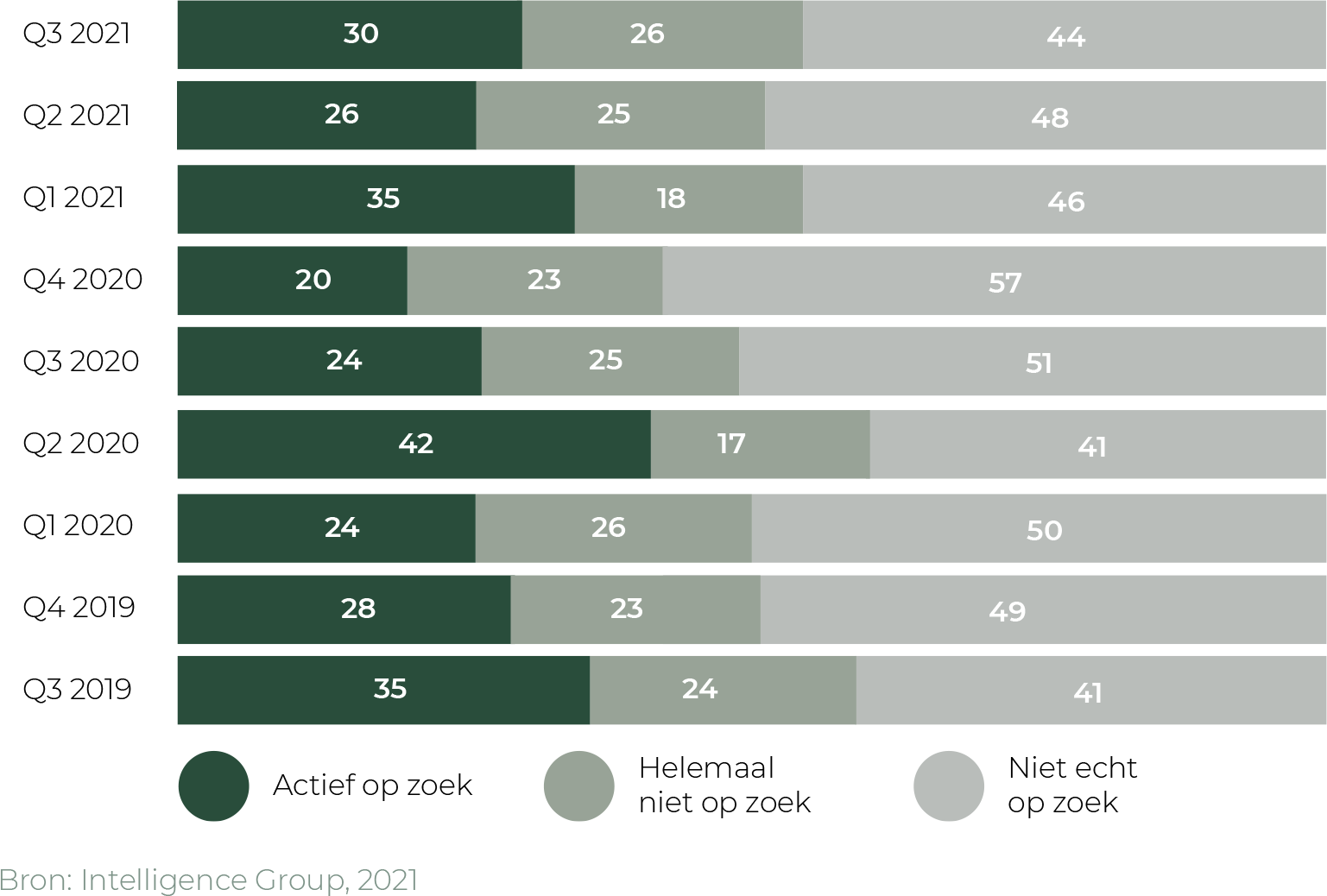

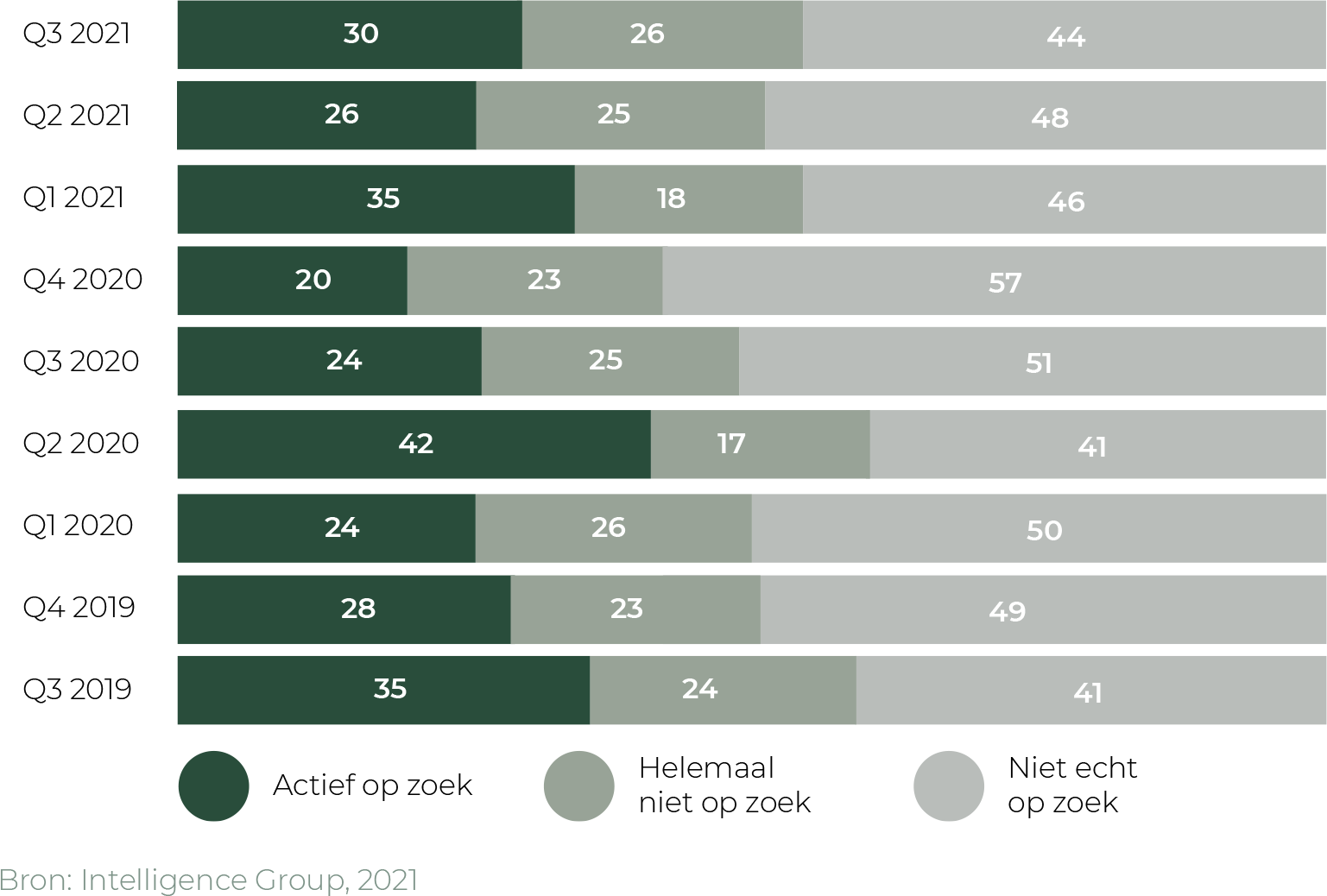

- The percentage of self-employed persons without employees actively looking for an assignment was 26% and 30% in the two most recent quarters, which means that nearly three-quarters of freelancers were not looking for a new assignment or were only doing so casually.

- Assignments for highly educated professionals currently receive five times fewer responses.

- In Quarter 2, 71% of highly educated and 58% of less educated self-employed persons without employees had fewer assignments than usual because of the pandemic, but these percentages dropped to 27% (highly educated) and 47% (less educated) in the third quarter of 2021.

- Talent sourcers are contacting a record number of self-employed persons for new assignments: nearly 7 in 10 self-employed persons without employees are currently contacted for an assignment at least once per quarter.

- The fees of highly educated self-employed persons without employees are rising by 3.5 to 7% each year. Fee rates seem to be rising faster and faster, particularly in recent quarters.

- Secondment agencies are responding by recruiting new staff: 47% increase in the number of vacancies advertised between Q3 2020 and Q3 2021.

Partner

Download Talent Monitor

"*" indicates required fields

Previous editions

Talent Monitor: Forecast tariff development professionals 2022

Intelligence Group, a labor market data specialist, has developed a...

Talent Monitor: Extreme labor market tightness

Every quarter - based on the recruitment data from Intelligence Group...

Talent Monitor: Forecast rate development professionals 2022

We compile quarterly - based on recruitment data from...

Talent Monitor: Hyperscarcity in the labor market

We compile quarterly - based on recruitment data from...

Talent Monitor: Forecast rate development professionals 2022

Talent Monitor: Forecast rate development professionals 2022

Labor market data specialist Intelligence Group has developed a unique rate prediction model, using data from HeadFirst Group, among others. At the end of 2021, we presented the first forecast, starting an annual tradition.

Highly educated professional gains an average of 5% percent

Self-employed and seconded professionals have a big rate hike ahead in 2022. On average, a highly skilled professional can increase the hourly rate by 5 percent in 2022. The largest increases are expected within practically trained professional groups, with the machine mechanic being the outlier. He is expected to gain 44.6 percent. Across all workers - from practical to highly skilled - the average expected increase is 7 percent. Read the entire press release here

Main observations

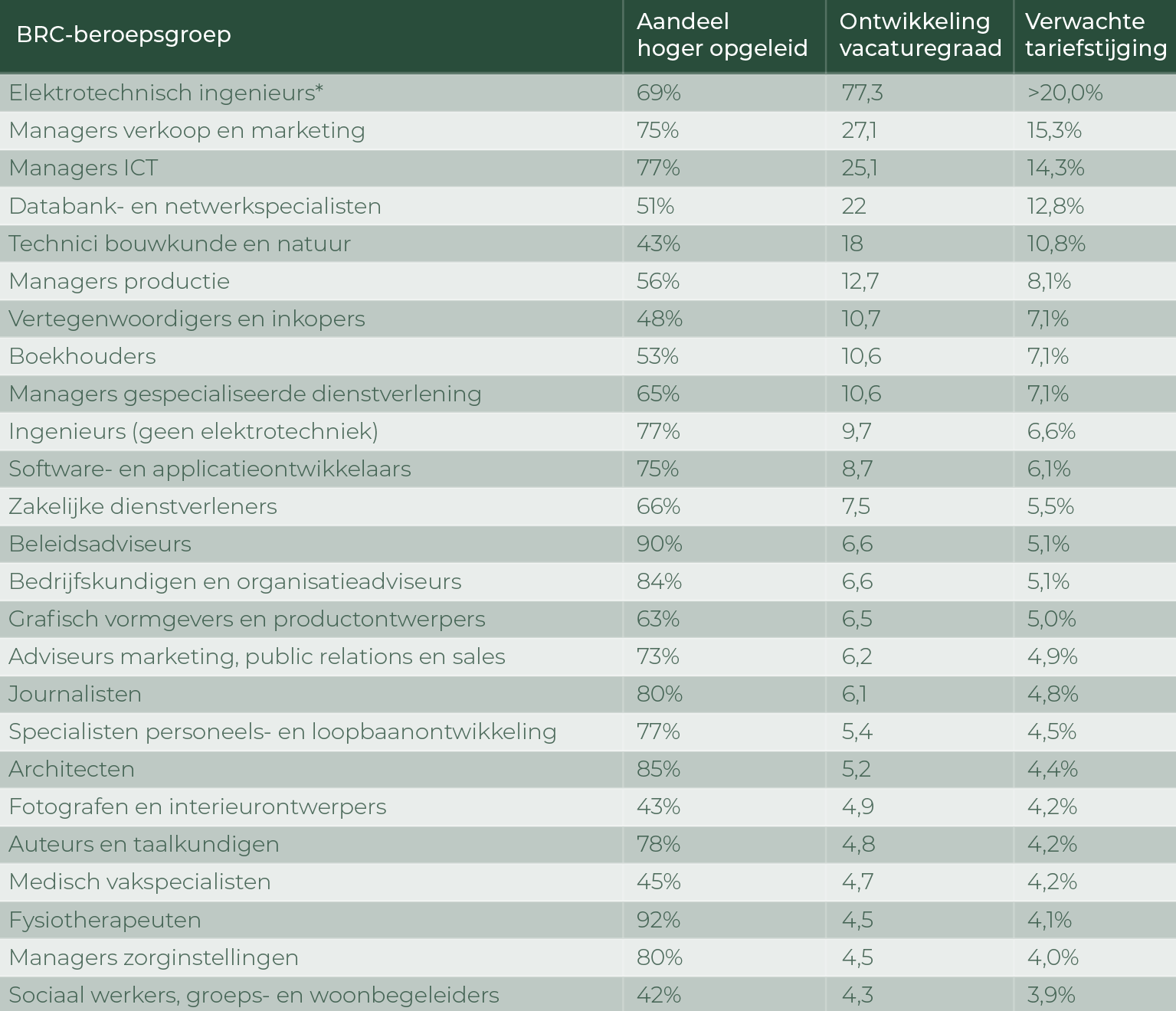

- The average expected rate increase in 2022 is 7%. For all highly skilled professionals, the expectation is 5% and for the more practical and operational occupations (blue collar) at least 7%.

- Zooming in on the professionals segment: only among logistics managers, librarians and conservators is a rate increase not expected. The former is a scarce occupational group, but less so compared to last year. The largest rate increases are expected among electrical engineers, sales and marketing managers, ICT managers, database and network specialists, and construction and nature engineers.

- Looking at the more practical and operational segment: only among self-employed bus drivers and streetcar drivers is a small decrease expected (-1.1%). The largest increases are expected among machine mechanics, plumbers and pipe fitters, carpenters, electricians and electronics mechanics, assembly workers, agricultural and forestry workers, welders and sheet metal workers, and truck drivers, among others.

- Rate increases are primarily explained by a constant increase year-over-year of 1.8%. Sensationally, this increase is most logically explained by inflation, but that is not always the explanatory factor. A second factor is the increase or decrease in the occupational vacancy rate. As the vacancy rate decreases or increases and thus the market becomes tighter or wider compared to the previous year, the rate moves with it. These two factors, explain 90.6% of the variance in the prediction model.

Partner

Download Talent Monitor

"*" indicates required fields

Other reports...

Talent Monitor: Forecast tariff development professionals 2022

Intelligence Group, a labor market data specialist, has developed a...

Talent Monitor: Extreme labor market tightness

Every quarter - based on the recruitment data from Intelligence Group...

Talent Monitor: Forecast rate development professionals 2022

We compile quarterly - based on recruitment data from...

Talent Monitor: Hyperscarcity in the labor market

We compile quarterly - based on recruitment data from...

Talent Monitor: Total Talent Management

Talent Monitor: Total Talent Management

We make available each quarter - based on Intelligence Group's recruitment data and HeadFirst Group's hiring data - unique insights on labor market related themes in our 'Talent Monitor'.

Corona accelerates rise of self-employed workers

In the first edition of the Talent Monitor, we look at Total Talent Management and it becomes clear that corona is accelerating the rise of the self-employed. Scarcity in both permanent and flex is increasing and the labor market is tilting completely. You can read more about these highlights here.

Main observations

Search behavior of self-employed people

for work is much the same as employees.

Payrolling

has become ten times smaller in the last four years.

Because of the turmoil surrounding the DBA law

clients are more often choosing to use professionals through suppliers, rather than self-employed workers.

The shortage of recruiters

combined with the shortage of candidates and temporary workers, means employers must rely more on recruiting on their own.

Many temporary workers

who lost their jobs during corona, became self-employed or went into permanent employment.

Platforms

currently have little impact in bringing supply and demand of self-employed workers together. Agencies, social media and own network play a bigger role. The game changer has yet to emerge.

Download Talent Monitor

We take you through the state of the labor market and specifically the relationships between permanent and flex

"*" indicates required fields

Other reports...

Talent Monitor: Forecast tariff development professionals 2022

Intelligence Group, a labor market data specialist, has developed a unique fee-forecasting model that, among other things, involves data gathered by HeadFirst Group. We presented the first forecast in late 2021, which we hope will be the start of an annual tradition.

Talent Monitor: Extreme labor market tightness

Every quarter - based on the recruitment data from Intelligence Group and the hiring data from HeadFirst Group - we provide unique insights on labor market-related themes in our 'Talent Monitor'.

Talent Monitor: Forecast rate development professionals 2022

We make available each quarter - based on Intelligence Group's recruitment data and HeadFirst Group's hiring data - unique insights on labor market related themes in our 'Talent Monitor'.

Talent Monitor: Total Talent Management

We make available each quarter - based on Intelligence Group's recruitment data and HeadFirst Group's hiring data - unique insights on labor market related themes in our 'Talent Monitor'.

Talent Monitor: Hyperscarcity in the labor market

We make available each quarter - based on Intelligence Group's recruitment data and HeadFirst Group's hiring data - unique insights on labor market related themes in our 'Talent Monitor'.

Talent Monitor: Hyperscarcity in the labor market

Talent Monitor: Hyperscarcity in the labor market

Where TTM and scarcity go hand in hand at the moment, a nice bridge - after the first edition of the Talent Monitor in the theme 'Total Talent Management' - to put the second edition entirely in the theme of 'scarcity'. We dive into this trend and provide unique insights based on Intelligence Group's recruitment data and HeadFirst Group's hiring data.

For the first time in history hyper-scarcity in the flex market

For a while, organizations were able to afford the luxury of filling the shortage of permanent employees with temporary, external professionals. Those days are over: the flexible labor market is also in short supply on all fronts. Read the entire press release here.

Zzp rates shoot up as inflation spikes

While inflation in the Netherlands is at its highest level in almost twenty years, a sharp dichotomy is emerging between the wages of employees and the rates of self-employed workers. The self-employed can demand considerably higher rates, while collective bargaining wages cannot keep up with price developments.

Main observations

- The proportion of active assignment seekers among self-employed workers is 26% and 30% in the last two quarters, meaning that nearly three-quarters are not looking for a new assignment, if at all.

- Assignments for highly skilled professionals receive five times fewer offers.

- Whereas in quarter 2, 71% of the highly educated and 58% of the low educated self-employed had fewer paid assignments due to corona, in the third quarter of 2021, the figure is only 27% (highly educated) and 47% (low educated).

- Sourcing pressure on self-employed to new record: nearly 7 out of 10 self-employed are approached at least once a quarter for an assignment.

- Rates of highly skilled self-employed workers are increasing from year to year between 3.5 - 7%. This increase seems to accelerate especially in the last quarters.

- Detachers respond with recruitment of new staff: 47% increase in number of vacancies between quarter 3 2020 and quarter 3 2021.

Partner

Download Talent Monitor

"*" indicates required fields

Previous editions

Talent Monitor: Forecast tariff development professionals 2022

Intelligence Group, a labor market data specialist, has developed a...

Talent Monitor: Extreme labor market tightness

Every quarter - based on the recruitment data from Intelligence Group...

Talent Monitor: Forecast rate development professionals 2022

We compile quarterly - based on recruitment data from...

Talent Monitor: Hyperscarcity in the labor market

We compile quarterly - based on recruitment data from...