Talent Monitor: ICT labor market in figures 2023-2024

ICT labor market in figures 2023-2024

Despite the fact that the market is turning, there is no sign of any relaxation or serious decrease in scarcity in the ICT labor market. This Talent Monitor focuses specifically on ICT professionals and provides insight into various aspects of the labor market. Such as development of vacancies/assignments, labor market activity, job changes, sourcing pressure, pull factors, employment conditions, the most desired employer, the most in-demand and fastest growing ICT skills and information on rates.

1 in 4 ICT workers switched jobs or employers in 2023

November 30, 2023 - The most recent Talent Monitor shows that 1 in 4 employed ICT professionals have changed jobs and/or employers in the past 12 months. While the ICT worker is by nature a latent job seeker, or in other words: they are open to another job, but do not actively search and apply themselves Where the mobility of ICT workers in recent years was fairly stable, this has increased sharply in the past year and the loyalty to the own manager and/or employer has decreased. These are some of the dozens of striking results from large-scale research into the current labor market for ICT professionals by Intelligence Group and HeadFirst Group.

Key findings

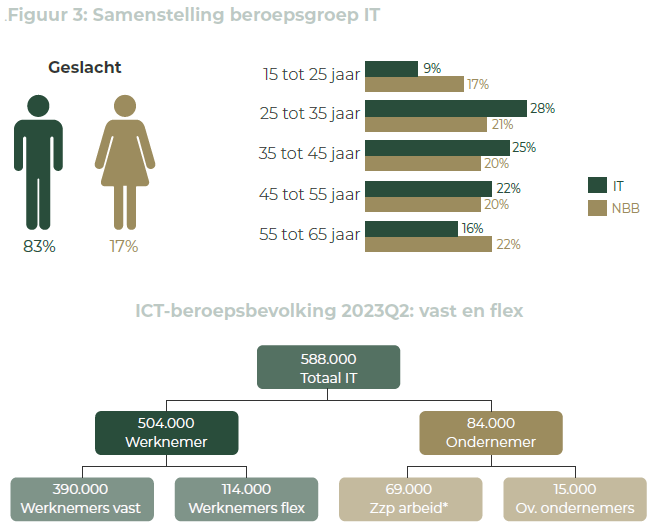

- Growth of the profession of I(C)T continues. Now it is at about 6% of the labor force. By 2030 it will be about 8.5%, is the expectation based on past growth and further development in the areas of automation, digitization, robotization and AI.

- IT and aging are not an issue within ICT workers or the IT sector. Legacy systems and skills are, however. It is therefore important to be well informed, especially about the fastest growing ICT skills among agencies and employers. This gives insight into the futureKey terms in this are: data, identity, Tmap, Vue.js, Apache and many more.

- The growth of the IT workforce over the past year is entirely due to the increasing number of self-employed workers. From 76 thousand in 2022 Q2 to 84 thousand in 2023 Q2, an increase of over 10%.

- The scarcity is huge and the recruitment feasibility is extremely difficult and will remain very to extremely difficult in the coming years.

- On average, ICT professionals move positions within their organizations or externally within 4 years. In particular, internal mobility and retention is a tricky phenomenon for ICT workers. Because of the high degree of specialization, growing internally or filling other roles is difficult. Therefore, a follow-up move outside is often more logical. Most ICT practitioners move when approached and do limited searching on their own.

- The target group is mostly latent which indicates greater recruitment complexity and implies a sustainably different recruitment strategy. Sourcing is the number one recruitment strategy, with LinkedIn being the base on the one hand and proving to be an increasingly difficult area where ICT talent leaves.

- More and more IT professionals are making sure they can no longer be hounded and are taking control of their own lives. That means they search for an interesting employer/client themselves or let their agency/account manager know they are available for a new job. Talent managers and talent pools are the success formulas for permanent and flex.

- In the Netherlands, between the hourly rate in salaried employment and the freelance or secondment rate, depending on experience level, is an average factor of 2.4 to 2.7. Not so for ICT workers. The average hourly rate factor for ICT professions is 3.78. There is a lot of extra margin and air in ICT freelance and secondment rates that cannot be explained by additional recruitment costs.

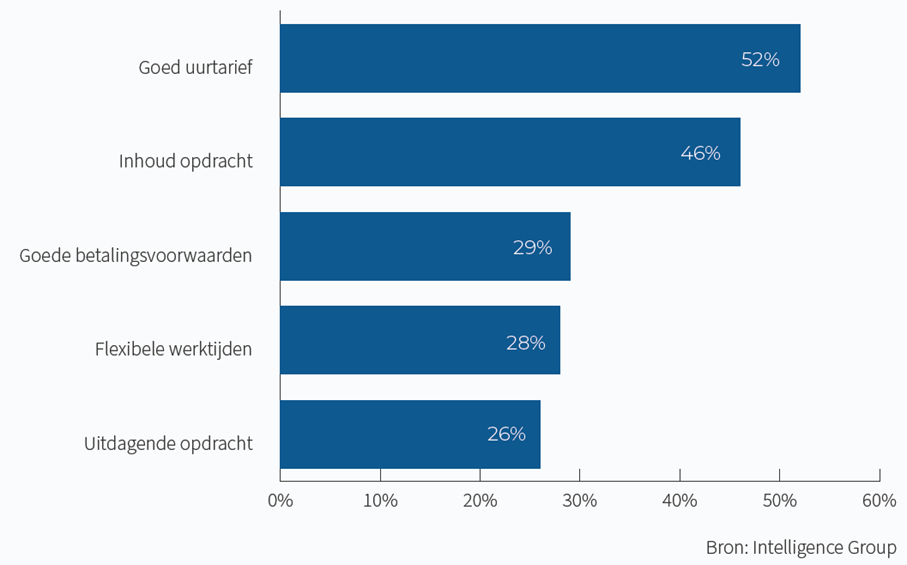

- ICT professionals go for a good salary/hourly rate and the work experience, whether in the office or not with nice colleagues. Flexibility is the norm already by definition for independent professionals.

- The State is again the most preferred employer among ICT workers in 2023, followed by ASML and Google. In Europe, they are Google, Microsoft and Amazon.

Partner

Download Talent Monitor

By downloading the Talent Monitor, you agree that your data will be shared with co-initiator Intelligence Group.

Other reports...

Talent Monitor: update forecast rate development professionals 2022

We compile quarterly - based on recruitment data from...

Talent Monitor: Zzp'ers: protect or set free?

We compile quarterly - based on recruitment data from...

Talent Monitor: Forecast rate development professionals 2022

We compile quarterly - based on recruitment data from...

Talent Monitor: Hyperscarcity in the labor market

We compile quarterly - based on recruitment data from...

Getting a grip on the zzp dossier. Facts and insights on self-employed workers in 2023

Getting a grip on the zzp dossier. Facts and insights on self-employed workers in 2023

In 2021, knowledge platform ZiPconomy released an independent and factual report on the zzp population in the Netherlands. A lot has changed in the past two years, so it was time for an update. In this renewed edition, we once again map the diversity of the target group to take the zzp dossier to the next level.

Self-employed workers more likely to work for multiple clients

Highly educated self-employed workers increasingly have more than three clients per year. In addition, the number of zzp'ers providing their own labor to organizations is declining slightly and only 2.7 percent of zzp'ers are working as entrepreneurs because the organization suggested this form of contract. Marion van Happen, CEO HeadFirst Group: "The self-employed are entrepreneurial and forced self-employment appears to be minimal. These are important insights for politicians in The Hague." Read the entire press release here.

Getting a grip on the diversity of the self-employed

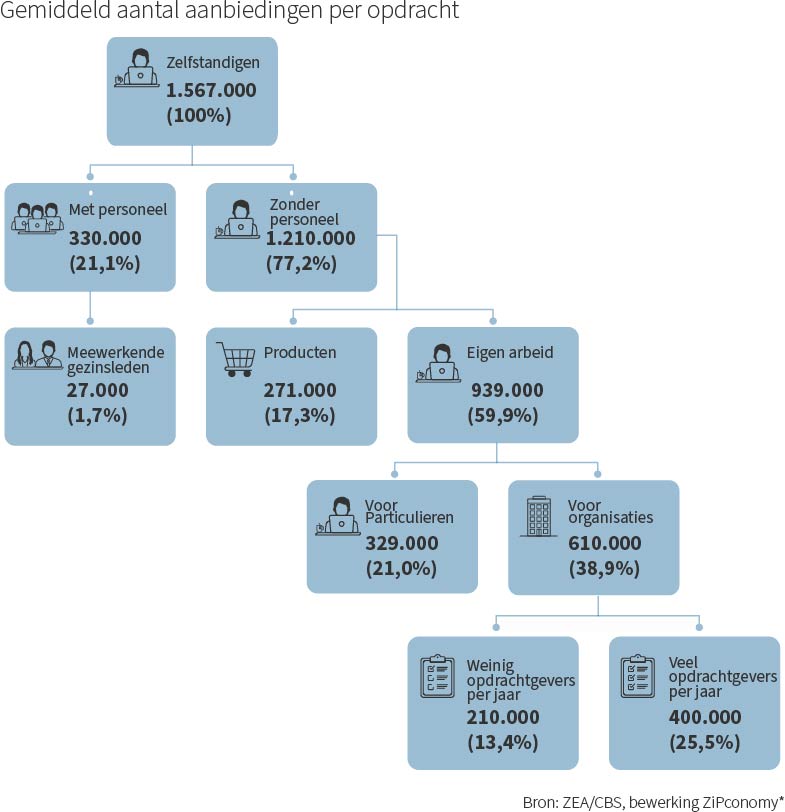

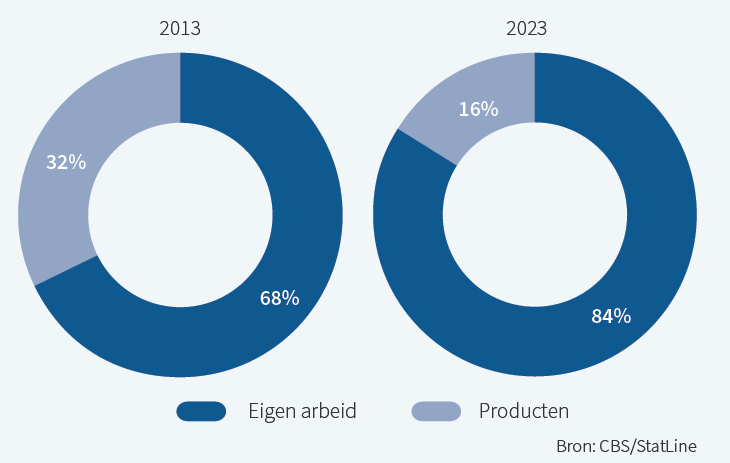

There are 1.2 million self-employed people without personnel (zzp'ers) in the Netherlands. So one in eight people in paid work is a zzp'er. It is a diverse group in many ways. The report provides insight into the diverse composition of the self-employed based on demographics and business practices over the past 10 years. With an emphasis on self-employed own labor. Their numbers increased by nearly 50 percent. By 2023, for the first time, there were more than 1 million such self-employed workers (1,028,000).

Percentage of self-employed workers own labor relative to self-employed products

Greater understanding of self-employment

Of the self-employed own labor group, 65% work mainly for organizations, the rest work mainly for individuals. Within the b2b group, there are two types of entrepreneurs, freelancers and interim professionals. The starting motives are slightly different. Intelligence Group asked freelancers what the main reasons are for taking on an assignment.

Drives to say yes to assignment (self-employment)

Partners

Download report

Professionally hiring outside labor

The hiring manual of the Netherlands

A practical reference book with a solid theoretical foundation that will get you started immediately on professionalizing your hiring. An indispensable handbook for line managers, executives, HR professionals and buyers.

Request a free copy now

'Professionally Hiring External Labor' is the only handbook that covers all aspects of the Dutch flex market and - where possible - substantiated with CBS figures.

This book offers a unique perspective as the hiring organization takes center stage. Temporary employment, secondment, payroll, self-employment and mediation, all forms of external employment are reviewed in detail. This includes ample attention to the business model of the various forms of supply.

The book is for sale via Bol.com, Managementboek.nl, Bruna.nl and AKO.nl. Are you a line manager, board member, HR professional or buyer? Then you can request a free copy from us!

Request a free copy now

Professionally hiring outside labor

In nine concise chapters, the authors describe, among other things, the supply and demand side of the market, the profile of the external worker, relevant laws and regulations and the trends that will shape the flex market in the coming period. Thanks to an integral framework for external hiring, the shell model and four possible hiring constructions, any organization can organize external hiring in a professional manner or outsource it if desired.

Hugo-Jan Ruts in conversation with authors Paul Oldenburg and Rob de Laat

Paul Oldenburg

Paul Oldenburg (1969) was responsible at Syntegra and Flex Groep Nederland for the deployment and development of consultants, interim managers and project managers. As co-founder of Evita Particuliere Zorg, he explored the possibilities of deploying various forms of flex-work as early as 2003. He also gained experience with the deployment of flexible labor as director of two small international temporary employment agencies. Since 2009 Oldenburg has been associated with Staffing Management Services. In this book he combines his interest in the functioning of markets and organizations (transaction cost theory) with his practical experience in organizing the flexible shell.

Max Boodie

Max Boodie (1964) started his career at Berenschot where he founded the procurement consulting group in 1997. In 2005 he started DPA Supply Chain together with the listed company DPA. At DPA Supply Chain Max was active in secondment, consultancy and recruitment for procurement and supply chain management. Since 2011, Boodie has been involved as an investor in the start-up or relaunch of companies. He is also a part time PhD candidate at the University of Groningen where he researches the behavior of buyers and the internal customers of procurement. Boodie is the author of many columns and articles. He has also published several books on benchmark studies and several collections of columns.

Rob de Laat

Rob de Laat (1966) has been active in the world of flexible labor since 1989. As a board member of the Rijnhaave Groep he was surprised by the lack of direction on hiring at organizations. At that time, he already questioned the lack of alignment between the organizational goals and the personal goals of the flex professionals deployed. Since the sale of the secondment agency. Flex Groep Nederland he has his hands free to focus on realizing his dream: creating a transparent and flexible labor market, where the interests of hirer, service provider and flex worker are in balance.

Peter Donker of Heel

Peter Donker van Heel Phd (1956) is a partner of The Policy Researchers. In the past decades he has completed over 500 studies in the field of the labor factor. Examples include studies on temporary agency work, payroll work and other triangular relationships, motives of employers and employees to choose a certain form of contract and evaluations of labor market policies and labor market measures.