Internet consultation 'Self-employment minimum wage act' launched

Monday, October 28, Minister Koolmees of Social Affairs and Employment, State Secretary Snel of Finance and State Secretary Keijzer of Economic Affairs and Climate announced an internet consultation. It concerns two parts of the proposals announced by the Cabinet to replace the DBA Act; the minimum rate of self-employed workers and the self-employment declaration.

Measures as of Jan. 1, 2021

The first measure relates to the lower end of the market and means that self-employed workers must earn a minimum of €16 per hour. This minimum rate applies to all the hours a self-employed person spends on an assignment. This takes into account spending on other work, such as administration. Direct costs, such as materials, are excluded. Zzp-ers who earn less than the minimum rate are not considered self-employed, but as employees of the client.

The second measure is the self-employment declaration. This is intended for self-employed people with a rate of at least €75. It allows them to agree in advance with the client that they are self-employed. Registration with the Chamber of Commerce is required to use the self-employment declaration. If the conditions are met, the self-employed and clients run no risk of having payroll tax and social premiums withheld for up to one year. In addition, they get as much certainty as possible about labor law consequences.

Web module not included

The web module, which self-employed people can start using in other cases, is not mentioned in this draft bill. In fact, no legislative amendment is needed for that. However, the questions from the web module have been tested with clients and trade organizations. Because the draft version received a lot of criticism, the effective date of January 1, 2020 has been postponed. Processing the feedback not only takes a lot of time, but makes the development of the web module an even more complicated puzzle.

Internet consultation

The Internet consultation means that the draft bill will be open for feedback for six weeks - until Monday, Dec. 9. Based on this feedback, the bill can be prepared for advice from the Council of State and then for submission to the House of Representatives. The Internet consultation can be found here.

Talent Monitor: Total Talent Management

Talent Monitor: Total Talent Management

We make available each quarter - based on Intelligence Group's recruitment data and HeadFirst Group's hiring data - unique insights on labor market related themes in our 'Talent Monitor'.

Corona accelerates rise of self-employed workers

In the first edition of the Talent Monitor, we look at Total Talent Management and it becomes clear that corona is accelerating the rise of the self-employed. Scarcity in both permanent and flex is increasing and the labor market is tilting completely. You can read more about these highlights here.

Main observations

Search behavior of self-employed people

for work is much the same as employees.

Payrolling

has become ten times smaller in the last four years.

Because of the turmoil surrounding the DBA law

clients are more often choosing to use professionals through suppliers, rather than self-employed workers.

The shortage of recruiters

combined with the shortage of candidates and temporary workers, means employers must rely more on recruiting on their own.

Many temporary workers

who lost their jobs during corona, became self-employed or went into permanent employment.

Platforms

currently have little impact in bringing supply and demand of self-employed workers together. Agencies, social media and own network play a bigger role. The game changer has yet to emerge.

Download Talent Monitor

We take you through the state of the labor market and specifically the relationships between permanent and flex

Other reports...

Nothing found.

Professionally hiring outside labor

The hiring manual of the Netherlands

A practical reference book with a solid theoretical foundation that will get you started immediately on professionalizing your hiring. An indispensable handbook for line managers, executives, HR professionals and buyers.

Request a free copy now

'Professionally Hiring External Labor' is the only handbook that covers all aspects of the Dutch flex market and - where possible - substantiated with CBS figures.

This book offers a unique perspective as the hiring organization takes center stage. Temporary employment, secondment, payroll, self-employment and mediation, all forms of external employment are reviewed in detail. This includes ample attention to the business model of the various forms of supply.

The book is for sale via Bol.com, Managementboek.nl, Bruna.nl and AKO.nl. Are you a line manager, board member, HR professional or buyer? Then you can request a free copy from us!

Request a free copy now

Professionally hiring outside labor

In nine concise chapters, the authors describe, among other things, the supply and demand side of the market, the profile of the external worker, relevant laws and regulations and the trends that will shape the flex market in the coming period. Thanks to an integral framework for external hiring, the shell model and four possible hiring constructions, any organization can organize external hiring in a professional manner or outsource it if desired.

Hugo-Jan Ruts in conversation with authors Paul Oldenburg and Rob de Laat

Paul Oldenburg

Paul Oldenburg (1969) was responsible at Syntegra and Flex Groep Nederland for the deployment and development of consultants, interim managers and project managers. As co-founder of Evita Particuliere Zorg, he explored the possibilities of deploying various forms of flex-work as early as 2003. He also gained experience with the deployment of flexible labor as director of two small international temporary employment agencies. Since 2009 Oldenburg has been associated with Staffing Management Services. In this book he combines his interest in the functioning of markets and organizations (transaction cost theory) with his practical experience in organizing the flexible shell.

Max Boodie

Max Boodie (1964) started his career at Berenschot where he founded the procurement consulting group in 1997. In 2005 he started DPA Supply Chain together with the listed company DPA. At DPA Supply Chain Max was active in secondment, consultancy and recruitment for procurement and supply chain management. Since 2011, Boodie has been involved as an investor in the start-up or relaunch of companies. He is also a part time PhD candidate at the University of Groningen where he researches the behavior of buyers and the internal customers of procurement. Boodie is the author of many columns and articles. He has also published several books on benchmark studies and several collections of columns.

Rob de Laat

Rob de Laat (1966) has been active in the world of flexible labor since 1989. As a board member of the Rijnhaave Groep he was surprised by the lack of direction on hiring at organizations. At that time, he already questioned the lack of alignment between the organizational goals and the personal goals of the flex professionals deployed. Since the sale of the secondment agency. Flex Groep Nederland he has his hands free to focus on realizing his dream: creating a transparent and flexible labor market, where the interests of hirer, service provider and flex worker are in balance.

Peter Donker of Heel

Peter Donker van Heel Phd (1956) is a partner of The Policy Researchers. In the past decades he has completed over 500 studies in the field of the labor factor. Examples include studies on temporary agency work, payroll work and other triangular relationships, motives of employers and employees to choose a certain form of contract and evaluations of labor market policies and labor market measures.

Request a free copy now

Han Kolff in 'The Open Talent Report Podcast' of CXC

The HR podcast of CXC explores all things open talent, direct sourcing, compliance and labor laws with industry experts. In each episode Connor speaks with CEOs, founders and experts from staffing, technology and legal sectors around the world. This week we are joined by CEO of HR services provider, Head First Group. Han has a deep knowledge of the staffing industry having spent 15 years in the fast moving goods industry (Heineken and Danone) before moving to work for Randstad for over 8 years.

On the podcast Connor and Han tackle the pressing questions in today's labor landscape from global labor shortages and remote working to the digitization of recruitment and automation. They also take a look into the glass at what may be in store for the future of work.

Key Points

Labour shortage/ Labour market paradox

There is always a paradox, there is always balance between the supply and demand in the workforce and technology is simply giving us more data and greater view of the mismatch making it seem like a bigger paradox than ever. Now that pandemic is hopefully lifting we are seeing a shift from where the demand side had previously had the power to more of a balance with the supply having more of say. Companies should change their perspective when hiring. For example in the IT space, if you are looking for a Java developer companies should look at if they need somebody who already has that skill set or if they can look at training a person up as a Java developer.

Is hiring anyone anywhere an area of growth?

In theory we can work remotely and cut jobs down into gigs so it is more concrete and easier to delegate a certain piece of work to somebody anywhere in the world. The issue comes with cooperation within companies which will slow down the adoption with global companies being able to adapt faster. Companies must also look at labor laws in different countries where they are engaging talent to ensure compliance.

The digitization of recruitment

There's two types of companies now, which are merging into trying to solve for everything. There's companies that come from more enterprise worlds, usually, they're more touch than tech. They have a bit more people supporting the product, they're not just a tech platform. Then there's companies that are more on the platform side like Upwork, maybe that's more gig related more shorter term projects and more instant. Sometimes they are more, b2c but they miss the touch part, to really sell into large enterprise clients. So if we look at it from the client side, they don't want only tech, they want a solution that encompasses technology and a personal touch.

Automation

I think that there is a lot more to be concerned about in his world, a lot more about climate and about food and other trends, than automation threatening the labor market. On the contrary automation can be a big opportunity and these bigger trends might influence how we as humans need to act and resolve things. But as we said when we started out, this labor market is so incredibly complex, and will need work everywhere, for a long period. So, this future where there's no work, it's very, very far out.

What would you do with a magic wand?

I think if I had a magic wand, I would want to have governments have a mindset of a more forward looking approach. They shouldn't stick to the past of a unionized world and a job or a specific labor market condition that needs to stay forever. If I look at many governments and many labor markets, a lot of them are trying to contain the power and the contract of the past, instead of creating a contract of the future that is less frictionless and actually gets more people to an income or a job. So it's all dependent on who has the power and then trying to protect what you have, instead I would appreciate if governments have a growth mindset.

About CXC

CXC enables companies to achieve a competitive advantage through managing contingent workforce quality, efficiency and risk, while reducing costs.

The Open Talent Report Podcast with Han Kolff

Group of 'independent professionals with a few clients' grows fastest of all self-employed workers

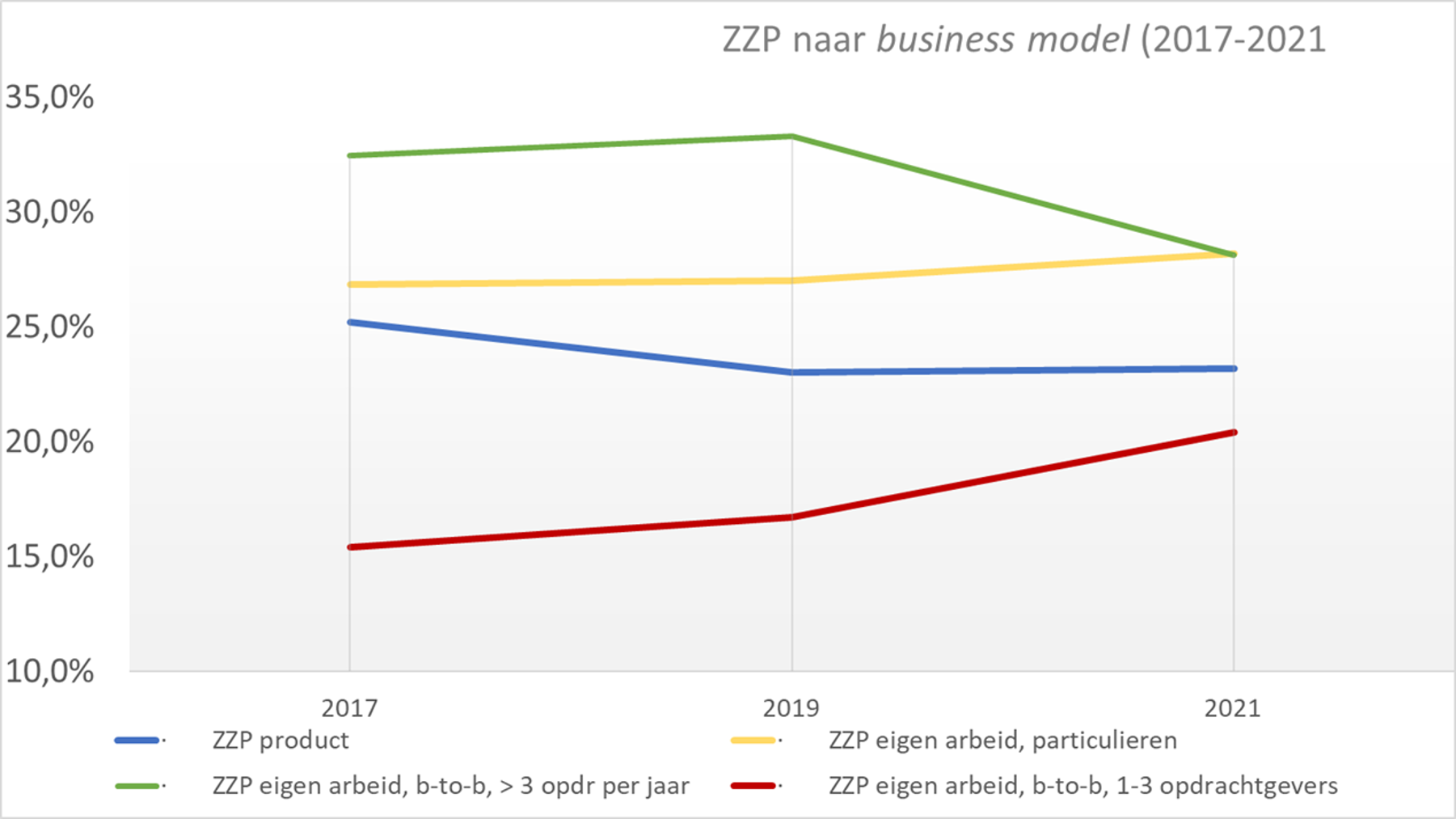

Self-employed workers are more likely to have long-term assignments with a few clients. Over the past four years, the percentage of self-employed individuals selling their own labor to fewer than three business clients increased by 5 percentage points.

Of all the types of self-employed workers, independent professionals with a few clients are the smallest group. But over the past four years, their percentage has increased significantly. Currently, 20.4% of all self-employed professionals sell services to fewer than three business clients per year. This is a lot higher than in 2019 (16.7%) and 2017 (15.4%). This is according to the report 'The self-employed do exist. Facts about the self-employed without staff' by ZiPconomy commissioned by HeadFirst and ONL for Entrepreneurs. ZiPconomy discovered this trend after analyzing figures from the Self-Employed Labor Survey (ZEA).

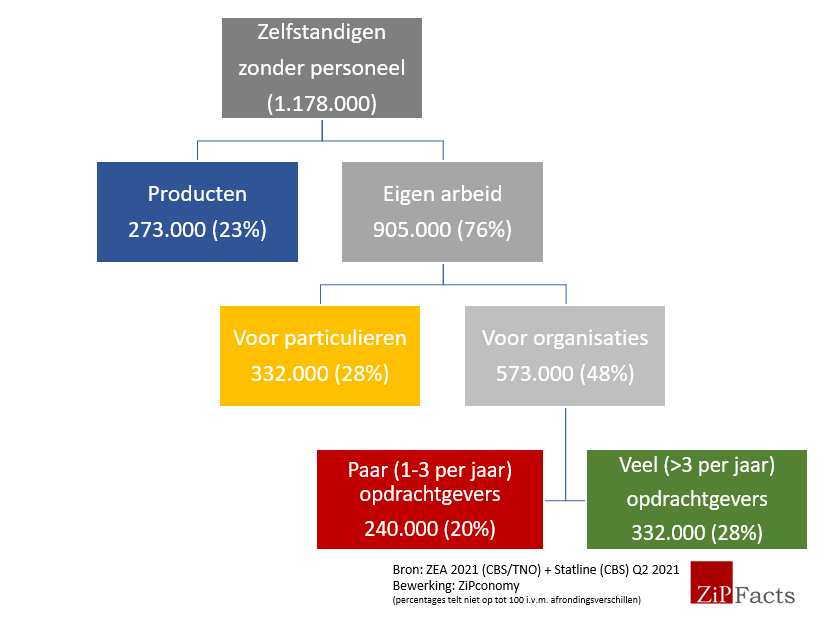

Four groups

Policymakers quite often overlook the heterogeneity among the self-employed, for example when replacing the DBA law or scaling back the self-employed deduction. By no means all self-employed people potentially compete with employees in the labor market. One way to clarify this heterogeneity is to divide the group of self-employed persons without personnel into four groups:

- Self-employed people selling products

- Self-employed individuals providing their own labor (services) to individuals

- Self-employed persons own labor, providing services to more than three companies or organizations per year.

- Independent contractors own labor, providing services to three or fewer companies or organizations per year. So they often do somewhat longer assignments with a client.

Shifts

For years there have been more self-employed people selling their own labor than self-employed people trading products. The ZEAs in the period 2012-2021 show that the difference is only increasing: in recent years, the percentage of "self-employed own labor" increased relative to the percentage of "self-employed products. In 2012, 29.5% of all self-employed people were still selling products; by 2021, that share will have dropped to 23.2%.

Business, private or both?

Thus, more than three-quarters of the total group of self-employed people sell their own labor. In 2021, about 53% of them worked exclusively for organizations (b-to-b); that percentage has remained almost the same since 2012. These are all kinds of entrepreneurs: day presidents, interim managers, freelance editors at a newspaper, zzp nurses at the hospital, contractors. In 2012, 29.5% of the self-employed worked own labor exclusively for individuals. In 2021, it will be 30.9%. Examples include handymen, cleaners or horseback riding instructors. In 2012, the remaining 18.1% worked for business clients as often as for private individuals. That percentage will drop slightly to 15.9% by 2021. An example is yoga teachers who teach both individuals and conduct business workshops.

Many or few clients

There are two types of self-employed people who work for companies and organizations: those with many different clients and those with a few clients per year. The group with many clients per year often works briefly for one client. Think of accountants, coaches, day chairmen and logo designers. It is usually also clear among these self-employed people that they do not have an employer-employee relationship with their client. The percentage of self-employed persons with more than three clients decreased: 28.2% of all self-employed persons fall into this category in 2021.

Smallest group grows the fastest

The self-employed category with a limited number of clients per year is the smallest group in percentage terms. At the same time, it is the group that is currently growing the fastest. From 2017 to 2021, their share in the total number of self-employed workers increased by 5 percentage points to 20.4%. These independent entrepreneurs often have longer-term assignments for many hours per week. Examples include interim managers, freelance editors of a TV show and carpenters working full-time on a large project for a contractor. Independent contractors with such long-term assignments are also called "independent interim professionals. Our analysis shows that this smallest group has grown the fastest over the past four years.

Statement

One possible explanation for the increase is the corona crisis: longer assignments for more hours per week give more security. Research by HR service provider HeadFirst Group and labor market data specialist Intelligence Group (2021) shows that during the crisis a shift was visible from staffing to hiring self-employed workers. In addition, the number of self-employed workers grew above average within certain occupational groups as additional demand arose during the corona crisis.

Curious about more facts and figures about the self-employed? Download the report 'The zzp'er does exist. Facts about the self-employed without staff' by ZiPconomy commissioned by HeadFirst and ONL for Entrepreneurs.

Appeal to all available talent: don't exclude zp'ers

The failure to tailor laws and regulations hinders the labor market. For example, the DBA law is still causing anti-zzp policies among various clients. This is problematic for the self-employed, but in view of the extreme scarcity in the labor market certainly also for clients. According to Han Kolff, CEO of HeadFirst Group, this requires decisiveness from politicians in The Hague and from clients.

Market maximally oversupplied

It is becoming increasingly complicated for organizations to find talent. Record after record is being broken of the number of open vacancies, and since the CBS measured the tension in the labor market, the number of vacancies has never before exceeded the number of unemployed. The limits of the flexible labor market have also almost been reached. HeadFirst Group and Intelligence Group showed in the recently released Talent Monitor that the (active) supply of independent professionals (zp'ers) is drying up and the benches at secondment agencies are emptying.

'Anti-zzp policy' still in play

In a time of extreme scarcity, all available talent is needed to keep the economy running. Despite this, various clients still too often exclude an important target group with valuable knowledge: independent professionals. This is the result of the DBA law and the "assessment of the relationship of authority" directive, which still causes nerves.

Since it is not always clear whether there is a relationship of authority between client and contractor - and the Tax Office only assesses afterwards - there is a fear among clients of possible retrospective levies. The Cabinet's earlier decision to suspend enforcement on this as of October 1, 2021, until more is clear about replacement legislation, is a wise choice. It was expected that this would create calm among principals. Unfortunately, little has changed among most clients when it comes to looking at self-employed workers in hiring applications or tenders, as we saw recently at the Municipality of The Hague.

The self-employed are hindered by this, although this is currently disguised by the fact that there is sufficient work for clients who are open to self-employed workers. It is most problematic for clients, who in the war for talent need every target group on the labor market, and certainly the knowledge-intensive group of hundreds of thousands of self-employed in the Netherlands.

Appeal to clients and politicians in The Hague

That principals are looking critically at hiring zp'ers for roles where perhaps someone in permanent employment would make more sense is good. But let go of the widespread fear of hiring self-employed workers. Within the frameworks of the DBA Act, more is possible than is currently happening at various clients. With a clear assignment description with defined results, good guidance for hiring managers on how to avoid a relationship of authority and a critical look at extremely long assignment periods, the expertise that self-employed people have can be used.

In addition, a call to a next cabinet, in line with earlier noises from professors, industry associations and self-employed organizations: get to work quickly on serious labor market reforms. Hold existing rules up to the light and engage in discussions with a broad representation of stakeholders. The pilot of the web module has shown that in certain sectors - such as transport, construction and hospitality - the risk of abuse with zzp constructions is highest. Vulnerable self-employed workers in these sectors deserve protection and benefit from effective enforcement. The €35 guideline in the SER opinion provides guidance for this. Only that removes the tension of the term "authority relationship" at the upper end of the market. That need has only increased with the current scarce labor market.

Wrong data and interpretations color debate on future of self-employment

The political debate about the future of the self-employed in the labor market is conducted on the basis of wrong data and misinterpretations. This is evident from a publication by independent knowledge platform ZiPconomy, which was commissioned by HeadFirst Group and ONL voor Ondernemers to map the heterogeneity and diversity of the self-employed population in the Netherlands. "Facts and figures are indispensable to make the right policy choices. In this report we bring together all relevant data on the self-employed, with the aim of taking the labor market debate to a higher level," explains Han Kolff, CEO at HeadFirst Group.

Most self-employed work in business services

Research by I&O Research, commissioned by the trade union FNV, shows that some 80 percent of the Dutch think that self-employed people work mainly in construction. A misunderstanding, because in reality the business services sector is the largest. More than a quarter of all self-employed workers work in that sector; only 15 percent work in construction. In addition, the education sector is the biggest riser between 2007 and 2019, at 186 percent. This does not mean that so many more teachers are self-employed in front of elementary school classrooms, the thought that is prevalent in political The Hague. In fact, almost half of the self-employed in education provided corporate training or tutoring in 2019. Their number tripled. On the contrary, the number of self-employed people teaching in regular education decreased.

Number of conscious, highly educated self-employed workers growing

Furthermore, figures from the Central Bureau of Statistics (CBS) show that self-employed people in 2021 are, on average, more highly educated than in previous years. The number of highly educated self-employed workers has more than doubled, while the share of practically educated self-employed workers, on the other hand, declined sharply. In six years, this percentage dropped from 19 percent to 15 percent. Kolff says: "The figures show that a growing group of employed people in their search for autonomy and challenge are taking the step to self-employment. Only just under 7 percent of the self-employed population call themselves forced self-employed. It is high time for a solution that supports needy self-employed people, but leaves the larger group of conscious self-employed people free to undertake."

Do care for the vulnerable self-employed

The report further shows that the distribution of wealth among the self-employed is greater than among employees, for example in terms of annual income and financial buffer. Self-employed people are overrepresented in both the lower income brackets (less than €20,000 per year) and the higher income brackets (more than €50,000 per year). Kolff argues that a helping hand from politics is needed for the self-employed with lower hourly rates and small financial buffers. "This group benefits from protection, for example against the consequences of disability and unemployment. However, this should go hand in hand with collectivity, social security and modern solidarity. A basic social system is needed for all working people, regardless of their contract or legal form, with securities that move with the changes in their working lives. A substantial change from the current system, but much needed to make the labor market future-proof," Kolff said.

Some of the results of the research are compiled in an infographic. The entire report 'The self-employed do exist. Facts about the self-employed without personnel' is free to download at hfgroup.headfirst.group.

About HeadFirst Group

HeadFirst Group is a leading, international HR service provider and the largest temporary employment platform for professionals in the Netherlands. The organization offers a diversity of HR solutions: Managed Service Providing, Recruitment Process Outsourcing, intermediary services (matchmaking, contracting) and HR consultancy. An average of fifteen thousand professionals work daily for over four hundred clients in Europe, with which HeadFirst Group realizes an annual turnover of over 1.5 billion euros. The main brands of HeadFirst Group are the intermediaries HeadFirst, Between and Myler, MSP service provider Staffing Management Services and RPO and recruitment specialist Sterksen.

Facts and figures self-employed indispensable for making the right policy choices

The European Commission wants the Netherlands to further cut tax credits for self-employed workers. It would be one of the two conditions to claim coronasteun from Brussels, mentioned the FD. This once again makes zzp'ers the subject of the political-social discussion about the labor market.

Politicians in The Hague see creating a more level playing field, including by phasing out the self-employed deduction, as one of the solutions to the proliferation of self-employed workers. We embrace the creation of a more level playing field. After all, every individual in the Netherlands - regardless of the form of work and employment relationship - is entitled to protection and security.

However, a helping hand from politicians is desperately needed for the self-employed with lower hourly rates and small financial buffers. This group benefits from protection, for example against the consequences of disability and unemployment. Nevertheless, due to the fixed amount of the self-employment deduction, self-employed people with lower incomes are hit harder.

Only 7 percent self-employed call themselves forced self-employed

A growing group of employed people - in their search for autonomy and challenge - are making the move to self-employment. Only just under 7 percent of the self-employed population call themselves forced self-employed. It is high time for a solution that supports needy self-employed people, but leaves the larger group of conscious self-employed people free to do business.

However, this must go hand in hand with collectivity, social security and modern solidarity. A basic social system is needed for all workers, regardless of their contract or legal form, with securities that move with the changes in their working lives. A substantial change from the current system, but much needed to future-proof the labor market.

To take the debate on the labor market to a higher level, facts and figures of self-employed people are needed. On Monday, November 8, ZiPconomy, ONL and HeadFirst Group will present a report with the aim: to map the diversity and heterogeneity of this group and contribute to a rational and factual debate.

Hyperscarcity in flex market for first time in history

For a time, organizations were able to afford the luxury of filling the shortage of permanent employees with temporary, external professionals. Those days are over: even in the flexible labor market there is scarcity on all fronts. This is evident from research by HR service provider HeadFirst Group and labor market data specialist Intelligence Group. "In order to recruit, bind and retain talent in these times, it is necessary for clients to pull out all the stops. The answer lies in improving employer branding, using data-driven recruitment methods, approaching alternative target groups and creating an attractive hybrid working environment," says Han Kolff, CEO HeadFirst Group.

Supply of flexible labor market dries up

The number of offers on assignments for highly skilled work has plummeted: it is now five times lower than five quarters ago. Secondment agencies have sold out and are trying to supplement their supply by recruiting new staff, but are running into the wall. In addition, the sourcing pressure on highly skilled freelancers has reached a new record: nearly 7 out of 10 are approached for an assignment at least once a quarter. Kolff says: "This hyper scarcity in the flex market is new in the Netherlands. It requires creativity and forces organizations to look at the entire labor population in an integral way. The form of contract is less relevant; bringing in the right talent is paramount."

No wage wave for permanent, but higher rates for flex

The scarcity in the flexible labor market shows itself, among other things, in rising hourly rates. The (offered) rates of professionals - self-employed and seconded - in various job groups are rising between 3.5 and 7 percent on average. In the third quarter of 2021, it is even going to accelerate. Remarkable given that the wage wave among permanent staff has not yet materialized. The September figures from the AWVN show an average wage increase of 2.4 percent. More than the annual average of 1.9%, but lower than the September inflation rate of 2.7%.

Geert-Jan Waasdorp, director and founder Intelligence Group: "For an accurate picture, we present - together with HeadFirst Group - at the end of the year the rate forecast for external professionals in 2022. With in-depth information at ISCO-3 level for around 130 job areas, the top 10 risers & fallers and of course various other notable items."

The Talent Monitor "Hyper Scarcity in the Labor Market" is available for free download at hfgroup.headfirst.group.

About Intelligence Group

Intelligence Group is an International Data & Tech company in the field of labor market and recruitment data. Intelligence Group focuses on the collection, storage and enrichment of labor market related data for the purpose of improving the recruitment of personnel (or employees) by employers and the employability/labor market opportunities of employees. This data is made available to clients in a wide variety, via reports, dashboards and APIs.

About HeadFirst Group

HeadFirst Group is a leading, international HR service provider and the largest temporary employment platform for professionals in the Netherlands. The organization offers a diversity of HR solutions: Managed Service Providing, Recruitment Process Outsourcing, intermediary services (matchmaking, contracting) and HR consultancy. An average of fifteen thousand professionals work daily for over four hundred clients in Europe, with which HeadFirst Group realizes an annual turnover of over 1.5 billion euros. The main brands of HeadFirst Group are the intermediaries HeadFirst, Between and Myler, MSP service provider Staffing Management Services and RPO and recruitment specialist Sterksen.

Stop the web module: time for reform instead of sticking band-aids

Last Monday, outgoing Minister Koolmees of Social Affairs and Employment informed the Lower House by means of the seventh progress letter 'Working as a self-employed person'. In this letter special attention was given to the pilot results of the web module, the online tool with which clients can determine whether they can hire a self-employed person for a specific assignment. Within a short period of time, industry associations, zzp-interest groups and trade unions criticized the results. For further decision-making and possible continuation of the web module, the ball is in the new cabinet's court.

HeadFirst Group believes it is unwise to further develop the web module. In an earlier phase of the web module, legal experts already criticized the tool. Now the evaluation of the pilot shows that in 28.4% of the cases the web module cannot give an opinion on the nature of the working relationship. "Unfortunately, the web module does not provide the clarity and clarity that clients and self-employed workers have been asking for for years. A new cabinet would be wise not to further develop the web module. Implement real reforms instead of just sticking band-aids," said Han Kolff.

Current web module not suitable for intervention

In the letter, Koolmees announces that the questionnaire specifically intended for intermediary situations has not yet been completed. This means that the web module is not suitable for self-employed people who work through an intermediary. The most recent Self-Employed Labor Survey shows that about 8% of the self-employed category have assignments or clients through an intermediary. Should the web module actually be introduced, agreement on the content and form of a questionnaire for intermediary situations must first be found in proper consultation with intermediaries and industry associations. The Bovib, the branch organization for intermediaries and brokers to which HeadFirst Group is also affiliated, reports on its own website that the talks with the Ministry of Social Affairs and Employment are proceeding with difficulty.

Time for serious reforms

A new administration must get serious about labor market issues and challenges. "The web module should not create regulatory pressure and uncertainty. The upper end of the flex market, consisting of conscious and autonomous independent entrepreneurs, functions much better if laws and regulations really give room to do business. This group satisfactorily makes clear agreements with clients and intermediaries."

The evaluation of the pilot shows that in certain sectors, such as the hospitality, transport and construction industries, the likelihood of an "indicative employment" outcome is highest. These sectors employ relatively more vulnerable self-employed workers with lower hourly rates. "The SER's advice to enforce hiring agreements below €35 per hour more strictly is a good starting point. Supervision and enforcement should focus on sectors where abusive zzp constructions are used. Trust that at the top of the market there is professional and good cooperation between clients and independent professionals, where intermediaries play a role to work in accordance with laws and regulations."

Finally, Kolff argues for a broad coalition of societal parties to discuss and think about a basic social system for all working people, for example for the consequences of disability. Earlier research by HeadFirst Group has shown support for such a system among independent professionals. "We still embrace the idea of a basic social system for all employed people in the field of disability, as proposed by the Borstlap Commission and the Social Agreement of ONL, VZN and AVV. If we create certainties around the individual rather than the form of contract, then the 'pressure' on the qualification question will decrease." To create a more level playing field between employees and the self-employed, the government has already begun by further and accelerated phasing out the self-employment deduction.