HR-tech service provider HeadFirst Group is B Corp certified

This achievement demonstrates the company's commitment to sustainability, social responsibility and ethical entrepreneurship. HeadFirst Group joins a global network of companies committed to creating both economic and social value.

A new milestone in sustainable business

The B Corp Certification is awarded to companies that meet high standards of social and environmental impact, transparency and responsible governance. It recognizes companies that set the bar high in their social and environmental impact. This certification aligns with HeadFirst Group's sustainability strategy, which focuses on creating a positive impact on people, society and the environment.

After achieving silver and gold EcoVadis ratings, the B Corp Certification marks another step in HeadFirst Group's commitment to responsible business practices. Marion Van Happen, CEO at HeadFirst Group, said, "This is not only a milestone for us, but also proof that corporate social responsibility is essential for growth and innovation in the HR tech sector. We are proud to be pioneers in the sector."

Sustainability as a core business value

Sustainability is a structural principle within HeadFirst Group's strategy. The company is committed to an inclusive labor market, promotes fair working relationships and actively works to reduce its carbon footprint. Over the past three years, HeadFirst Group has reduced its carbon emissions by 30 percent and the HR-tech service provider aims to achieve a further 50 percent reduction by 2025. In addition, the company has engaged 98 percent of its suppliers in sustainable procurement practices, demonstrating that sustainability is deeply rooted in its operations.

Van Happen adds, "We believe that sustainable growth is not only about economic profit, but also about improving the world around us. By reducing our carbon footprint and making our supply chain more sustainable, we are taking responsibility for the impact we have on our planet."

Excellent B Impact Score and a sustainable future

HeadFirst Group achieved a B Impact Score of 90.3 out of the maximum 200 points achievable in the B Impact Assessment. A minimum of 80 points is required for a company to become a B Corp. This score is achieved through performance in several areas, including governance, employees, environment, customers and community. With the certification, HeadFirst Group joins about 500 B Corps in the Benelux, such as Bugaboo, Rituals, Tony Chocolonely and Triodos Bank.

B Corp Certification is not an end point, but a continuous process of improvement. Certified companies must review their social and environmental impact every three years to remain B Corp. Van Happen concludes, "For the coming years, we have a clear ambition: to make our procurement policy more sustainable and to increase our social involvement. One way we do this is by actively supporting local communities, for example through volunteer work. We remain committed to a more sustainable future and take responsibility in this by working together with customers, partners and other stakeholders to accelerate sustainable change for society."

Do you have questions about this post? Feel free to contact us through one of our colleagues.

Natasja Spooren-Wassenaar

Manager Communications

natasja.spooren-wassenaar@headfirst.nl

Thomas ten Veldhuijs

Senior Legal Counsel

thomas.tenVeldhuijs@headfirst.nl

Gemma Keijzer

Head of Quality & Compliance

gemma.Keijzer@headfirst.nl

Skip Saegaert

SROI Coordinator

skip.Saegaert@headfirst.nl

Hourly rates for self-employed and seconded workers continue to lag behind collective bargaining wages in 2024

Expected rate increase in 2025 maximum 1.5 percent

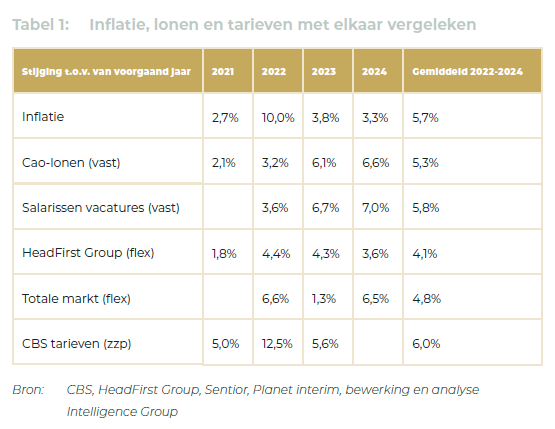

The hourly rates of flexible workers, self-employed workers and professionals employed by secondment agencies, rose an average of 3.6 percent in 2024 compared to 2023. This increase lags behind average collective bargaining wage increases and rate increases for (practically skilled) self-employed workers. A limited rate increase is expected for 2025, between 1 and 1.5 percent. This is according to the latest Talent Monitor from labor market data specialist Intelligence Group and HR-tech service provider HeadFirst Group.

Rate development lags behind CAO wages

According to CBS figures, the average wage increase in collective bargaining agreements in 2024 was 6.6 percent, significantly higher than the 3.6 percent rate increase for highly skilled self-employed and seconded workers. The rate increase of (practically skilled) self-employed workers also came out higher at 6.5 percent. The average hourly rate of a highly skilled self-employed worker is currently €99.65. Top formBottom form

"The slight increase in hourly rates in 2024 can be explained by shrinking demand and increased supply of self-employed workers, falling inflation and the effects of the (announcement) of enforcement on the DBA law" says Geert-Jan Waasdorp, director and founder of Intelligence Group. "Because the labor market is expected to become slightly less scarce in 2025, we expect moderate growth in average rates of 1 to 1.5 percent. Due to union demands, the differences in increases between salaried and self-employed workers will increase further in 2025."

Demand for flexible talent unabatedly high

Waasdorp notes that despite a slight slowdown in growth in the labor market and a decrease in the number of open vacancies, the scarcity of flexible workers continues. "On average, self-employed people are approached 16 times a year for a new assignment, which illustrates how high the demand for flexible talent remains," Waasdorp said.

Marion van Happen, CEO of HeadFirst Group, adds: "The labor market remains tight and therefore talent is still in control. Despite the ongoing discussion and enforcement around the DBA law, the choice for self-employment remains popular. Zzp'ers choose their own path, driven by freedom and flexibility. Companies that want to attract highly skilled professionals must adapt to the reality of a flexible labor market and develop strategies to retain both permanent and flexible talent."

More insights into professionals' rate trends over 2024 and into 2025? Download the Talent Monitor at headfirst.group.

Rate development professionals 2025

Rate development professionals 2025

The Talent Monitor provides an in-depth analysis of trends and developments in the market for independent professionals and secondees. This report examines the impact of legislation, labor market movements and the scarcity of highly skilled self-employed professionals, with insights on rates, supply and demand, and expectations for 2025.

Hourly rates for self-employed and seconded workers continue to lag behind collective bargaining wages in 2024

The hourly rates of flexible workers, self-employed workers and professionals employed by secondment agencies, rose an average of 3.6 percent in 2024 compared to 2023. This increase lags behind average collective bargaining wage increases and rate increases for (practically skilled) self-employed workers. A limited rate increase is expected for 2025, between 1 and 1.5 percent. This is according to the latest Talent Monitor from labor market data specialist Intelligence Group and HR-tech service provider HeadFirst Group.

What to expect:

- Detailed analyses of labor market trends and rate changes.

- In-depth insights into the impact of legislation (such as the DBA Act) on the zzp market.

- Forecasts for the labor market in 2025, including forecasts for rates and the employment situation.

Summary of key findings:

- The number of self-employed workers rises slightly to nearly 1.1 million, with labor market activity increasing.

- Fees for independent professionals lag behind inflation and wage increases, with a projected increase between 0.5% and 1% in 2025.

- The demand for self-employed workers remains high, but the flexibility and choices of workers, especially self-employed workers, are determining trends.

Partner

Download Talent Monitor

By downloading the Talent Monitor, you agree that your data will be shared with co-initiator Intelligence Group.

Other reports...

Talent Monitor: The convergence of fixed and flex

We compile quarterly - based on recruitment data from...

Talent Monitor: Fixed is getting more mobile and flex is getting more sustainable

We compile quarterly - based on recruitment data from...

Talent Monitor: Rate development professionals 2023

We compile quarterly - based on recruitment data from...

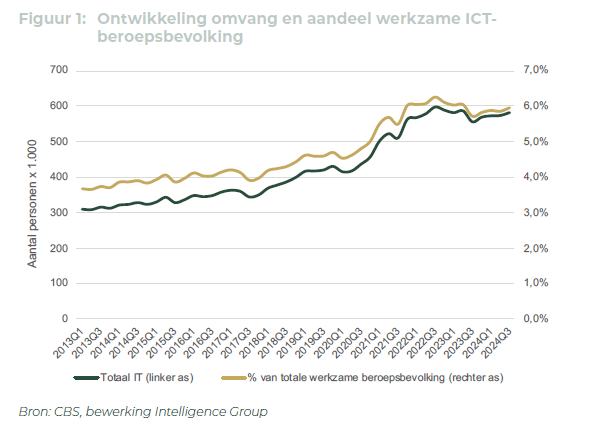

Cabinet goal unachievable: no 1 million ICT workers by 2030

While the government is aiming for one million ICT workers in the Netherlands by 2030, new research by labor market data specialist Intelligence Group and HR-tech service provider HeadFirst Group suggests that this goal is far out of reach. Even in a scenario of explosive growth, the Netherlands would have a maximum of 862,000 ICT workers by 2030. In more likely scenarios, the number is much lower still: between 628,000 and 783,000. Marion van Happen, CEO at HeadFirst Group nuances, "We don't have to meet the set target because AI can take over certain roles of ICT workers."

Stagnating growth of ICT workers

The latest figures from the Talent Monitor show that the ICT labor force in the Netherlands will number approximately 583,000 by the third quarter of 2024. This represents 6 percent of the total employed labor force. For the development of the ICT labor force until 2030, the report outlines four possible future scenarios. The most optimistic case involves explosive growth, with the number of ICT workers increasing exponentially to 8.2 percent of the labor force, or 862,000 people. A more realistic prospect is linear growth to 783,000 ICT professionals (7.4 percent). Under a scenario of stabilization, the number of ICT professionals grows slightly to 628,000. Even a scenario of contraction to 452,000 ICT professionals (4.3 percent) is considered realistic by the researchers.

Geert-Jan Waasdorp, director and founder of Intelligence Group, explains, "Since 2022, the growth in the number of ICT workers has virtually come to a halt, and towards 2030 stabilization seems most likely. This is partly due to a structural tightness in the labor market, which makes it difficult to retrain lateral entrants to meet the growing demand. In addition, other sectors such as healthcare, education and engineering have competitive demand for workers."

Can AI mitigate the consequences?

The stagnant growth in the number of IT workers could have major negative consequences for the digital transition in the Netherlands, and thus for labor productivity. Artificial intelligence (AI) may offer relief. Large companies such as Google and Amazon point out that an increasing portion of their software development is being filled by AI. Marion van Happen, CEO at HeadFirst Group, says: "If the AI trend continues - and that expectation is real - the demand for developers in particular will eventually change. In the Netherlands, AI adoption will be gradual, limiting the impact on the demand for ICT professionals until 2025. This does mean that we do not need to reach the goal of 1 million ICT professionals in 2030 to successfully realize the digital transition. At the same time, it remains necessary to encourage as much growth in the ICT workforce as possible, because AI cannot completely replace the demand for ICT workers."

The full report is available for download at headfirst.group.

Talent Monitor | ICT labor market in figures 2024 - 2025

ICT labor market in figures 2024 - 2025

Since the 1990s, ICT professionals have been at the forefront of the labor market. From introducing work-life balance to pioneering online platforms such as LinkedIn, ICT professionals have always been at the forefront of labor market innovations. Now the sector is in a critical transition phase that could affect not only the ICT market itself, but the broader labor market. Find out what this means for employers, employees and (self-employed) ICT professionals.

Cabinet goal unachievable: no 1 million ICT workers by 2030

While the government is aiming for one million ICT workers in the Netherlands by 2030, new research by labor market data specialist Intelligence Group and HR-tech service provider HeadFirst Group suggests that this goal is far out of reach. Even in a scenario of explosive growth, the Netherlands would have a maximum of 862,000 ICT workers by 2030. In more likely scenarios, the number is much lower still: between 628,000 and 783,000. Marion van Happen, CEO at HeadFirst Group nuances, "We don't have to meet the set target because AI can take over certain roles of ICT workers."

What will you learn from this report?

In this detailed Talent Monitor, we chart current trends in the ICT labor market:

- How the long-term growth in the number of ICT workers is slowing down and the role of AI in this change.

- The high employment rate of ICT workers, both salaried and self-employed.

- Declining Demand: The declining demand for ICT workers and how this affects recruitment strategies.

- What employers are doing differently now to attract ICT workers, including the impact of the DBA law.

- How specific ICT skills are key to both the current and future job market.

- What rising rates mean for freelancers in the industry.

- As AI and globalization change norms, what can we expect from industry dynamics?

Partner

Download Talent Monitor

By downloading the Talent Monitor, you agree that your data will be shared with co-initiator Intelligence Group.

Other reports...

Talent Monitor: The convergence of fixed and flex

We compile quarterly - based on recruitment data from...

Talent Monitor: Fixed is getting more mobile and flex is getting more sustainable

We compile quarterly - based on recruitment data from...

Talent Monitor: Rate development professionals 2023

We compile quarterly - based on recruitment data from...

Successful fourth edition of the Labor Market Gateway

On Tuesday, October 15, members of parliament, journalists, civil servants and experts gathered again in Nieuwspoort for the fourth edition of the Labor Market Gate. This time the topic on the agenda was 'the connection between education and the labor market'. Although the subject is of great importance to employers and educational institutions, it is not yet high on the political agenda. All the more reason to exchange views with all stakeholders.

Lifelong development

"We really need to accelerate on the Lifelong Development dossier," stated ROC Mondriaan board chairman Hans Schutte. Led by Hans Biesheuvel, former chairman of ONL for Entrepreneurs, Schutte entered into a conversation with Maurice Limmen, chairman of the Association of Universities of Applied Sciences. Two gentlemen with a clear vision on the issue and a rich career in the field of education. Limmen came with strong words towards the cabinet: "I call the education plans from the coalition agreement worrying. What strikes me is a lack of notion of retraining and upskilling from one sector to another, a vision on this is completely lacking."

Especially in professions where labor is in high demand - such as engineering, healthcare and ICT - it appears that there are too few qualified people to meet this demand. This problem is exacerbated by technological change and an aging workforce. All in all, this is putting increasing pressure on these sectors.

Educational institutions come along with difficulty

Long-term study penalty and labor shortages

Do you have questions about the Labor Market Gateway? Our experts are ready for you - leave your details and we'll get back to you.

Questions about this? Please contact us.

Sem Overduin

Public Policy & Affairs Manager

Sem.Overduin@headfirst.nl

Oifik Youssefi

Public Affairs Officer

Oifik.Youssefi@headfirst.nl

Maaike van Driel

Head of Legal

Maaike.vanDriel@headfirst.group

Thomas ten Veldhuijs

Senior Legal Counsel

Thomas.tenVeldhuijs@headfirst.nl

Central government launches public campaign to tackle false self-employment

As of Jan. 1, 2025, the Tax Administration's enforcement moratorium will expire. From then on, companies and organizations that hire self-employed workers when in fact they are employed risk an additional tax assessment or fine. As part of the lifting of the enforcement moratorium, the Ministry of Social Affairs and Employment has launched a public campaign. The campaign is aimed at clarifying the rules around labor relations, with the goal of helping clients and contractors understand when someone is self-employed and when employment is involved.

Central to the campaign is a new website, on which clients and self-employed people can find information and tools. An important part of this is the so-called "choice tool." This tool consists of ten questions that help self-employed people determine whether they are actually working on an assignment as a self-employed person or whether there are still many elements that belong to employment. The selection tool, however, does not give a binding judgment and offers advice to start a conversation about the right contract. The website also lists 10 characteristics that indicate self-employment and 10 that fit with being an employee. For example, it looks at whether a self-employed person bears commercial risk, makes their own investments and decides how the work is done. Characteristics of salaried employment include structural work within an organization, fixed working hours and a commitment to effort. What is important here is that no single characteristic is decisive; all factors must be considered in conjunction, which sometimes makes the assessment complex.

The website does not provide any new insights. The examples of ten concrete situations being worked out were already found in the Explanatory Memorandum of the draft law Verduidelijking Beoordeling Arbeidsrelaties en Rechtsvermonden (VBAR). Furthermore, the webpage refers to the web module, but this web module does not take into account the viewpoints and elements from the Deliveroo judgment. In response to the public campaign and the website, MP Thierry Aartsen (VVD) asked written questions to the ministers Van Hijum and Idsinga.

We advise and support our clients and independent professionals on the basis of a framework based on the viewpoints and elements arising from the Deliveroo judgment. In consultation with both parties, we look for an appropriate solution, which may differ per situation. If you would like to know more about this, please contact us.

DGA construction not a solution to false self-employment

With the lifting of the enforcement moratorium on Jan. 1, 2025, many self-employed workers have questions, "Can I continue my current assignment? Can I continue to work for the same client(s)?" With changing legislation and misleading information in the media, there is much confusion, especially about how to avoid "false self-employed" status. An often mentioned solution is to set up a limited liability company and appoint yourself as a DGA, but this is a misconception. In this article, we explain the real situation.

Other rates

The tax authorities do not recognize the term 'zzp'; for tax purposes, a self-employed person without staff is seen as a sole proprietorship or a private limited company (bv). The report 'Grip op het zzp-dossier', conducted by knowledge platform ZiPconomy on behalf of HeadFirst Group and ONL voor Ondernemers, shows that in 2023 one in ten zzp'ers had a bv, while nine in ten had a sole proprietorship. With a sole proprietorship, the entrepreneur is personally liable for debts of the company.

With a PLC, this liability basically remains with the PLC itself and not with the directors or shareholders. Setting up a PLC can also have tax advantages, because different tax rates apply. Whereas with a sole proprietorship you pay income tax in box 1, with a PLC you pay tax in box 2. It is agreed, however, that these tax benefits only become relevant at a minimum annual profit of €100,000 to €200,000.

Mock security

Professionals and consultants regularly advise self-employed people on social media to set up a private limited company and appoint themselves as director and major shareholder. This would protect them from the risks of false self-employment. However, the Inland Revenue assesses the nature of the employment relationship, regardless of the legal form.

Practice rather than legal form

The fact that a person works through a private limited company does not automatically mean that there can be no false self-employment. It ultimately revolves around the "facts and circumstances in the performance of the work. The practical situation is leading, making it important to actually behave as an independent contractor.

The Deliveroo ruling

In the Deliveroo ruling, the Supreme Court listed ten important points for determining whether there is a true employment contract. These must always be considered in conjunction; there is no fixed order or point that outweighs the others. What matters is the overall picture of all the facts and circumstances. Together, they give a good picture of the working relationship and determine whether an employment contract exists.

At HeadFirst Group we advise and support our clients and independent professionals on the basis of a framework based on the points of the Deliveroo judgment. In consultation with both parties, we look for an appropriate solution, which can differ per situation.

Laws and regulations are constantly changing. Find out how this affects your external hiring. Our experts are ready for you - leave your details and we'll get back to you.

Questions about this? Please contact us.

Sem Overduin

Public Policy & Affairs Manager

Sem.Overduin@headfirst.nl

Oifik Youssefi

Public Affairs Officer

Oifik.Youssefi@headfirst.nl

Maaike van Driel

Head of Legal

Maaike.vanDriel@headfirst.group

Thomas ten Veldhuijs

Senior Legal Counsel

Thomas.tenVeldhuijs@headfirst.nl

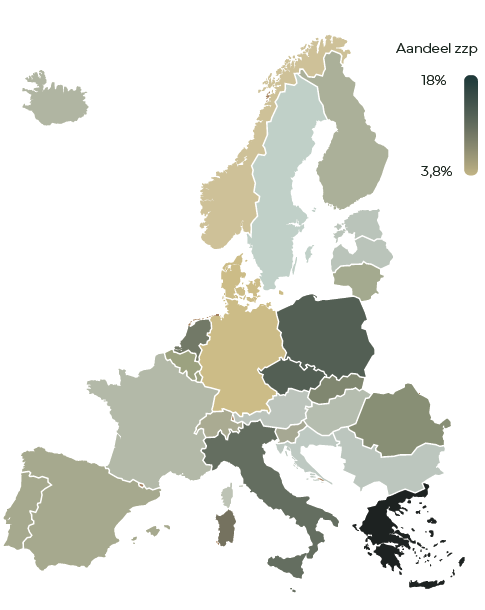

Emancipation drives number of female self-employed in Europe

After steady growth over the past 15 years, one in three self-employed people in Europe are now women. This growth goes hand in hand with increasing gender equality in Europe. In the Netherlands, 37.8 percent of self-employed people are women, which puts us in 11th place in Europe. Research for the latest Talent Monitor, conducted by labor market specialist Intelligence Group and HR-tech service provider HeadFirst Group, shows that the further emancipation has progressed in a country, the more women choose self-employment.

Rise of female self-employed workers

An extensive analysis of data since 2010, shows a very strong relationship between emancipation and the proportion of female self-employed workers in Europe. By linking the data to the World Economic Forum's Gender Gap Index (GGI), which measures gender inequality, a clear correlation was found. In countries with smaller gender gaps, the percentage of female self-employed workers is significantly higher, it can be argued. In other words, increasing gender equality encourages entrepreneurship among women. This is a very good trend and at the same time emphasizes the need to continue promoting equal opportunities as an engine for economic and social growth," said Marion van Happen, CEO of HeadFirst Group.

By 2024, 36 percent of self-employed workers in the European Union (EU-27) will be women, up from 34 percent in 2010. As of this year, Luxembourg is the first European country where more than half of the self-employed are women (50.7 percent). Latvia follows with almost an equal share (49.8 percent), while countries such as Ireland (26.8 percent) and Romania (26.9 percent) lag far behind. In the Netherlands, the percentage is 37.8, slightly higher than in Belgium (36.6 percent).

Fewer hours, more women

The study also shows that in countries where self-employed workers work fewer hours per week on average, the proportion of female self-employed workers tends to be higher. On the contrary, in countries where the difference in hours worked between men and women as self-employed workers is small, we see relatively fewer female self-employed workers. "Being self-employed offers women an attractive form of work because it allows them to combine care responsibilities with flexibility and a better work-life balance. The possibility to work fewer hours or achieve other ambitions as a self-employed worker contributes to their autonomy and strengthens women's emancipation," said Geert-Jan Waasdorp, director and founder of Intelligence Group.

In Europe, men work an average of 40.9 hours per week as self-employed, while women work an average of 34.5 hours. Greek self-employed workers work the most hours (43.4 hours), followed by Spanish self-employed workers (41.7 hours). Luxembourg self-employed workers make the fewest hours (30.8 hours), followed by Estonian self-employed workers (31.9 hours). In the Netherlands, the average is 33.6 hours, well below the European average.

The full report is available for download at headfirst.group.

Talent Monitor | European self-employed under the microscope: Trends, growth & diversity

European self-employed under the microscope: Trends, growth & diversity

The European labor market is in flux. With nearly 20 million self-employed spread across several countries, there are big differences in how this group develops. The Netherlands leads the way with unique trends in flexible work, but how do we compare to the rest of Europe?

The Talent Monitor offers an in-depth analysis of the European self-employed market, sharing insights you shouldn't miss.

Increasing number of self-employed people under 30 in the Netherlands, Belgian numbers actually decreasing

Over the past five years, the number of self-employed people under 30 in the Netherlands has increased significantly, accounting for 12.7 percent of the total number of self-employed people in our country. This places the Netherlands among the top European countries, along with countries such as Malta, Slovakia and Lithuania. In contrast to the Netherlands, Belgium - at almost 4 percent - has actually seen a decline in the number of young self-employed people. This is shown in the most recent Talent Monitor, a joint study by labor market data specialist Intelligence Group and HR-tech service provider HeadFirst Group.

What can you expect in this report?

- A unique comparison between the Dutch labor market and the rest of Europe.

- Find out why older and highly educated self-employed people dominate, and why younger people are less likely to become self-employed.

- Analysis of the growing role of women in the self-employed market and its link to emancipation.

Who should read this report?

- Legislators: To place the Dutch labor market in a broader European perspective.

- Clients with international ambitions: To develop an effective European recruitment strategy.

- Zzp'ers: To understand how unique the Dutch zzp is compared to other European countries.

Partner

Download Talent Monitor

By downloading the Talent Monitor, you agree that your data will be shared with co-initiator Intelligence Group.

Other reports...

Talent Monitor: The convergence of fixed and flex

We compile quarterly - based on recruitment data from...

Talent Monitor: Fixed is getting more mobile and flex is getting more sustainable

We compile quarterly - based on recruitment data from...

Talent Monitor: Rate development professionals 2023

We compile quarterly - based on recruitment data from...