Clarity and decisiveness required in the zzp dossier

Tomorrow afternoon, the Labor Market Policy Committee debate is scheduled. With 36 topics on the agenda, I expect a scattered debate, with a different focus for each party. Leading up to it, I am happy to share some insights regarding the zzp dossier and the current state of affairs.

For a long time it was quiet around the DBA law, but last week the corresponding enforcement moratorium received the necessary attention again due to a report by the Court of Audit. The conclusion was clear: the Tax Administration is currently unable to effectively combat false self-employment. The much-discussed outcome is expected to come up during the debate, in part because the PvdA earlier requested that State Secretary for Taxation and Fiscal Affairs Van Rij join the debate. The request could not count on a majority, but that the report is on the minds of politicians is clear.

Wet DBA affects the employment of professionals

Despite the continuing uncertainty regarding enforcement, replacement of the DBA Act and the further development of the web module, we see that the number of highly skilled zzp'ers (independent professionals) continues to increase. Professionals who consciously choose entrepreneurship and are usually hired by one client for a longer period of time (14 months on average) because of their knowledge and expertise. Detailed information that we have previously set out in the report 'De zzp'er bestaat wél wel', a must-read for politicians and policy makers concerned with the zzp-dossier.

At the same time, we observe a striking development among clients who hire independent professionals. They more often commit themselves - usually in good cooperation with intermediaries - to a maximum deployment period of two years, whether or not laid down in their hiring policy. Although the DBA law is not (yet) being enforced and there is as yet no clarity on an alternative plan, it can be said that the "law" is having an impact.

Focus enforcement on specific sectors

Enforcement of the DBA law in the higher segment of the labor market is undesirable. I therefore recommend focusing on sectors, where the percentage of vulnerable zzp'ers is high. Zzp'ers who work at low hourly rates, struggle to build up financial buffers and forced zzp-ship is more widespread. Although only 7% categorize themselves as "forced self-employment" (+/- 80,000 workers in the labor market), it is important that we fight this together and protect vulnerable workers.

Results of the web module pilot previously showed that in sectors such as construction, hospitality and transportation, the likelihood of "indication in employment" is highest. This sectoral approach is in line with the Belgian model with its Labor Relations Act. In our neighbors to the South, false self-employment is effectively combated by (1) clearer distinctions between employees and the self-employed and (2) stricter enforcement in sectors where the risk of underpayment and financial vulnerability is greatest.

The MLT opinion of the SER also provides more clarity regarding enforcement. A concrete example from this advice is the "legal presumption of employment" under the maximum daily wage of €30 to €35 per hour. This directive will promote enforceability and is also aimed at sectors where vulnerable self-employed workers would benefit from greater protection and certainty. The limited quantitative and qualitative capacity of the Tax and Customs Administration, as concluded in the report of the Court of Audit, can then be optimally utilized.

Nuance in the discussion

In summary, this report is yet another page in the self-employed chapter and so far it remains unclear what the next step is going to be in this dossier. I miss the nuance in the political-social debate about self-employed workers at the base of the labor market. The lion's share of the self-employed population consciously choose entrepreneurship and are very satisfied with their working conditions. Let's be mindful of this development, because we incredibly need all workers in times of tightness. HeadFirst Group is happy to think along with the next step.

Organizations holding hands: drastically low unemployment yet tightness

Unemployment in the euro zone - countries whose currency is the euro - reached its lowest level since 1998 last December, figures from statistics agency Eurostat show. Still, the labor market tightness is becoming more acute, fixed and flex.

Flex in high demand (again)

While the labor market for permanent staff has been scarce for some time, the limits for the flexible labor market are now almost reached as well. The number of offers on assignments for highly skilled work has plummeted: it is now five times lower than five quarters ago. Secondment agencies have sold out and are trying to supplement their supply by recruiting new staff, but are running into the wall. In addition, the sourcing pressure on highly skilled freelancers is skyrocketing: nearly 7 out of 10 are approached at least once a quarter for an assignment.

Finding & engaging talent

This hyper scarcity in the flex market is new in the Netherlands. In order to recruit, bind and retain talent in these times, it is necessary for clients to pull out all the stops. It requires creativity and forces organizations to look at the entire workforce in an integral way. The form of contract is less relevant; bringing in the right talent comes first.

If organizations do not have their employer branding and corporate social responsibility in order, they will miss the boat. Embedding them in the business is required, especially to attract and retain millennials - the growing group of workers. Weak employer branding is currently being compensated by organizations by hiring hordes of recruiters. While the answer lies in two areas; data-driven recruiting methods and targeting alternative audiences in the job market.

In the Talent Monitor "Hyper Scarcity in the Labor Market," we provide unique insights based on Intelligence Group's recruitment data and HeadFirst Group's hiring data. The report is free to download from our hfgroup.headfirst.group website.

Important not to lump various groups of self-employed people together

In the first corona year, there were 130,000 more employed people than in 2019 whose labor income dropped at least 10 percent. In particular, flexible workers and the self-employed experienced lagging growth in labor income, reports NU.nl following the CPB study "Development of labor income during corona. An important nuance: this does not apply to all self-employed workers.

Impact COVID-19 on external hiring

The impact of corona on highly skilled self-employed workers in 2020 was minimal. Naturally, in principle, we saw a setback in new hiring requests and hours worked. Fortunately, the positive trend gently set in from May. The number of professionals whose assignments were specifically terminated also remained very limited.

Three reasons underlie this; 1) highly skilled freelancers can perform work at clients largely remotely, 2) they are often employed in mission-critical processes of organizations, with the result that these projects just kept going, and 3) government organizations make extensive use of externals, they proved to be a stable hiring force at the time of the corona crisis.

Importance of reforms

According to CPB, the published figures show that it is important to reform the labor market, central to which can be the reduction of the distinction between permanent and flexible work and the promotion of economic independence. To make the right choices in this regard, facts and properly interpreted figures are indispensable. An example: the distribution of wealth among the self-employed is greater than among employees, for example in terms of annual income and financial buffer. The self-employed are overrepresented both in the lower income brackets (less than €20,000 per year) and in the higher income brackets (more than €50,000 per year).

Do care for vulnerable self-employed

HeadFirst Group embraces the plans to protect (forced) self-employed with lower hourly rates and small financial buffers, for example against the consequences of disability and unemployment. At the same time, legislation should not have a negative impact on the growing group of highly skilled professionals, who sell their own labor to clients and consciously choose self-employment. Customization is thus essential to protect vulnerable self-employed professionals while facilitating innovation and entrepreneurship.

In the report "The self-employed do exist. Facts about the self-employed without personnel.' - prepared by independent knowledge platform ZiPconomy - HeadFirst Group lists valuable facts, figures and insights about the self-employed. It is free to download via the hfgroup.headfirst.group website.

Hague update: directives from the EU and a headline debate on the labor market

The new cabinet has been in place for some time now, there is an ambitious coalition agreement on the table, and the new ministers have settled in reasonably well. This is noticeable in The Hague. Officials are busy writing policy plans and the Lower House is also regularly debating. A good time to briefly take you through the most important events and developments of the past few weeks.

EU proposal platform work

It is clear that Brussels is becoming more and more explicitly involved in national affairs and issues. Not entirely surprisingly, last December the European Commission came up with a proposal to better protect platform workers. Patience with Uber and Deliveroo has been running out in Brussels for quite some time, and in the new directive, the European Commission demands that platform workers be given the same rights and obligations as employees. Since the issue of platform work plays out in several European countries, Brussels is now picking up the gauntlet to come up with clear guidelines and criteria to clarify the qualification of the employment relationship.

The proposal sets out five criteria for determining whether an employee is an employee or a self-employed person. These are as follows:

1. The platform determines the remuneration of the worker;

2. The platform sets requirements for the appearance of the worker (for example, he must wear a uniform); 3;

3. The platform monitors the worker's performance through digital means;

4. The platform determines working hours;

5. The platform limits the worker's ability to work for others.

Should it remain in practice that there are two or more criteria, it will be up to the platform to prove that there is still a zzp'er rather than an employee. According to European Union calculations, this will have a major impact on the Dutch treasury, as billions in tax revenue and social security contributions can be benefited.

Now, there are some fundamental questions that need to be asked about this proposal and the whole discussion about platform work. For what exactly is the definition of a platform? And is this proposal only about tackling false self-employment among platform workers, or is this proposal about the mediation and classification of self-employed workers in general? In any case, last weeks it became clear that all political parties agree that this proposal is going to have an effect on the self-employment issue in the Netherlands. The discussion about when a self-employed person is really self-employed has been going on in the Netherlands for a long time and many attempts to clarify this have failed and have been put on ice. This fatigue is an extra reason to be alert, because The Hague should not accept this proposal too easily and should clearly guard the line between vulnerable platform workers and true self-employed workers. It is likely that public bodies such as the Tax Office and the Labor Inspectorate will be allowed to use these criteria to test and enforce the presumption of employment. This immediately indicates that the proposal is not only aimed at protecting the vulnerable platform worker, but that it also gives public law bodies tools to start enforcement. We will therefore need to monitor developments closely and inform Chamber members of our interests and concerns as early as possible.

Mainline debate Social Affairs and Employment

On Thursday, February 17, the Parliamentary Committee on Social Affairs and Employment debated the plans in the coalition agreement with the new ministers of Social Affairs and Employment. Various themes were addressed in the debate and with 19 political groups, it went in all directions at times. Fortunately, the debate also focused on topics that are important to us, such as the web module, the enforcement moratorium and clarity regarding the hiring of the self-employed.

Prior to the debate, we as HeadFirst Group provided input and asked several members of parliament to provide more clarity on the further development of the web module and enforcement of the DBA law. It was good to see that parties returned to this during the debate. The market is yearning for clear and enforceable rules after all these years.

Although the minister did not answer our questions directly, there were certainly some bright spots. For example, the minister himself indicated that only a small percentage of workers on the labor market are 'vulnerable self-employed' and that we should focus on those sectors where the chance of false self-employment is greatest. This interfaces with the Belgian model that we previously wrote a report about with ZiPconomy and ONL, and we have also been advocating sectoral enforcement for some time. The minister has also promised to come up with a "broad plan" on labor market reform before the summer and to outline this in a letter and share it with the House of Representatives.

Is 2022 the year of the TTA breakthrough?

Organizations have long been able to afford the luxury of filling the shortage of permanent employees with temporary, external professionals. Those days are over: even in the flexible labor market there is scarcity on all fronts. Hourly rates are rising fast: by 7% on average. This scarcity is forcing organizations to look at the entire labor force in an integral way. Recruiting, binding, motivating and developing the right talent is paramount. The form of contract is becoming less and less relevant. Thus, 2022 could well be the year when Total Talent Acquisition (TTA) actually takes off. Expert Alexander Crépin shared his vision on ZiPconomy.

Start with a living lab

One of the key challenges to getting started with Total Talent Acquisition (TTA) is setting up a single TTA process. How do you ensure that all open positions are picked up in a "one-stop shop" fashion and that the hiring and hiring processes are uniformed? However, the step from the as-is situation to this is huge. The advice: start small, start a living lab. This can be done using just two steps:

- Start by handling all requests in one central location. You could call this the TTA Desk or the Inflow Service Point (ISP).

- Then, in line with Agile thinking, engage in multidisciplinary learning with each other. This offers the opportunity to work pragmatically result-oriented, and thus the expertise of all stakeholders can be utilized step by step to achieve the intended TTA gains. For example, you can choose to start working within a certain department and/or with a certain type of roles first. Look together at how the two entry tracks can be arranged to fill the position in a customer-focused, efficient and effective way.

In the way outlined here, existingbest practicesof recruitment and external hiring can be brought together much more easily. It is also possible to experience, without too much risk, how best to implement TTA to optimize the inflow of talent. It also avoids having to invest directly in systems and tools, for example for integrations or switching to a new solution that better supports TTA. These are processes that are best started only when there is a good picture of the operational implications of TTA.

You can read the entire article by Alexander Crépin his hand at ZiPconomy

Deliberate action necessary in implementing coalition agreement

Wednesday, December 15, 2021, the long-awaited coalition agreement "Looking out for each other, looking forward to the future" was presented. For the labor market, the new administration has an important goal: reform to reduce burdens, improve social security and combat poverty. 'So that working pays, being an employer and entrepreneur remains attractive, our well-being increases and staff shortages in vital sectors can be met.' Han Kolff, CEO HeadFirst Group, responds to the proposed plans.

Rutte IV wants to invest €500 million annually to implement "a number of major reforms," guided by the principles of the Borstlap Commission and the MLT advice of the SER. Solid reports and largely good plans, but now the hard part begins: implementation. This also applies to the premise 'genuine self-employed people are supported and entrepreneurship is stimulated', which has not been further elaborated. I underscore the point of view wholeheartedly, but it depends on making the right choices. Translating words into action requires manpower, knowledge and a clear vision.

The current tightness in the labor market only compounds this challenge. Hastily implementing generic and ill-considered plans can have fatal consequences. We saw this with the introduction of the DBA law, when many independent professionals (zp'ers) experienced loss of income due to reluctant clients. Indeed, many self-employed people are still experiencing inconvenience: the lack of clarity has meant that more than half have found it more difficult to find a suitable assignment. This is on top of the self-employed, nearly 40 percent, whose assignments have been terminated prematurely by clients in recent years due to concerns and lack of clarity around legislation. We absolutely cannot use any further increase. We desperately need every professional group, in whatever form of contract, in the coming years.

Further development of web module

Despite criticism of the web module from industry associations and zzp-interest groups, the focus for the replacement of the DBA law is mainly on the further development of this questionnaire. To create both political and social support, a crucial step is for the Lower House to hold a substantive debate with Karien van Gennip and Marnix van Rij - ministers of Social Affairs and Finance and key players in this discussion - on the pilot results of the web module. The web module can provide certainty in advance, but it is essential that relevant officials at the department restart the conversation with field parties to critically review the underlying system of questions and make fundamental adjustments.

The outcome must not lead to reduced hiring of the self-employed, who are not in need of help and do not need protection against false self-employment. I emphasize this emphatically, because clients and intermediaries do not benefit from unrest and uncertainty either. For situations of intermediation, the web module is not ready, nor has there been a pilot phase. The intermediary industry is happy to help with the further development of a workable web module, so that we can prevent unrest and demand drop-out from self-employed workers.

Enforcement on employment relationships

To "combat false self-employment, there will be better public enforcement in the case of suspected employment". As we discussed in a roundtable discussion with FNV Zelfstandigen, ONL voor Ondernemers and TNO, enforcement on labor relations can have an important function for the balance on the labor market. Important to protect vulnerable and forced self-employed workers and offer security, at the same time we must keep an eye on the diversity of the self-employed population and give conscious self-employed entrepreneurs in the higher segment the freedom to do business. Start enforcement step by step in the sectors, where we know there are many vulnerable self-employed workers working at lower hourly rates. The SER opinion provides guidance for this and keeps the labor market above €35 open and workable.

Stay in conversation with field parties

I advise politicians to stay in conversation with industry associations, intermediaries and self-employed advocates. These are the specialists when it comes to connecting supply and demand in the fragmented and very tight labor market. As one of the parties guiding people from work to work and contributing to the sustainable employability of employed people, we are happy to do our part. In the coming years, we are happy to work and - more importantly - implement the plans to make serious work of the labor market of tomorrow.

Roundtable discussion: the zzp'er does exist

'The self-employed person does not exist' is a cliché that has regularly recurred in the political-social debate in recent years. It indicates that the total group of more than one million self-employed persons without personnel is very diverse. This makes policy development difficult. To arrive at future-proof and implementable policies, facts and figures are crucial. Therefore, ZiPconomy, HeadFirst Group and ONL for Entrepreneurs presented the report 'The zzp'er wélél! Facts about the self-employed without staff'.

What facts and figures stand out? What are the conclusions in a nutshell. Hugo-Jan Ruts (founder and editor-in-chief of ZiPconomy) presented the most important insights. And what can or should these mean for the coalition agreement and policy of a new cabinet? In a round table discussion Frits Huffnagel (founder Castro Communicatie) discussed this with Irene van Hest (Sector Head FNV Zelfstandigen), Ronald Dekker (Labor Economist TNO), Han Kolff (CEO HeadFirst Group) and Hans Biesheuvel (Co-founder ONL.

Participants were invited to join online and actively participate in this by asking questions of the table guests and responding to statements and polls. Check back on the roundtable discussion below:

About the report

With the report 'The self-employed do exist. Facts about the self-employed without staff' - compiled by independent knowledge platform ZiPconomy - HeadFirst Group and ONL for Entrepreneurs present valuable facts, figures and insights about the self-employed. The goal: to map the heterogeneity and diversity of the target group and raise the public debate about the labor market to a higher level.

In 2022 rate hike of 7 percent for self-employed and secondees

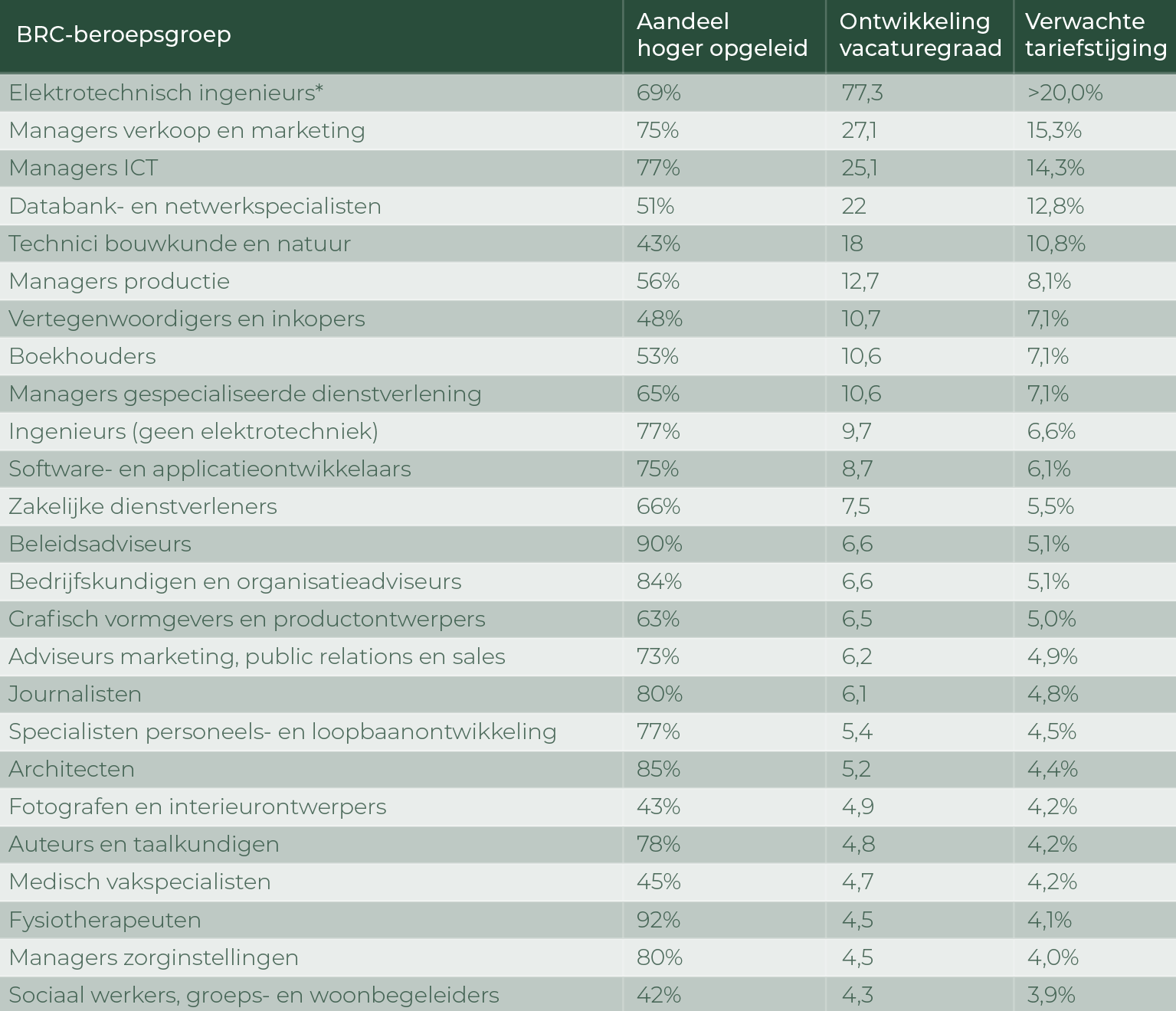

Flexible workers, more specifically self-employed workers and professionals employed by secondment agencies, are expected to become 7 percent more expensive on average in 2022. A highly educated professional can increase the hourly rate by an average of 5 percent. For the practically educated, the hourly rate will rise even more: 10 percent. This is according to a rate prediction model for 114 professions developed by labor market data specialist Intelligence Group, which it is presenting for the first time this year in cooperation with HR service provider HeadFirst Group.

Notable rate increases and decreases.

The largest increases are expected within practically trained occupational groups. Especially among machine mechanics (44.6%), plumbers and pipe fitters (36.7%), carpenters (32.6%), electricians and electronics mechanics (28.5%), assembly workers (28.5%), agricultural and forestry workers (25.8%), welders and sheet metal workers (24.8%) and truck drivers (23.9%) are reaping the benefits of the scarcity of their skills. Among highly skilled professionals, it is electrical engineers who can make or see the hourly rate rise the hardest (>20%), followed by managers in sales and marketing (15.3%) and ICT (14.3%). Database and network specialists and structural and nature engineers can also expect their rates to increase by at least 10 percent.

Only the practically educated occupational groups bus drivers and streetcar drivers see their rates under pressure, with a small decrease of 1.3 percent. For the highly educated, this is true of librarians and conservators (2.6 percent) and logistics managers (8.2 percent).

Han Kolff, CEO at HeadFirst Group: "It has been a long-held desire to bring predictive power to the hourly rates of hired professionals. This offers freelancers and secondment companies insight into their market position, equally clients can use the forecast to budget hiring costs for next year. A next step in the smart use of data in organizing flexible labor."

Vacancy rate of great influence

The rate forecasting model is based on nine factors, including the income development of freelancers, inflation, economic growth and vacancy rate. Geert-Jan Waasdorp, director and founder of Intelligence Group: "Rate increases are primarily explained by a constant year-on-year increase of 1.8 percent. Logically, inflation plays an important role in this, but the development of the vacancy rate - the number of vacancies per 1,000 jobs - also has an influence. As this decreases or increases and thus the market becomes tighter or wider compared to the previous year, the rate moves with it. These two factors largely explain the variance in the forecasting model."

The Talent Monitor 'Forecast rate development professionals 2022' is available for free download at hfgroup.headfirst.group.

About Intelligence Group

Intelligence Group is an International Data & Tech company in the field of labor market and recruitment data. Intelligence Group focuses on the collection, storage and enrichment of labor market related data for the purpose of improving the recruitment of personnel (or employees) by employers and the employability/labor market opportunities of employees. This data is made available to clients in a wide variety, via reports, dashboards and APIs.

About HeadFirst Group

HeadFirst Group is a leading, international HR service provider and the largest temporary employment platform for professionals in the Netherlands. The organization offers a diversity of HR solutions: Managed Service Providing, Recruitment Process Outsourcing, intermediary services (matchmaking, contracting) and HR consultancy. An average of fifteen thousand professionals work daily for over four hundred clients in Europe, with which HeadFirst Group realizes an annual turnover of over 1.5 billion euros. The main brands of HeadFirst Group are the intermediaries HeadFirst and Between, MSP service provider Staffing Management Services and RPO and recruitment specialist Sterksen.

Rate development professionals 2022 - CEO Han Kolff in conversation with BNR

An increase in rates is predicted in virtually all occupational groups for self-employed workers and professionals employed by secondment agencies. This emerges from a rate prediction model for 114 professions developed by labor market data specialist Intelligence Group, which it is presenting for the first time this year in cooperation with HR service provider HeadFirst Group. Han Kolff, CEO of HeadFirst Group, spoke about it with BNR.

Flexible staffing is expected to be about 7% more expensive next year, with appropriate differences within occupational groups. 'We expect the biggest increase on the practical side of the market, with an average increase of 10%. Where there are large shortages of skilled workers - such as plumbers, carpenters and assembly workers - hourly rates will even go up by >20%.'

Vacancy rate

'Because of scarcity, inflation trends and COVID-19, it is an exorbitant year to develop a forecasting model. These are very important trends,' Kolff says. 'The vacancy rate - the number of job openings per 1,000 employee jobs - is the biggest indicator that determines how rates develop. If year-on-year the number of vacancies increases, that's a sign of scarcity and you'll see rates adjusted accordingly. So you will sometimes have to pay a little more for sought-after professionals.'

More freedom

Kolff argues for more freedom in the labor market. 'Perhaps other legislation can provide more room on the flex market. Zzp'ers do not always have it easy. At the bottom of the market we must protect people well, so that they are not forced to work for too low a price. And for the top of the market, there must be freedom to do business. The market is blunted by legislation, because it leaves no room for further growth.'

According to Kolff, it is very interesting to see which occupations are going in which direction. 'But the distribution could be a lot better, people should be better guided from job to job. That's what we as the Netherlands must continue to focus on.'

About the report

A long-held wish has come true: to make hourly rates predictable. We do it in the Talent Monitor 'Forecast rate development professionals 2022'! The next step towards more datadriven hiring and a good hold for freelancers and secondment agents in the flex market who want to know what they are worth. In the report we make statements about the expected rate increase/decrease in 114 professional groups, with extra attention to 51 professional groups in which mostly highly educated professionals are active. The report is free to download from our hfgroup.headfirst.group website.

Talent Monitor: Forecast rate development professionals 2022

Talent Monitor: Forecast rate development professionals 2022

Labor market data specialist Intelligence Group has developed a unique rate prediction model, using data from HeadFirst Group, among others. At the end of 2021, we presented the first forecast, starting an annual tradition.

Highly educated professional gains an average of 5% percent

Self-employed and seconded professionals have a big rate hike ahead in 2022. On average, a highly skilled professional can increase the hourly rate by 5 percent in 2022. The largest increases are expected within practically trained professional groups, with the machine mechanic being the outlier. He is expected to gain 44.6 percent. Across all workers - from practical to highly skilled - the average expected increase is 7 percent. Read the entire press release here

Main observations

- The average expected rate increase in 2022 is 7%. For all highly skilled professionals, the expectation is 5% and for the more practical and operational occupations (blue collar) at least 7%.

- Zooming in on the professionals segment: only among logistics managers, librarians and conservators is a rate increase not expected. The former is a scarce occupational group, but less so compared to last year. The largest rate increases are expected among electrical engineers, sales and marketing managers, ICT managers, database and network specialists, and construction and nature engineers.

- Looking at the more practical and operational segment: only among self-employed bus drivers and streetcar drivers is a small decrease expected (-1.1%). The largest increases are expected among machine mechanics, plumbers and pipe fitters, carpenters, electricians and electronics mechanics, assembly workers, agricultural and forestry workers, welders and sheet metal workers, and truck drivers, among others.

- Rate increases are primarily explained by a constant increase year-over-year of 1.8%. Sensationally, this increase is most logically explained by inflation, but that is not always the explanatory factor. A second factor is the increase or decrease in the occupational vacancy rate. As the vacancy rate decreases or increases and thus the market becomes tighter or wider compared to the previous year, the rate moves with it. These two factors, explain 90.6% of the variance in the prediction model.

Partner

Download Talent Monitor

Other reports...

Nothing found.