Self-employed want flexibility in mandatory disability insurance

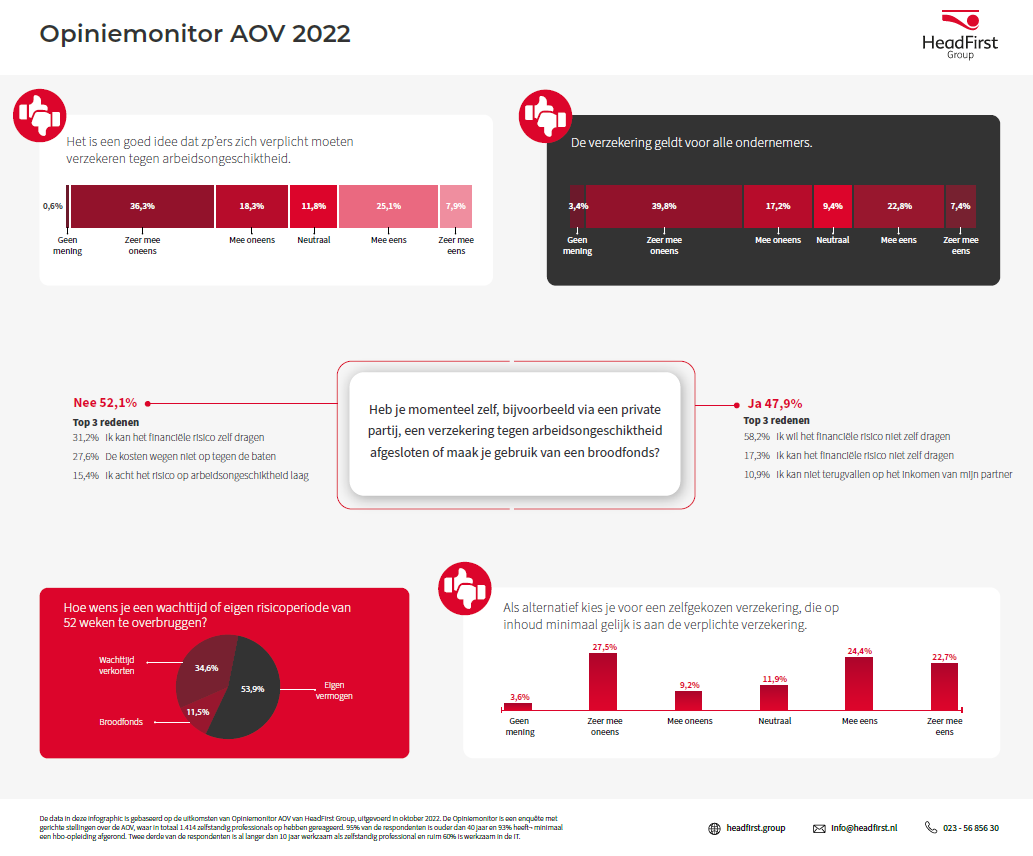

A third of highly educated self-employed support plans for mandatory disability insurance (AOV). However, almost half are in favor if self-insurance is allowed as an alternative. So says research by HR-tech service provider HeadFirst Group among more than 1,400 participants. CEO Marion van Happen shares the opinion about this opt-out: "We support the principle of an AOV for all self-employed people, but choices are a crucial success factor in this."

Opt-out scheme

By January 1, 2025, there should be a law to make it mandatory for self-employed workers to have insurance against disability. With the aim of preventing large income risks for individuals and countering unfair competition on working conditions. The rules and conditions of the intended law were recently discussed again during the Labor Market Policy Committee debate. In it it was announced that a simple AOV can be implemented by 2027, more customization means postponement to 2029. Minister Karien van Gennip of Social Affairs and Employment is investigating customization in the form of an opt-out arrangement.

Van Happen - along with the SER - stresses the importance of introducing an AOV with the right choices. "Mandatory disability insurance is important to protect vulnerable self-employed people and offer security. At the same time, we must keep in mind the diversity of the self-employed population with different assignments, starting motives and hourly rates. The option for self-pay insurance, which is at least equal in content to the public AOV, can count on support because it fits well with the different wishes and needs of this group of workers," Van Happen said.

Half of self-employed have nothing arranged

Last year HeadFirst Group also surveyed the opinion of self-employed people in the field of AOV. The results are virtually unchanged. Currently just under half of the self-employed have covered the risks of disability themselves - for example through a private party or a mutual fund. The most important reasons for highly educated self-employed workers to take out insurance is that they are unwilling (58 percent) or unable (17 percent) to bear the financial risk themselves. Another 11 percent cannot fall back on their partner's income. Of the self-employed who have not taken out disability insurance, 31 percent say they can bear the financial risk. Furthermore, over a quarter feel the costs do not outweigh the benefits and 15 percent consider the risk of disability low.

For self-employed people who have not yet made any arrangements should they become disabled, HeadFirst Group offers a low-threshold provision: Select iCommunity Crowdsurance (SiCC). This is an endowment-based provision. It is a net benefit for up to two years. In line with the need for an affordable, flexible solution that does not pay out until retirement age, but for a framed period. This provision also matches the desire of self-employed workers to bridge the 52-week self-risk period with a bread fund - desired by 12 percent of research participants - or to shorten the waiting period (35 percent).

Check out the survey results in this infographic.

Authority criterion remains a hot topic in labor market file

The Labor Market Policy Committee debate took place last Thursday. The Parliamentary Committee on Social Affairs and Employment spoke with Minister Van Gennip (SZW) about the announced plans to reform the labor market. In the debate, she indicated that she was committed to clarifying the authority criterion to determine whether an employee or self-employed person is involved. That the Cabinet recognizes this and is working toward replacing it is crucial.

Embedding in the organization

The Borstlap Commission proposes to modernize the authority criterion by making "embeddedness in the organization" more central to the assessment of the employment relationship. I am not in favor of giving this criterion more weight, because there is already enough debate about the interpretation of when authority exists. When is a worker "embedded in the organization"? And what tasks are part of "the regular work of an organization"?

In practice, we see just the opposite happening. Hybrid teams with different specialists working on a project basis on solutions and issues of importance to the organization at that time. These are often teams where there are different forms of contracts. The results of the recently published CBS survey support this picture: employers consider the "type of contract" much less important than previously thought. Factors such as knowledge, expertise and work experience are much more important. Will this soon no longer be possible if we deal too rigidly with authority and embedding in the organization?

Great diversity zzp population

In addition, I question the modernization of one general authority criterion. After all, in the Netherlands we are dealing with a very diverse self-employed population. This group of workers has diverse assignments, works for different hourly rates and the duration of assignments is also very different. One authority criterion for this entire target group will therefore not work. We need more customization.

What next?

Currently, the minister is working with the social partners to further develop the proposals. She aims to have the next letters ready before Christmas so that they can be shared with the House of Representatives in January. These letters will clarify how the minister intends to further clarify the authority criterion and form the basis for the debate in February 2023, after which the bills can be shared with the market through an Internet consultation in the summer of 2023.

All in all, it is clear that all parties feel the urgency to tackle false self-employment quickly and keep up the pace. As the largest HR-tech service provider, we will of course remain in dialogue with our stakeholders in The Hague and will act together with our partners.

Note to editors:

For more information: Natasja Spooren, PR & Content Specialist at HeadFirst Group, reachable at 06 - 151 924 85 or natasja.spooren-wassenaar@headfirst.nl.

What will be Minister Van Gennip's next move?

Tomorrow afternoon the Labor Market Policy Committee debate is scheduled. On the parliamentary agenda are a number of important topics, such as the report of the Borstlap Commission and the Labor Market Outline Letter of July 5. Ahead of the debate, Marion van Happen is happy to share her views on the current proposals on the table in political The Hague.

First of all, I would like to emphasize that I am positive about the first outline letter from the Minister of Social Affairs and Employment. The three tracks mentioned - the level playing field, regulatory clarification and improving enforcement - are the right knobs to turn. If seen and dealt with in conjunction, I see the contents of this letter as a step in the right direction.

Established criteria supplemented by sectoral approach

I welcome the attention given to the Belgian Labor Relations Act in the outline letter. The thinking and underlying principles offer an opportunity to replace the DBA law. The Labor Relations Act establishes clear legal criteria for determining whether one is an employee or a self-employed person. Criteria have also been established at the sectoral level for sectors and professions where the likelihood of underpayment or vulnerable entrepreneurship is greatest. This approach increases the effectiveness of enforcement and does more justice to the diversity of self-employed workers.

What also makes enforcement more effective and targeted is the SER's MLT recommendation to introduce a legal presumption of employment below the hourly rate of €35. The SER's proposal thus distinguishes between vulnerable self-employed people and self-reliant self-employed people. This allows the tax authorities to focus on the sectors and professions where self-employed workers are hired under this rate. Clear and legally defined criteria plus a sectoral approach are a good starting point as far as I am concerned.

Embedding in the organization

Then I'll jump to the authority criterion, surely a hot topic in this dossier. In my opinion, this is the crux of the discussion: when can an organization hire a self-employed person for a particular job and when is it an employee? For various reasons, the DBA law has failed to provide this clarity. That the Cabinet recognizes this and is working toward replacing it is crucial.

The Borstlap Commission proposes to modernize the authority criterion by making "embeddedness in the organization" more central to the assessment of the employment relationship. I am not in favor of giving this criterion more weight, because there is already enough debate over the interpretation of when authority exists. When is a worker "embedded in the organization"? And what tasks belong to "the regular work of an organization"? In practice, I see just the opposite happening. Hybrid teams with different specialists working on a project basis on solutions and issues of importance to the organization at that time. These are often teams where there are different forms of contracts. The results of the recently published CBS survey support this picture: employers consider the "type of contract" much less important than previously thought. Factors such as knowledge, expertise and work experience are much more important. Will this soon no longer be possible if we deal too rigidly with authority and embedding in the organization?

Great diversity zzp population

In addition, I question the modernization of one general authority criterion. After all, in the Netherlands we are dealing with a very diverse self-employed population. This group of workers has diverse assignments, works for different hourly rates and the duration of assignments is also very different. One authority criterion for this entire target group will therefore not work in my view. We need more customization.

The web module, in its current form, also does not sufficiently take this diversity into account. It only tests for the aspects of being an employee and does not sufficiently take into account aspects of being self-employed. As a result, the arrow can only move in one direction and that is the direction of "indication of employment.

In the recent budget of the Ministry of Social Affairs and Employment, I read back that the web module is being further developed to provide clarity on the nature of the employment relationship. To make the web module somewhat operational and reliable, I recommend that the questions and assessment also take self-employment into account. This will result in more balance in the answers.

Clear rules first, then enforcement

With regard to enforcement, I read back that enforcement will resume on January 1, 2025. I agree that enforcement needs to be started. The way in which and how this will be rolled out, I still see some bumps in the road. The coalition of industry associations states in their joint letter - quite rightly, by the way - that enforcement will only be effective if the ground rules and criteria are clearly established at the front. For all parties involved - the Tax Office, intermediaries, principals and zzp'ers - this must be clear. My appeal to The Hague is therefore: take the outstretched hand of the industry associations and enter into discussions with implementing organizations about enforceable criteria. Let us as intermediaries be an extension of the implementers. We are pre-eminently the parties in the labor market with knowledge and expertise.

In the coming months we will keep a finger on the pulse and remain involved in relevant developments. At the end of this year I expect more clarity about the next step with the second outline letter and a progress letter 'Working on a self-employed basis'. As the largest HR-tech service provider, we will of course remain in dialogue with our stakeholders in The Hague and will pull together with our partners.

Minister of Social Affairs and Employment puts dot on horizon, follow through now much needed

Minister Karien van Gennip (Social Affairs and Employment) has shared the Labor Market Outline Letter with the House of Representatives. This is the next step in making the labor market future-proof. It is important to outline clear frameworks for the self-employed, clients, intermediaries and implementing organizations immediately after the summer recess. A Labor Market Policy Committee debate is scheduled for Thursday, September 8, an appropriate time to follow up on the contents of the letter.

Role of flex in the labor market

It is good to read that "flexible labor plays a useful role in the labor market. This recognition is correct and corresponds to daily practice. The right degree of flexibility is good for the labor market. It allows organizations to move flexibly with economic and social developments. At the same time, partly unjustifiably, there is also attention for the lesser aspects of flexible work. Obviously, politicians are looking for the right balance, but the discussion about flexible work needs to be placed in perspective with the right nuance. The Self-Employed Labor Survey (ZEA) 2021 shows, among other things, that the lion's share of flexible workers, mainly self-employed, are very satisfied with their working conditions and consciously choose to do so. A factual discussion is crucial to arrive at solutions that actually support the workers who need them.

Labor relations act and SER opinion

The replacement of the DBA law plays a major role in the zzp dossier. The fact that the Outline Letter pays specific attention to the Belgian Labor Relations Act and the MLT opinion of the SER makes me feel positive. In previous position papers, reports and discussions with stakeholders in The Hague, we have fully committed to the Belgian model. As a result, it is now on the political and official agenda. The legal presumption of employment for vulnerable workers below the hourly rate of €35 (MLT advice from the SER) is also a step in the right direction. I agree with the government's position that it can strengthen the position of vulnerable people in the labor market. Whether the Tax and Customs Administration and the UWV can actually implement it is the question, because here too it is ultimately about reliable and good implementation.

Sufficient freedom the higher end

If the government maintains a focus on sectors where the risk of underpayment is greatest, the intermediary industry will be given the responsibility to ensure that the higher end works optimally. This requires clear agreements with independent professionals and clients. I will gladly continue to seek that cooperation with the government.

Enforcement, clarification and renewal of DBA law rules must go hand in hand

Minister of Social Affairs and Employment Karien van Gennip and State Secretary of Finance Marnix van Rij responded last week to two investigations about the lack of enforcement on false self-employment by the Tax Administration. They emphasized that they want to tackle false self-employment "in conjunction". First, the cabinet wants clear rules around the hiring of freelancers, a more level playing field between employees and the self-employed, and research into the consequences of enforcement for controlling agencies. Until there is more clarity, the enforcement moratorium on the DBA law will remain in place.

HeadFirst Group embraces the message of branch organization Bovib (branch organization for intermediaries and brokers), which together with ABU, I-ZO Netherlands, NBBU, RIM and VvDN sent a response to the parliamentary letter on enforcement of the law DBA. We support the ambition to prevent false self-employment and are pleased that the government recognizes the complexity of monitoring distinctions between employment relationships.

Take example of Belgian Labor Relations Act

One of the suggestions described: consider the Belgian Labor Relations Act as a serious option. In the structure of this law, the labor relationship is assessed on criteria specific to the situation where a worker is hired by a client. In this way, more clarity is created, without amending labor law and without affecting workers' rights. Such a structure fits with the fact that the nature of the employment relationship does not depend on one criterion (such as authority relationship), but several in conjunction (for example, also the nature of the assignment, sector or specialty of the worker). Moreover, self-employed workers who, for example, sell products or provide services to individuals (together about half of all self-employed workers) are not affected by this solution.

A setup like the Belgian Labor Relations Act also removes the current objections to the web module. This is because this tool now too often does not provide a definitive answer and does not take into account contextual circumstances surrounding entrepreneurship. Furthermore, the web module is currently not suitable for situations where self-employed persons work from a PLC or through an intermediary.

Meanwhile, the labor market and zzp-dossier gets all the attention in The Hague, with yesterday a debate and today a letter from Minister Van Gennip. HeadFirst Group follows it closely and likes to think along about the assessment criteria, further implementation and enforcement on false self-employment. A well functioning labor market is in all our interests.

"Working together to make change possible."

Hans Biesheuvel, founder of ONL voor Ondernemers, has been an entrepreneur at home and abroad for 35 years. With all the knowledge and experience he has gained in these years, he is committed to one goal: to make the voice of many entrepreneurs heard by politicians.

With ONL, Biesheuvel is closing the gap between the business community (the self-employed and SME organizations) and The Hague. By bundling information and translating it in such a way that it ends up on the political agenda. "Lobbying, raising problems and creating support are crucial here. But certainly also offering a solving and helping attitude in realizing this," Biesheuvel explains.

ONL has the influence to bring about real change. For example, after the corona outbreak there was immediately a plan with recovery measures, which was almost completely followed by politics. But also substantive input on the future of the Dutch labor market was included in the Borstlap Committee report. This input was created in collaboration with HeadFirst Group, similar to reports such as 'De zzp'er bestaat wél' and 'Een kijkje over de grens', and plays an important role in influencing the political agenda.

"It's better to talk with each other than about each other. Our office in The Hague is the place for that. Working together to make change possible."

In the past two years, politics has been lived by the subject of corona, while important dossiers await. The energy transition, the housing market and certainly also the labor market require attention. Biesheuvel: "It is time to take decisions. Even if we continue to be inundated by a tsunami of problems, it is important that we look ahead. And we are providing the right handholds for that."

This interview appears in our Annual Report. Curious about other interviews or our results and strategy? Then read the entire report.

Overly rigid rules on hiring self-employed not desired

Last Thursday, Parliamentary questions about enforcement of the DBA law were answered by Minister Van Gennip and on Thursday, June 30, the SZW Committee will debate the zzp dossier. Ahead of this, ZiPconomy published the report "Employee, unless... 8 variants for replacing the DBA law.

A clear overview of all the different proposals made in recent years to replace the DBA law. More importantly, the pros and cons and consequences for the self-employed and clients are detailed. By combining these insights with the correct facts and figures about the self-employed, politicians in The Hague can come to a well-considered decision.

Take into account labor market situation

Two elaborated variants, the proposal of the Borstlap Commission and the ABC test from California, have heavy impact on the freedom of self-employed workers and clients. Given the current tight labor market, it is important not to underestimate these impacts. Employers and clients are crying out for talent and are pulling out all the stops to retain the current population.

I completely agree that there should be clear rules and frameworks for when someone can be hired as a self-employed person. However, too rigid rules are not desirable, because practice shows that the form of contract is becoming less and less decisive. It is therefore important to deal carefully with laws and regulations concerning work and not to restrict workers too much in their choices.

Belgian model good alternative

The report also highlights the Belgian model with the Labor Relations Act. In Belgium, the problem of false self-employment is effectively combated by (1) having a clear set of criteria as to whether someone can perform an assignment as a self-employed person, (2) looking more at the aspects of entrepreneurship and (3) having stricter rules in sectors where the risk of underpayment or vulnerable workers is high. This combination of factors works well in Belgium, so it is interesting to see if we can adopt the positive aspects and improve the less good ones in the Netherlands.

And now?

For now, it is not clear what the next step will be from Minister Van Gennip. Before the summer, an outline letter will go to the House of Representatives on the elaboration of the labor market package. Finally, there will be a response to the report of the Court of Audit before the debate on June 30. We are following developments closely and remain in close contact with MPs and policy staff.

The report "Employee unless... 8 variants for the replacements of the DBA law is available for download on the ZiPconomy website.

8 variants for replacing the DBA law

The hot topic: employee unless...

On Thursday, June 30, the Social Affairs and Employment Committee will debate the zzp dossier. Ahead of this debate, ZiPconomy published the report 'Employee, unless ... 8 variants for the replacement of the DBA law' this morning. Packed with interesting insights and a clear overview of the different variants on the table. "We hope that based on the contents of this report a substantive and qualitative debate will be held," said Marion van Happen, CEO of HeadFirst Group.

Different schools of thought brought together

The role and position of the self-employed on the labor market has long been the subject of debate in the Netherlands. The issue: when is someone who performs work for pay an employee or a self-employed person? Previous cabinets have failed to clarify this and several plans have failed for various reasons. In addition, several reports have been published with proposals to move the discussion forward. Ranging from enforcement of existing rules to sweeping legislative changes.

"This report offers a clear overview of all the different proposals made in recent years to replace the DBA law. More importantly, the advantages, disadvantages and consequences for the self-employed and clients are detailed. By combining these insights with the correct facts and figures about the self-employed, politicians in The Hague can come to a well-considered decision."

Take labor market situation into account

Two elaborated variants, including the Borstlap Commission's proposal to make "embedding in the organization" leading in the distinction between employee and self-employment and the ABC test from California, have heavy impact on the freedom of self-employed workers and clients. Given the current tight labor market, it is important not to underestimate these impacts. Employers and clients are crying out for talent and are pulling out all the stops to retain the current population. "That there should be clear rules and frameworks when someone can be hired as a self-employed person, I completely agree. On the other hand, too rigid rules are not desirable, because practice shows that the form of contract is becoming less and less decisive. It is therefore important to deal carefully with laws and regulations concerning work and not to restrict workers too much in their choices," says Van Happen.

Belgian model good alternative

The report also highlights the Belgian model with the Labor Relations Act. This model - also described in the report 'Independence, flexibility and social security. A look across the border.' - has many advantages. Van Happen says: "In Belgium, the issue of false self-employment is effectively combated by (1) having a clear set of criteria as to whether a person may perform an assignment as a self-employed person, (2) looking more at the aspects of entrepreneurship and (3) having stricter rules in sectors where the risk of underpayment or vulnerable workers is high. That combination of factors works well in Belgium, so it is interesting to investigate whether we can adopt the positive aspects and improve the less good aspects in the Netherlands."

The legislation in Belgium has now also been noticed in Dutch politics. During the debate on labor market policy on April 13, Minister Karien van Gennip explicitly referred to the situation in the South's neighbors, and MPs Smals (VVD) and Palland (CDA) earlier also called attention to it.

And now?

For now, it is not clear what the next step will be from Minister Van Gennip. Last Thursday, Parliamentary questions about enforcement of the DBA law were answered by the minister. Before the summer there will be an outline letter to the Lower House about the elaboration of the labor market package. Finally, there will be a response to the report of the Court of Audit before the ZZP debate on June 30. HeadFirst Group follows the developments closely and stays in close contact with MPs and policy staff.

The full report is available for free download here.

Only tens of thousands of 1.2 million self-employed work for hourly rate below 20 euros

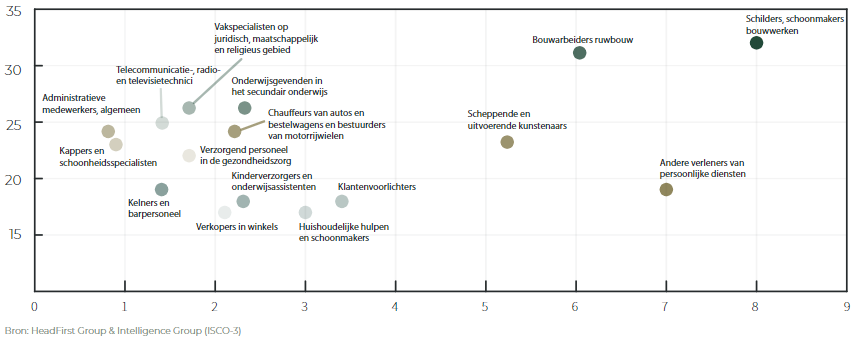

Zzp'ers working as store salesmen, childcare workers, teaching assistants, waiters or bartenders work in the Netherlands on average at the lowest hourly rates. They also have a relatively low scarcity indication, which predicts that the prospect of rate increases is limited. On the other hand, relatively few self-employed workers are active in these occupational groups, compared to the total of nearly 1.2 million. These insights were published in the Talent Monitor by HR service provider HeadFirst Group and labor market data specialist Intelligence Group.

Focus on labor market base

Enforcement of the DBA law recently received attention due to a report by the Court of Audit. The conclusion: the tax authorities are unable to combat false self-employment effectively. Marion van Happen, CEO HeadFirst Group: "The most acute problems with false self-employment occur at the base of the labor market, where hourly rates are low. We therefore look with interest at the MLT advice of the SER, which proposes to apply a 'legal presumption of employment' at a rate below the maximum daily wage (30,- to 35,- euros per hour)."

The Talent Monitor zooms in on this group of self-employed workers. It shows that painters and cleaners of construction works and construction workers of structural work have an average hourly rate of €30 or higher and are very scarce. They therefore have a rosy financial perspective in the labor market. Creative and performing artists are also scarce, although their average hourly rate is much lower at €23. Occupations that have a harder time include waiters and bar staff, domestic helpers and cleaners, childcare and teaching assistants and salespeople in stores. They work for an average hourly rate of €20 or less and the scarcity indicator is low. Relatively few self-employed workers are active in these occupational groups, totaling only a few tens of thousands. Hairdressers are an exception: we have more than 25,000 freelance hairdressers in the Netherlands, albeit working at an average hourly rate of €23.

Let entrepreneurs do business freely

In addition, the report shows that self-employed professionals with an hourly rate of €70 or higher are overrepresented in professional groups such as software and application developers and analysts, lawyers and doctors. Specialists in sports & fitness and traditional & alternative medicine are largely found in the €35 to €70 rate group. All are (very) scarce professions, which is generally reflected in rising rates.

Van Happen: "More than half of all self-employed people in the Netherlands have an hourly rate of €35 or higher. This large group of self-employed people who consciously choose to do business in freedom, have a strong negotiating position and are very satisfied with their working conditions should not be ignored. If the new cabinet focuses on appropriate measures for occupations with lower hourly rates, we can successfully move toward clarity for all self-employed workers and their clients."

The Talent Monitor "Zzp'ers: protect or set free?" is available for free download here.

Talent Monitor: Zzp'ers: protect or set free?

Talent Monitor: Zzp'ers: protect or set free?

We believe that exploitation in the labor market must be countered with appropriate measures, while at the same time not ignoring the large group of self-employed people who consciously choose to do business in complete freedom and have control over their own work. With the insights in this report, we hope to make a new contribution to this.

Only tens of thousands of 1.2 million self-employed work for hourly rate below 20 euros

Zzp'ers working as store assistants, childcare workers, teaching assistants, waiters or bartenders work on average at the lowest hourly rates in the Netherlands. They also have a relatively low scarcity indication, which predicts that the prospect of rate increases is limited. On the other hand, relatively few self-employed workers are active in these occupational groups, compared to the total of nearly 1.2 million. These insights were published in the Talent Monitor by HR service provider HeadFirst Group and labor market data specialist Intelligence Group.

Main observations

- Self-employed people with an hourly rate of €35 or lower work mainly as domestic help and cleaners, waiters and bar staff or childcare and teaching assistants.

- In particular, the occupational groups of child care and teaching assistants and domestic helpers and cleaners seem to be the needy target groups based on the hourly rate and the prospect of rate increases.

- Specialists in the field of sports and fitness and authors, journalists and linguists can largely be found in the €36 to €70 rate group.

- Zzp'ers with an hourly rate of €70 or higher are overrepresented in professional groups such as lawyers, software and application developers and analysts, and doctors.

- At 28%, self-employed persons with an hourly rate of €35 or lower are slightly more actively looking for a (new) assignment than self-employed persons in the other two rate groups. The part that is not actively looking, but is keeping an eye on the market, at 49%, is actually smaller than the other two rate groups.

- Zzpp'ers with a lower hourly rate are more willing to go into paid employment (again) (18%). For self-employed people with an hourly rate of €70 or higher, that percentage is slightly lower, at 16%. For self-employed people with an hourly rate between €36 and €70, it stalls at 11%.

- Zzp'ers with an hourly rate of €70 or higher are approached most often by clients and intermediary agencies. Their sourcing pressure, the percentage who are approached at least once per quarter, is 67%. For freelancers with an hourly rate of €35 or lower, it is 63% and for freelancers with an intermediate hourly rate 61%.

- Zzpp'ers with an hourly rate of €35 or lower are less willing to travel far for an assignment. Half of the self-employed with an hourly rate of €70 or higher are willing to travel longer than an hour, compared with 37% of self-employed with an hourly rate of €35 or lower.

Partner

Download Talent Monitor

Previous editions

Nothing found.