'There's no way half of self-employed people are sham self-employed'

Recently the Financieele Dagblad paid attention to the abolition of the enforcement moratorium and the fiscal and employment risks for zzp'ers and clients. These concerns are justified, because also at HeadFirst Group we notice an increasing number of questions from clients about this issue. Labor law and tax are significant risks, so good information is crucial. At the same time, we need to keep the peace, support each other, keep hiring genuine self-employed workers and encourage compliant behavior. I noticed in the FD article that there are misunderstandings about the number of false self-employed and that wrong figures are presented. As the CEO of an HR-tech service provider, I feel compelled to respond based on facts and objective research. This is because the claim that "half of all self-employed people may be a false self-employed person" is unfounded.

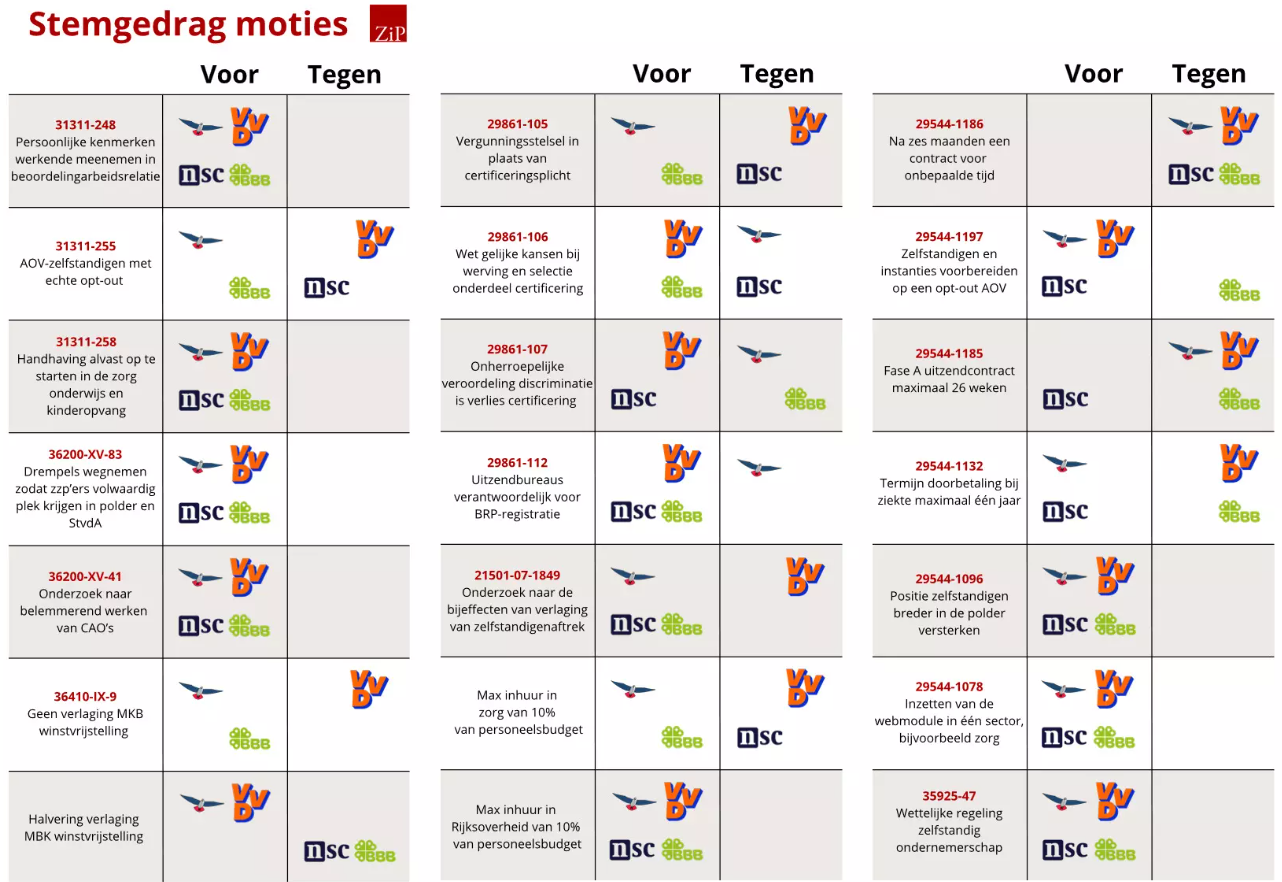

Dutch politicians and politicians have been working for quite some time on policies to make a clearer distinction between employees and the self-employed. It is important to conduct this discussion on the basis of facts and figures, because only then can we together arrive at feasible policies that really work. We contribute to this discussion by conducting research with partners such as ZiPconomy, ONL for Entrepreneurs and SEO Economic Research.

Facts and figures on self-employed population

In our recently published 'Grip op het zzp-dossier' we describe the zzp-population working in the Netherlands. This group is heterogeneous, diverse and active in the labor market in all shapes and sizes. Based on these figures, I can tell you one thing: it is impossible that half are sham self-employed. Of the approximately 1.2 million self-employed in the labor market, over 270,000 sell products. By definition, these fall off as sham self-employed. In addition, a large group of self-employed workers, about 329,000, offer their labor to individuals. They also fall off as sham self-employed.

Zooming in further on the self-employed who offer labor to organizations, we see a large group that has many clients per year and does short-term assignments. This group is actually growing compared to the group doing longer assignments with few clients per year. In 2023, 65% of the self-employed who provide their own labor had more than four clients per year. In 2021, this percentage was still at 58%. That leaves about 210,000, which is about 17.35% of the total. Even in this group, not everyone is a sham self-employed person.

In addition, I continue to be puzzled by the discussion about the sustainability and affordability of the social security system. Earlier we commissioned SEO Economic Research to map the social and economic value of independent professionals (those who fall into the category with fewer clients per year). The figures do not lie: government, business and workers themselves all see positive results. Although less premiums are paid, this is more than offset by higher tax revenues.

Road to a workable solution

Finally, I am aware of the different interests and perspectives regarding the self-employed dossier. At the same time, surveys show time and again that the majority of self-employed people choose entrepreneurship very consciously, are satisfied with their working conditions and are happy to dedicate themselves to the Dutch labor market and economy. Although there are free birds and outlaws among them, it does not help to state that half of them are pseudo self-employed; this does not contribute to a constructive discussion or workable solution. The legal presumption of employment below an hourly rate of €32.24 is an excellent proposal to better position vulnerable workers at the base of the labor market. In an earlier opinion piece I already called for the bill 'clarification of assessment of labor relations and legal presumption' to be cut up and for the legal presumption to be dealt with quickly in the Lower House. After all, there is broad support for it in both the polder and the field. In addition, we must sit down together to formulate clear entrepreneurial criteria, so that self-employed workers and clients get the clarity and recognition they deserve.

Postponing WTTA to 2027: reflection needed

Outgoing Minister Van Gennip announced this week that the introduction of the Law on the Admission of Workforces to the Netherlands (WTTA) will be postponed until Jan. 1, 2027. This is due to the need for service Justis to take more time for the implementation test, as a result of which the previously proposed time frame did not prove feasible.

Criticism of bill

The original purpose of the WTTA remains unchanged: to combat rogue broadcasters and improve the position of migrant workers. We support the decision to delay implementation by one year, given the complexity of the admission system and its significant impact on the labor market. Thorough reflection and careful consideration of feasibility are crucial.

We remain critical of the broad scope of the system. In large parts of the (flexible) labor market, such as secondment, consultancy, interim management and the intermediary services for higher-educated professionals, there are no accommodation problems, underpayment or malafidity.

Scope raises questions

This broad scope raises questions as to the extent to which the principles of proportionality and subsidiarity have been observed. Bona fide companies, which in principle have nothing to do with the problems mentioned in the Roemer Commission report (the reason for the WTTA), face significant administrative burdens and additional regulatory burdens. Annually they may be burdened with at least €143 million in additional regulatory burden.

Improving enforcement

We support the call by the Advisory Committee on Regulatory Burden Assessment (ATR) for a thorough review of enforcement capacity at the Labor Inspectorate. Effective enforcement is essential to ensure the effectiveness of such a regime. An alternative suggestion is the use of a register of companies working with migrant workers. This is more manageable, reduces the regulatory burden on uninvolved companies, and enables the Labor Inspectorate to enforce effectively and in a targeted manner. It is simpler, easier to implement and helps protect and improve the position of migrant workers.

Laws and regulations are constantly changing. Find out how this affects your external hiring. Our experts are ready for you - leave your details and we'll get back to you.

New bill introduces admissions system: what does it mean?

A new bill, the Law on the Admission of the Supply of Workers (WTTA), will begin to be debated in the House of Representatives this year. This proposal brings with it an admission system for temporary employment agencies and other companies that make workers available to a third party to work under its management and supervision. The scope of the law is thus considerably broader than just the temporary employment sector. What exactly does it entail and what impact will it have on suppliers and clients?

The new regime requires that lenders be allowed to operate in the market only if they are authorized to do so under a new regime. To be admitted, they must meet several conditions:

- The company meets the standards framework by means of an approved inspection report provided by an inspection body designated by the Minister (article 12q Waadi);

- A Certificate of Good Conduct for legal entities is provided (Article 12o Waadi);

- The company deposits a deposit of €100,000 (Article 12p Waadi).

Hirers using temporary employment, secondment or payroll agencies, the so-called lenders, may only do business with agencies that have been admitted to the system by the Minister of Social Affairs and Employment. The Dutch Labor Inspectorate will supervise whether in- and on-borrowers actually work with authorized lenders and whether the lenders are authorized. Failure to comply with applicable laws and regulations can result in hefty fines, both for hirers, and hirers.

Transitional regime

The bill also provides for transitional law to encourage hirers - in the run-up to the entry into force of the obligation of admission on January 1, 2026 - to apply for admission no later than June 30, 2025, who already possess an SNA seal of approval. Companies that already have this seal of approval will be admitted on the basis of the SNA seal of approval, even if they have not yet been actually inspected on the basis of the new standards framework.

Implications for in- and out-workers

For suppliers who engage in the provision of labor, this bill represents a significant change in the way they operate. To remain active in the market, they will have to be admitted to this public system. Lenders will be audited periodically (probably twice a year) on the standards framework. This therefore requires compliance with laws and regulations, as well as the necessary investment in time and resources to meet all requirements. In- and on-lenders will be prohibited from doing business with lenders who are not admitted to the system. There will be a public register to verify that the hirer is actually admitted to the system.

In essence, the WTTA will change the dynamics of the Dutch labor market, with the goal of improving the position of migrant workers, keeping rogue broadcasters out of the labor market, and thus ensuring a level playing field for all buyers and sellers. It is important for both suppliers and clients to be well informed about developments regarding the WTTA. Needless to say, we at HeadFirst Group are preparing in a timely and adequate manner so that we can continue to provide our services.

Hourly rates for self-employed and seconded workers lag behind collective bargaining wages

Expected rate increase of one to two percent in 2024

The hourly rates of flexible workers, self-employed workers and professionals employed by secondment agencies, rose an average of 4.3 percent in 2023 compared to 2022. This increase lags slightly behind the trend in collective bargaining wages. An average rate increase of one to two percent is expected for 2024. This emerges from the latest Talent Monitor of labor market data specialist Intelligence Group and HR-tech service provider HeadFirst Group.

Over 2023, the average agreed wage increase for permanent staff was six percent, according to figures from CBS. HeadFirst Group's hiring data show that professionals who started a new assignment in 2023 experienced a lower increase, at 4.3 percent. The average hourly rate of highly skilled self-employed and seconded workers currently stands at €95.80.

The hourly rates of flexible workers have risen continuously in recent years, over 2022 and 2023 even by more than four percent. Due to the faltering economy, the increasing supply of self-employed and seconded workers in the labor market and falling inflation, this is highly unlikely to continue in 2024. Geert-Jan Waasdorp, director and founder of Intelligence Group, says: "Our forecasting model showed a rate drop of four to six percent based on all these factors, but we do not consider that realistic. The exceptional inflation situation over the past 2 years, has thrown the robust forecasting model off track. We consider a slight increase of 1 to 2 percent as the most likely scenario. "

Scarcity remains, despite slight growth in economy

Waasdorp notes that several developments point to a possible easing of labor market scarcity, but that has little effect on actual scarcity. "We have experienced nine months of economic contraction, but just in the fourth quarter of 2023 there was a small upturn (+0.3 percent). We have seen a decline in job openings for quarters, yet demand remains extremely high and the unemployment rate low. At the same time, bankruptcies and reorganizations are increasing. This is bringing more personnel into the labor market, although it is only a drop in the bucket. Both the increasing supply of talent and the degree of movement in the labor market is still very small in historical perspective and absolute terms."

In addition, a decrease in scarcity is not reflected in the sourcing pressure among freelancers. In fact, the frequency in which they are approached for an assignment shows an upward trend. On average, self-employed people are approached eighteen times a year. In comparison, employed people are approached about nine times a year on average. Marion van Happen, CEO of HeadFirst Group, emphasizes, "These figures show the continuing demand for flexible labor and the growing interest in being self-employed within the labor market. It is undeniable that highly skilled professionals make an invaluable contribution to the Netherlands, with a social and economic value of approximately 4.4 billion euros per year. This also highlights the importance for self-employed professionals to present their profile and skills well, and for organizations to develop effective strategies to attract and retain permanent and flexible talent in a competitive labor market."

More insights into professionals' rate trends over 2023 and into 2024? Download the latest Talent Monitor for free at headfirst.group.

HeadFirst Group responds to the internet consultation on the Law on Admission for the Posting of Workers

HeadFirst Group responds to the internet consultation on the Law on Admission for the Posting of Workers

From Wednesday, January 24 through Saturday, February 24, it was possible to respond to the Internet consultation on the amendment of the Decree on allocation of labor forces by intermediaries. This in connection with the plans to introduce an admission system. A total of sixteen public responses were submitted.

As a market-leading organization, we believe it is important to contribute to the political-social debate on the future of the (flexible) labor market. For this reason, we also responded to the internet consultation. Below is a brief summary of our response point by point:

- HeadFirst Group is concerned about the broad scope of the admission system. We embrace the recommendations of the Roemer Commission to improve the position of migrant workers, but as an HR service provider at the top of the market, we have nothing to do with this issue. We therefore call for more customization;

- Much important information in the Explanatory Memorandum is currently missing. The draft decision does not yet contain a framework of standards and information is also missing with regard to the waiver scheme. In order to make a well-considered and complete judgment on this change, it is important that we as an organization have all relevant figures and obligations;

- HeadFirst Group supports the advice of the Advisory Panel on Regulatory Burden (ATR) to investigate less burdensome alternatives and first firmly enforce the laws and obligations in force. By following this advice, companies will be prevented from being saddled with at least 143 million euros of additional regulatory burden every year;

- The broad scope means that thousands of companies will soon have to be admitted to the system. This requires good representation from industry associations and umbrella organizations so that all interests and concerns are heard in a timely and regular manner.

Curious about our full input? Check out our response here.

Specialized and highly educated self-employed provide social value added of 4.4 billion euros per year

New research offers insight into true costs and benefits of independent professionals

New research offers insight into the true value of the total output for the Dutch economy of highly skilled self-employed workers, working for mostly large clients in business services (zp'ers). This amounts to 17.3 billion euros per year for the current population of 110,000 independent professionals. Although the social position of self-employed professionals is regularly under fire, the report "The Economic and Social Value of Independent Professionals" - which SEO conducted on behalf of HR tech service provider HeadFirst Group - makes clear what contribution this group of workers has for society. It shows, for example, that at the bottom of the line they provide additional revenues worth as much as 4.4 billion euros. This knowledge can contribute to better regulation in the future, and prevent obstructive policies.

"In our research we make clear the significance independent professionals have for our society and economy. This turns out to be undeniable, since their contribution to the economy has a value of euro per year. Without their input, some of this production would no longer take place or would be moved abroad. This would be at the expense of numerous jobs and lead to a great loss of knowledge. That is something we cannot afford, with the current tightness," said Marion van Happen, CEO of HeadFirst Group. "Zzp'ers are needed more than ever at a time when the labor market is screaming for qualified personnel. For example, specialists in different sectors are crucial, to make the transitions our society faces succeed. This applies to all workers - regardless of the form of contract. Unfortunately, there are still many misconceptions about the highly educated self-employed population. For example, it is wrongly assumed that they cost society more than they provide. The report shows that the real and great value of independent professionals for the economy and our society cannot be underestimated."

The social costs and benefits

According to the study, the social costs and benefits of independent professionals amount to a positive balance of as much as 4.4 billion euros per year. This positive balance is mainly the result of the additional production and profit realized through the use of the current population of 110,000 independent professionals. This is mainly the result of higher labor force participation. Without the possibility of self-employment, some of this production would no longer take place or move abroad. In addition, this positive balance of 4.4 billion euros per year also has to do with higher average productivity (+10 percent) compared to a situation where they would be working in another form of contract. Finally, government and society benefit from a higher profit and income tax, compared to a situation without self-employment. This is because more is worked, produced and earned - both by independent professionals and clients.

Call to politics

With this data, HeadFirst Group contributes to the political debate on the labor market, where impending regulations may severely limit self-employment. Van Happen: "We call on politicians to pay attention to the great value of independent professionals and to listen to the needs of clients. They appreciate the flexibility and possibilities of specialized professionals. This report shows that on balance there is a social added value by the possibility to work as an independent professional. Although less social contributions are paid, this is more than compensated by more tax revenue. Regulations for the base of the labor market - to combat false self-employment, for example - can have consequences for the rest of the market, however, and this can lead to loss of welfare. In addition, our earlier report on the entire self-employed population showed that the number of forced self-employed is minimal, contrary to what many policymakers believe. This group of workers deliberately chooses this form of contract precisely because of the degree of professional autonomy and flexibility it offers. Customization in legislation is therefore essential to combine protection of vulnerable workers with facilitating entrepreneurship."

Facts and figures about self-employed workers

The report contains many other interesting insights about highly educated self-employed people. An overview:

- It is estimated that over 110 thousand highly skilled independent professionals are now active in the Dutch labor market. This amounts to 10.2 percent of all self-employed people and 1.1 percent of all employed people.

- Highly educated self-employed workers work for the government (22 percent), business services (19 percent), financial services (15 percent) and in the healthcare and IT sectors (both 9 percent).

- Most highly educated self-employed workers work annually for a limited number of mostly larger clients. Most work for one client (38 percent) or two to five clients (45 percent). Only a small proportion work for five to 10 clients (10 percent). The part that works for a limited number of clients often does so for (very) large companies.

- Half of the highly educated self-employed are between the ages of 35 and 55. In addition, the proportion over 55 (33 percent) is almost twice as large as the proportion younger than 35 (17 percent).

- Almost a third of highly educated self-employed workers have been active in this form of work for more than 10 years and 13 percent even more than 20 years.

- Three in five highly educated self-employed workers work full-time; 32 percent are employed between 20 and 35 hours per week and 7 percent work less than 20 hours per week.

- Highly educated self-employed workers would, in a null alternative - if it were no longer possible to work as a self-employed worker - work in another form of employment in nine out of 10 cases. Almost a third would return to permanent employment, while 20 percent would be active as seconded workers. In addition, 12 percent are expected to be working in a regular temporary contract, while 10 percent would be inactive, working abroad or in (early) retirement.

Can PVV, VVD and NSC shake hands in future labor market negotiations?

It is abundantly clear which parties may crown themselves winners and which parties "modesty befits" after the last House of Representatives elections. The elections have caused a solid shift in the political landscape. If we take a look at PVV, VVD and NSC, what do these parties actually think about the labor market? ZiPconomy found out.

NSC is fairly outspoken and believes that the Borstlap Commission report should guide future labor market reforms. For example, NSC wants the dismissal law to be reformed and the sick pay continuation for SMEs to be shortened to one year. The VVD will certainly go along with this, but the PVV, like SP and GroenLinks/PvdA, is precisely not in favor of this. Also, NSC wants temporary work to be limited to 26 weeks, while VVD and PVV voted against this limit. Who will pour water on the wine?

Future of the zzp file

If we look at the plans regarding the zzp dossier, we immediately see a clear overlap: all three parties are not fans of the draft bill "Clarifying Assessment of Labor Relations and Legal Presumption. So what do they want?

PVV is not really outspoken on the zzp dossier with their statement "zzp'ers should not have unnecessary extra rules or obligations. VVD has the view that the assessment of the individual self-employed person should be central, for example by setting entrepreneurial criteria by law. NSC does not think that the person, but the job should be assessed. If it takes too long, for many hours in the week or is low paid, then that assignment should not be done by a self-employed person.

Migration policy as a point of discussion

Labor migration is also a hot topic in political The Hague. The three parties seem to agree that there should be "a brake on migration. But how and for which target groups exactly, there are still some differences.

PVV wants to introduce work permits for migrant workers within the EU, something that now only applies to migrant workers from outside the EU, and restrict study migration. NSC also wants a sharp restriction on the number of labor and knowledge migrants, but first wants to "investigate" how to get a better grip on this. The NSC wants to reduce the influx of expats, including by reducing their tax benefits.

VVD is firm in tone when it comes to asylum, but less outspoken when it comes to labor migration from within the EU, since labor migrants in a tight labor market are crucial to keeping a number of economic sectors running. She does believe that the requirements for non-EU migrant workers should be tightened and is in favor of encouraging and accelerating return.

How to move forward?

It is somewhat hypothetical and looking into a crystal ball, but should VVD and NSC eventually join Geert Wilders at the formation table, the differences regarding the labor market seem bridgeable. Topics such as "the democratic rule of law" and "military aid to Ukraine" will be higher on the agenda. In a country of minorities, forging coalitions and compromise, sooner or later you really will have to step over your own shadow.

Want to know more about the election results and impact on the labor market? Find the relevant ZiPtalk episode of ZiPconomy here.

HeadFirst Group releases response to zzp bill

From Oct. 6 through Nov. 10, it was possible to respond to the draft bill "Clarifying Assessment of Labor Relations and Legal Presumption. A total of 1,111 public responses to this proposal were received through an Internet consultation. Many self-employed workers responded to the plans of outgoing Minister Van Gennip (Social Affairs and Employment), but self-employed organizations, trade associations and employer organizations also submitted a response.

As a market-leading organization, we believe it is important to contribute to the political-social debate on the labor market and the self-employed dossier. In our response, we are critical of the current plans. We believe that the plans as proposed will not provide the clarity that clients, intermediaries and self-employed workers are looking for.

In addition, the following views are reflected in our response:

- The embedding criterion is not going to provide the desired clarity and therefore should not be included in legislation.

- Insufficient account is taken of the diversity of the self-employed population in the Netherlands. We therefore call for more room for sectoral agreements.

- There needs to be more balance between employee status and entrepreneurship when assessing the employment relationship. For this reason, give more attention to the entrepreneurial criteria.

- The current proposal lacks transitional law. We call for greater peace of mind and certainty for clients and contractors by establishing a transitional rule.

- We are positive about the legal presumption of employment below the rate of €32.24 per hour. This will improve the position of working people at the base of the labor market.

Curious about our full input? Check out our response here.

Minister Van Gennip comes up with new criteria for hiring zzp

Friday, October 6, the bill 'clarifying assessment of employment relationships and the legal presumption' was made public through an internet consultation. With this bill, outgoing minister Van Gennip (Social Affairs and Employment) wants to replace the DBA law and further clarify the legislation around 'working in the service of'.

Three criteria for self-employment

The minister aims to achieve this clarification with three criteria:

- Work content management

- Organizational embedding

- Working at your own expense and risk

Together, these three criteria determine whether an assignment can be performed by a self-employed person, or whether it is still an employment contract.

Legal presumption of employment contract

In addition, as part of the overall bill, a legal presumption of employment contract is also introduced under the €32.24 rate. This proposal should strengthen the position of vulnerable workers at the base of the labor market. This is a civil law legal presumption that can be invoked by the worker himself. It is not about a minimum rate, but the legal presumption should make it easier for workers to claim an employment contract. The response to this is generally positive.

Reaction to legislative proposal

As an organization, we have good contact with the major zzp organizations and relevant industry associations (ABU, NBBU, VvDN, Bovib and RIM). On Tuesday, October 10, we met directly to discuss the latest developments. Several zzp organizations have already criticized the bill. HeadFirst Group will also respond to this bill itself, by preparing a position paper. Read our reaction to the bill here.

The Internet consultation runs until November 10, 2023. If the cabinet then sticks to this plan, a discussion in the Lower House will follow. Naturally, we will keep you informed of relevant developments.

Bill zzp dossier: repeat of moves

At the beginning of October, outgoing Minister Van Gennip (Social Affairs and Employment) made public the bill "clarifying assessment of employment relationships and legal presumption. The legal presumption of employment under a rate of €32.24 is going to improve the position of vulnerable workers at the base of the labor market. A good proposal that specifically targets the group of working people who deserve more protection. But the proposal to replace the DBA law and the three proposed criteria are not going to provide the needed clarity. In fact, we are heading for the same impasse as in 2016 with the DBA law.

The minister proposes three criteria: 1) what is the work content management like, 2) is there organizational embedding, and 3) does the self-employed person work for his own account and risk. This is merely a ranking of existing case law. The criteria are not sufficiently clearly defined. And it is a missed opportunity that entrepreneurial criteria are not more firmly anchored in the new proposal, even though the House of Representatives has previously expressed a positive opinion on them.

The embedding criterion, which dictates that in principle a self-employed person cannot fill a position that a colleague in permanent employment also performs, is not going to provide the desired clarity. Or worse: many workers who consciously choose self-employment end up in an uncertain situation. The result: a repetition of moves, a gray area and a lot of ambiguity. And if clients, freelancers and intermediaries do not want anything in the current tight labor market, it is unrest.