Nearly 2 in 5 zzp'ers miss out on assignments due to approaching enforcement of false self-employment law

Strong 13 percent increase from September 2024

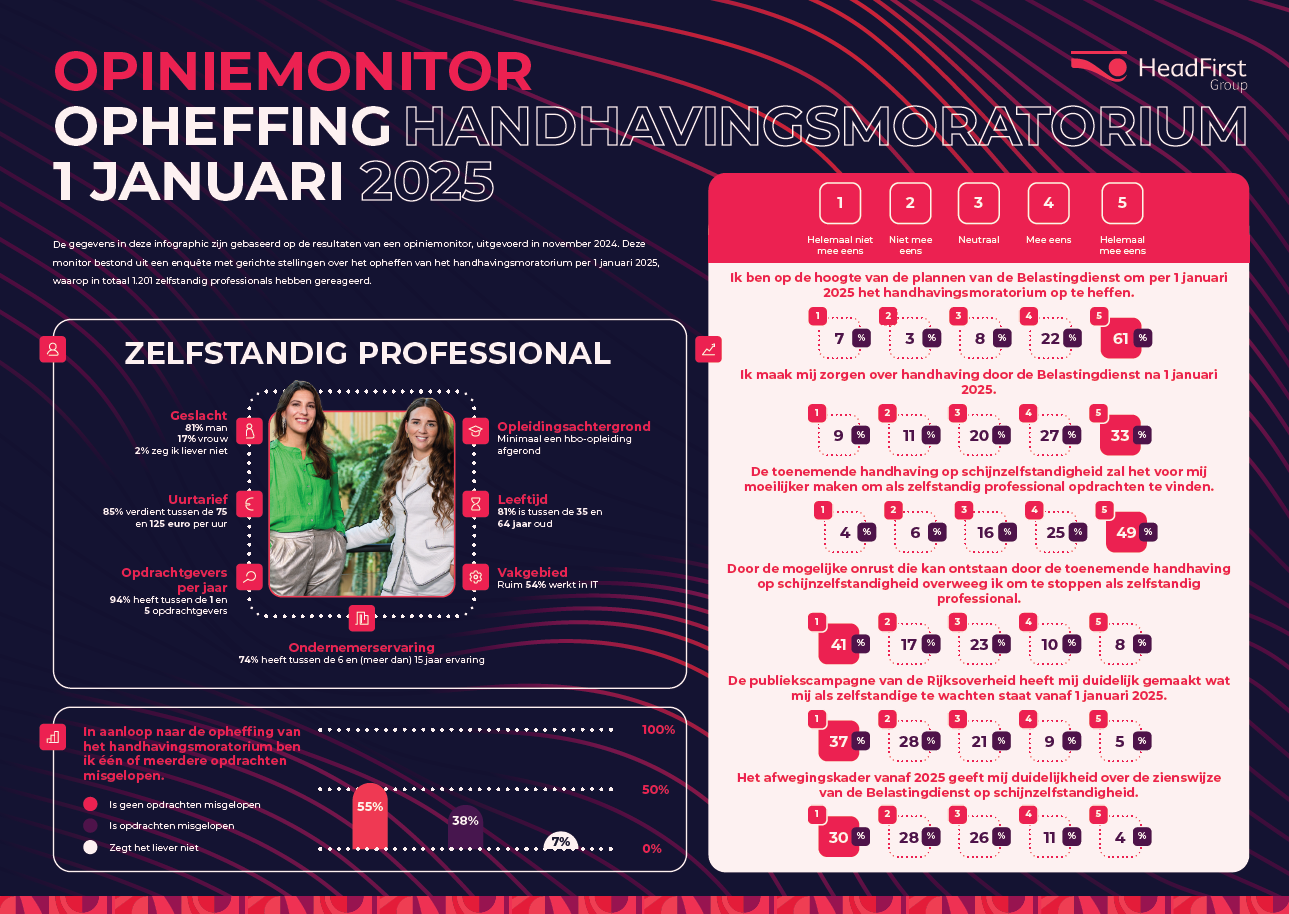

The uncertainty surrounding the lifting of the enforcement moratorium as of Jan. 1, 2025 has further increased the impact on the labor market. The latest measurement by HR-tech service provider HeadFirst Group, among 1,201 independent professionals (zp'ers), shows that 38 percent of zp'ers have now lost one or more assignments. This is a sharp increase from the 25 percent in September 2024. In addition, 18 percent of the self-employed are now considering quitting business, up from 15 percent earlier this year.

Growing concerns about the future

In addition to the immediate consequences, concerns about the future are growing. Whereas in September 57 percent of self-employed people expected it to become more difficult to find assignments after January 1, 2025, this percentage has now risen to 74 percent. Marion van Happen, CEO of HeadFirst Group, expresses her concerns: "These figures show that uncertainty in the market is growing. Both self-employed people and clients still experience uncertainty and complexity, which leads to reluctance. This is a worrying trend that we must collectively address in order to maintain peace in a tight labor market. It is essential that organizations get their processes in order, enter into discussions with self-employed workers and realize that after January 1, 2025, it will simply still be possible to hire self-employed workers for assignments in an effective and responsible manner. As an HR service provider, we are happy to support this."

Lack of clarity remains major bottleneck

The central government launched a public campaign in September to inform self-employed workers and clients about the lifting of the enforcement moratorium, and the Tax and Customs Administration published a consideration framework to provide more clarity about assessing a working relationship. In addition, the Tax and Customs Administration's market team worked intensively with industry associations and umbrella organizations to further spread the message. All these efforts resulted in more than 80 percent of independent professionals being well aware of the expiration of the enforcement moratorium as of January 1, 2025.

Still, according to many self-employed workers, the consideration framework published on the Tax Administration's website offers little relief: only 15 percent indicated that the framework provides clarity about their employment relationship. One respondent aptly articulated the problem: "The consideration framework is too general, all the criteria are multi-interpretable and it offers no concrete guidance for specialized or long-term assignments."

Call for action and cooperation

With the imminent lifting of the enforcement moratorium, HeadFirst Group calls for calm among clients and zzp'ers, clear information and intensive cooperation between government, market parties, industry associations and civil society organizations. "The rapid developments require continuous monitoring, good mutual communication between the parties involved and timely actions to limit the impact," Van Happen said. "As a major HR service provider, we continue to take our responsibility by supporting clients, suppliers and self-employed people with up-to-date information, clear advice and practical solutions."

Looking back on the zzp dossier 2024: VZN president Cristel van de Ven on the polder and that zzp'ers can indeed be united

"If employees with all their diversity can be represented in politics and polder, why shouldn't the self-employed with all their diversity?" The president of the Association of the Self-Employed in the Netherlands (VZN), Cristel van de Ven, looks back on an eventful year, in which the position of the self-employed has been called into question by the expiration of the enforcement moratorium, while at important tables in The Hague there is still too often insufficient zzp representation. She is positive about the growing role of VZN in the polder, but stresses that it is time to structurally involve zzp'ers in serious discussions about labor market reform. "Politicians and the polder must realize that zzp'ers are not going away anymore. We have 1.6 million self-employed people in the Netherlands, and they deserve a permanent place at ALL tables where they are discussed and decided upon." In conversation with Sem Overduin of HeadFirst Group, she reflects on the challenges of 2024 and her expectations for 2025.

Cristel, 2024 was a hectic year, especially for VZN. How do you look back on the past year regarding the zzp file?

This was certainly a hectic and dynamic year. Especially from the summer onward, things started moving more and more. The year still started rather "slowly," with the wait for a new cabinet and what this new cabinet would include in the outline agreement on the labor market and the self-employed. Just before the outgoing cabinet transitioned into a new one, there was still a lot going on, such as the bill Verduidelijking Beoordeling Arbeidsrelaties en Rechtsvermoeden (VBAR), which was sent to the Council of State just before the summer. This, combined with the Internet consultation for the Basic Disability Insurance for the Self-Employed (BAZ) Act, led to a turnaround last summer. We went from relatively quiet to super busy. After the summer there was also increasing news coverage of the lifting of the enforcement moratorium, and that caused quite a stir in the market. Both clients and the self-employed had questions, and as a result you noticed that this subject was becoming more and more widespread in society.

So has the phone been ringing red hot at VZN in recent months?

Absolutely, we notice at VZN that questions are coming in from all sorts of angles. These are mostly very personal questions about whether certain labor constructions and collaborations with a client will still be possible from January 1, 2025. We forward these to our members. Many of our members currently have a jam-packed mailbox and receive many phone calls every day. They listen to the questions of self-employed people about their way of working together and then try to give advice. What we also see is that there are so many sources of information that people just can't see the wood for the trees. Clients often don't know where to look for it either, and that adds to the turmoil. Unfortunately, there are still far too many ghost stories going around.

VZN represents the interests of more than 120,000 self-employed people. What role do you play in the polder?

Since our founding in 2020, we have made great strides. Our role is primarily to coordinate the voice of the self-employed. We translate this into a clear message towards politics and polder. This is going better and better. It is a boost that there are seats in the SER that are really earmarked for the self-employed. As a result, we are invited more quickly to relevant consultations. At the same time, we are still far from where we want to be. Unfortunately, in important political negotiations about the labor market or the economy, self-employed organizations are still too often overlooked. In part this is because many politicians and civil servants have not been self-employed themselves. As a result, there is less affinity with this group of workers. Moreover, in the polder and in politics there is still a certain fear of major changes in the labor market. And existing parties cling to their positions. That makes it difficult to really get our ideas across.

It is often said that the group of self-employed people is too diverse and that it is therefore difficult to speak of a 'unified self-employed sound'. How do you view this?

I know that argument and I think it's a fallacy. Just look at employees, there is at least as much diversity there. Surely VNO-NCW, MKB-Nederland, ONL and the trade unions also represent numerous sectors and different types of employers and employees? Why should it be any different for the self-employed? At VZN, we actually try to look for the common denominator for all self-employed people. I think this argument is often used to keep the self-employed out. Because let's face it; if another party comes to the table, then surely you have to share the influence you have more. In doing so, zzp'ers also show where the labor market pinches. The growth in the number of self-employed workers is partly due to the lack of flexibility within some collective bargaining agreements and because some employers have not had such a people-oriented personnel policy in recent years. Some established parties find that difficult to hear, because it forces them to take a critical look at their own role. At the same time, we as self-employed organizations sometimes have to step over our own shadow for the sake of cooperation. That is difficult, I understand. There are still groups of self-employed people who prefer not to unite in an umbrella organization like VZN, because they are unique in their kind. And that's true, of course. Each professional group has its own unique characteristics. Nevertheless, I call on self-employed workers' advocates to cooperate. Because if we cooperate on the points where we do agree, and there are many, we can make a more powerful fist. Together we really are stronger than every man for himself, is my conviction. And through good consultation, you can combine many interests. The past few years have taught me that.

What did you think of the political debates on the zzp file this year?

You notice that politicians have to start from scratch again. This is understandable, because the zzp dossier is complicated and there has been a huge changing of the guard in the Lower House. There are a lot of new people on the zzp file. I see that most MPs are now breaking into this file, but that also takes time. A MP like Thierry Aartsen (VVD) has been around longer. He really wants to work for the situation of the self-employed. The BBB is also making itself heard for the self-employed. At the NSC there was a MP on the zzp file with a lot of entrepreneurial experience, but Tjebbe van Oostenbruggen recently became State Secretary. I hope that all MPs also get - and take - enough time to master this dossier. I am a bit skeptical about that. This could have a big impact on the depth of the discussion. Fairly recently we had a good conversation with Minister Van Hijum. He is genuinely interested in the zzp perspective. He is sharp and asks good questions. But I see it as a missed opportunity that the coalition agreement paid so little attention to the labor market and the self-employed. The policy of the previous administration was simply continued and the approach is pretty classic: the permanent job is the norm. That is out of date. Sticking a past solution on a current problem. That's not going to work.

How do you view the VBAR, especially after the critical opinion of the Council of State? Where are your concerns?

The opinion of the Council of State was heartening for us. Back in the fall of 2023, we came up with a solid response to the Internet consultation. Many of our concerns I read back into this opinion. The section on clarifying the employment relationship is not going to provide clarity and the entrepreneurship of the individual is secondary. At VZN, we advocate for a modern approach that incorporates individual entrepreneurship much more. The growth in the number of freelancers shows that the classic model no longer works. It is time to recognize that we cannot put the genie back in the bottle. We need to move toward a system where all working people have some arrangement for disability, old-age provision and also education. If you as a self-employed person want to take advantage of the entrepreneurial facilities that we have, then you can link it to that, so that you will then actually arrange those other things for yourself. For example, by creating a business buffer from which you hedge your entrepreneurial and social risks. This is how you stimulate sustainable self-employment. That is something from which people and society both benefit. Defining employment and entrepreneurship to the letter, as the minister is now trying to do, is not going to work. Instead, start organizing all the preconditions around it properly. And tackle the issue of social security. Make sure it is no longer merely linked to employment. That is forward-looking.

What was your highlight of this year?

Good question, but actually I don't have a concrete highlight. There is a lot of movement, but few concrete results yet. Maybe then the State Council's opinion on the VBAR. For me, that is a bright spot. It does away with wishful thinking and puts its finger on the sore spot.

And a low point?

That this same VBAR, despite all the warnings and criticism, is being sent to the House anyway. At the last minute, Van Gennip pushed the bill through to the Council of State. Then comes a critical opinion and yet it is pushed through again. Frankly, I find that a low point. Not only self-employed persons' interest groups are critical; numerous points for improvement have also been put forward by scientists and other industry associations. So why is the bill being pushed through anyway?* And another low point is that the criteria that are used in the approach to false self-employment are still too unclear for many clients. As a result, even genuine self-employed workers are now losing their assignments. They see their income evaporate before 2025. Very bad. The government should focus on distressing false self-employment, at the bottom of the labor market. Now they are shooting with a cannon at a gnat. It remains to be seen whether they are hitting the mosquito. But in any case, they also hit all sorts of other birds flying around, which we very much need for dynamism in the labor market and in our economy and which, according to the rules, will be allowed to continue flying around next year.

What do you expect from 2025 regarding the labor market and self-employment issue?

I expect a lot of hassle in the first few months, especially around enforcement. It's really not going to work to get all those self-employed people back into salaried employment. They don't want it. And I fear that the temp and secondment constructions that are coming up now are going to lead to even higher personnel costs. We wake up on January 1 on a waterbed. The flex signs have been moved here and there but the permanent contract has still not begun to take off, because both many clients and workers no longer want it. Eventually we will have to recognize the need for flexibility and autonomy. That will hopefully open the door to a broader discussion about how we are going to organize the labor market differently. I hope we will have that fundamental discussion together in 2025. How we can really work on a different system with a full role and position of the self-employed in this future-oriented labor market.

*Minister van Hijum (SZW) made a commitment during the Social Affairs and Employment budget debate to "take another good look" at the VBAR. Earlier, Van Hijum had intended to send the bill to the Lower House this year, but indicated that he was still waiting for the Supreme Court to answer preliminary questions in the Uber/FNV case. This has changed between the interview and publication dates.

*This interview is part of a series, in which in recent weeks the Public Affairs team has interviewed several experts closely involved in issues surrounding the self-employed and the labor market. The series consists of six interviews, which will be published in the coming weeks.

Request a free consultation

Questions about this? Please contact us.

Sem Overduin

Public Policy & Affairs Manager

Sem.Overduin@headfirst.nl

Oifik Youssefi

Public Affairs Officer

Oifik.Youssefi@headfirst.nl

Maaike van Driel

Head of Legal

Maaike.vanDriel@headfirst.group

Thomas ten Veldhuijs

Senior Legal Counsel

Thomas.tenVeldhuijs@headfirst.nl

Looking back on the 2024 zzp dossier: ZiPconomy editor-in-chief Hugo Jan Ruts on the 'superficial political discussions' on the zzp dossier and why vision for the labor market is really needed now

"Much has been said and written this year, but as yet there is no clear vision for the labor market," says ZiPconomy editor-in-chief Hugo-Jan Ruts. Politicians showed little evidence of an innovative vision this year, and the level of discussion left much to be desired, he says. The 2024 zzp debate revolved mainly around repairs and restrictions, while opportunities for innovation and structural improvements were barely discussed. In conversation with Sem Overduin, of HeadFirst Group's public affairs team, Ruts critically reflects on the challenges of the past year, the political discussion and the role of journalism, but also outlines how 2025 could become a year of confrontation and perhaps much-needed change.

How do you look back on the past year, in terms of the zzp file?

2024 was in some ways disappointing. The last six months in particular have revolved almost entirely around the lifting of the enforcement moratorium. That was already on the way because the date of January 1, 2025 is getting closer, but the debate was mainly about what is no longer allowed, rather than what is still possible. During lectures and presentations I try to show that there are opportunities to take the hiring of freelancers to a higher level. Unfortunately, the market, politics and society hardly ever talk about this. Many parties act as if the measures are unexpected, while this was already known since December 2022. On the other hand, I do understand it in a way: often organizations are mainly occupied with the delusion of the day, such as filling up the occupation, making it difficult to look ahead. At the same time, politics is mostly preoccupied with headlines and a fundamental debate about the future of the labor market remains absent.

From a journalistic perspective, it was an interesting year, with many different narratives and perspectives. What particularly struck you about the coverage around the self-employed issue this year?

Above all, it was much, much. Much is being written and said about it, especially since there is a sense of ambiguity in the market. Hard interests play a role in this, of course: both political and commercial. There is also a lot of misinformation going around. Anyway, my algorithm on social media is almost entirely focused on the labor market, so then it also seems like everyone is talking about this topic.

How has ZiPconomy contributed to the demand for - and interpretation of - information on surely quite complex topics such as the end of the enforcement moratorium, compulsory disability insurance for the self-employed and the WTTA?

ZiPconomy is a niche platform. We focus mainly on clients of self-employed people and the agency world. We start from a basic level of knowledge and add depth, often in collaboration with our partners, who in turn come up with interesting insights. We then offer a platform, provided it's correct, of course. In addition, we do two things: first, the hard, factual news and the corresponding interpretation. Secondly, we want to fuel the debate about the flexible labor market by giving our partners a platform and by focusing even more on factual reporting, especially given the amount of misinformation going around.

I see you respond more and more often on LinkedIn to posts that contain incorrect information about the zzp file. Do you see yourself as an activist and controlling journalist? What role do you see yourself playing?

That is part of who I am. My personality tells me that the debate should be based on facts. If I read something that is not true, I almost feel obliged to respond. That can irritate people, but I take that for granted. I think it is very important that we start the discussion on the basis of correct facts and figures.

You are often in The Hague to follow the debates on the self-employment and labor market file. You then provide lightning-fast interpretation and coverage. What is your impression of those debates?

To be honest, I am increasingly dissatisfied with it. I found the September 5 roundtable discussion on the lifting of the enforcement moratorium interesting, but the September 12 debate on the zzp dossier was superficial. And I found the debate on labor market policy on October 23 downright disappointing. This is partly because we have a lot of new MPs on this dossier. That makes it difficult to get to the bottom of the dossiers. In the zzp-debate the real conversation was lacking, partly because the ministers Van Hijum (Social Affairs and Employment) and former state secretary Idsinga (Taxation and Fiscal Affairs) are relatively new. What I really thought was a missed opportunity is that there was no vision of the future of the labor market during the labor market debate. There is a solid package of measures on the table to reform the labor market. In my opinion, those measures are mainly repairs, but there is far too little discussion about the next step we want to take together. What role will the self-employed have in the labor market? How do we work toward a contract-neutral system? I had expected Van Hijum to take a pioneering role in this, but unfortunately this was not forthcoming.

Speaking of concrete measures, news came out on Friday, Nov. 22, that mandatory disability insurance for the self-employed (BAZ) is not feasible. The WTTA (admission system) has also been postponed for the second time this year. Why are these plans failing to get off the ground?

As a whole, it mainly points to capacity problems in the implementing agencies, and that's what I find so crazy about politics: political ambition usually starts from its own wish list instead of looking at what is possible according to those implementing agencies. There is a paradox here: the government has to solve more and more with fewer resources. The annoying thing is that if all those legislative proposals do not get off the ground, political support for all those plans may subsequently decline as well. And we must remain really critical of the usefulness, necessity and proportionality of new legislative proposals.

The so-called 'polder' plays an important role in the creation of socio-economic policy in the Netherlands. How do you view the relationship between the polder and politics with regard to the labor market and self-employed workers file?

The influence of the polder, that is something I do look at critically. Because the impression that is being created is that the polder rules. It is all very well for parties such as the SER to discuss labor market policy, but let's be honest; the polder is dominated by classical, mainly conservative, forces. They are very good at creating support and improving policy, but real innovation does not take place here. Other players are needed for that. Borstlap produced a solid report in January 2020, but the 'renewal plans' are hardly taken up by politicians and the polder. I do miss that in the polder and I find that disappointing.

You published a report this year on zzp law in international perspective. What did you want to achieve with this comparative study?

I wanted to broaden my outlook and look beyond national borders. For example, Belgium is interesting because self-employed people there have hardly any tax advantages and they pay full contributions to social security. Secondly, they have a separate law. I think those are two interesting principles. Not to adopt directly, but to think about. That law brings together labor law, entrepreneurial law and tax aspects around the specific employment relationship of the self-employed and the worker. The rules are not even very different, they are more concrete and focused. Germany is also an interesting example because they work with a categorization of self-employment based on the type of occupation. All these kinds of insights provide material for careful consideration.

What was the highlight of the zzp issue for you this year?

I don't really have one highlight, but I do have two hopeful moments. The outline agreement suggests that there will be "policies for the truly self-employed," although no one knows exactly what that means and I haven't seen much of it at this point. But anyway, it's there and hopefully that's going to take on more substance. Second, the expiration of the moratorium is important. You cannot have eight years of a law that is not enforced. Hopefully that will force all parties involved to be innovative; why am I hiring people? And under what conditions?

And a low point?

The committee debate on labor market policy in October. I did find the level of discussion and the level of questions to be a low point. It really could have been better.

What do you expect from the zzp file in 2025?

I hope that this year's hopeful signs will continue. Politically, I am somewhat less sure, as the political situation is somewhat shaky after all, and there are tensions within the coalition. I expect the first half of 2025 to be turbulent. The wishes of politicians and the policy of organizations to scale down are going to cause confrontations, because production has to continue and we are facing shortages in the labor market. So it will be a search for a new balance and we will have to compromise somewhere. There are many places in the labor market where the self-employed have become indispensable. All in all, it's going to be very interesting to follow those dynamics.

*This interview is part of a series, in which in recent weeks the Public Affairs team has interviewed several experts closely involved in issues surrounding the self-employed and the labor market. The series consists of six interviews, which will be published in the coming weeks.

Request a free consultation

Questions about this? Please contact us.

Sem Overduin

Public Policy & Affairs Manager

Sem.Overduin@headfirst.nl

Oifik Youssefi

Public Affairs Officer

Oifik.Youssefi@headfirst.nl

Maaike van Driel

Head of Legal

Maaike.vanDriel@headfirst.group

Thomas ten Veldhuijs

Senior Legal Counsel

Thomas.tenVeldhuijs@headfirst.nl

Looking back on the zzp dossier 2024: University lecturer Niels van der Neut on misinformation around false self-employment, the VBAR and the too-long enforcement moratorium

Let's face it: many self-employed people still find the legal frameworks for enforcement against false self-employment too unclear. "Nonsense," says Niels van der Neut, associate professor of labor law at the University of Amsterdam. "There is already a lot of legal handholding." In conversation with Oifik Youssefi, Public Affairs Officer at HeadFirst Group, Van der Neut shares his thoughts on the expiration of the enforcement moratorium, the misinformation about it online and on the role of social partners in unlocking the tightness in the labor market.

Niels, as an academic in labor law, how have you experienced this year in terms of the zzp file?

Chaotic. There is a lot of shouting about self-employed workers and the expiration of the enforcement moratorium, especially on social media like LinkedIn. Many people are voicing their opinions, often from an incomplete understanding of the situation. The remarkable thing about this chaos is that those opinions can by no means always be separated from commercial interests. A lot of money is made from services that check the compliance of clients and freelancers, offering a form of false security. Sometimes I see invitations to seminars or workshops come along about the qualification question (employee or self-employed?) that contain legal errors, which is embarrassing. At the same time, I also see public campaigns by the Ministry of Social Affairs and Employment and the Tax Administration to make the rules around zzp hiring clear. But even that apparently does not lead to the desired clarity. So are these campaigns unclear or does the practice not find the answers desirable? My answer to that question can probably be guessed.

You've started speaking out more and more on this subject. Why really?

The amount of misinformation frustrates me; I feel a responsibility to correct it. As an independent academic, I try to enrich the public debate with nuance and interpretation. Sure, this sometimes results in less than kind responses, given the sensitivity of this issue. Nevertheless, I feel it is important to continue to give my opinion, which is substantiated by scientific research.

Self-employed people complain about the lack of a clear legal framework and that that could affect enforcement from 2025, to what extent is that true?

The enforcement moratorium was once established with the promise of new legislation to make it clearer when a worker is an employee or self-employed. There will be no new law on Jan. 1, 2025, but the perception that there is no clear legislation at all now is simply not true. Much has changed between the promulgation of the enforcement moratorium and Jan. 1, 2025. In the Deliveroo judgment, the Supreme Court gave nine points of view in testing false self-employment (employee status). That offers quite a bit of guidance. The problem is that people often want one hundred percent clarity in advance, and that is simply difficult in a market that is so diverse. If you assume one hundred percent certainty, you take away the possibility of applying open standards that do justice to the actual situation of how parties work with each other ('substance goes before appearance'). And if you do want extra certainty, the Tax Office offers room for a pre-consultation; I know a number of people who got a response to the pre-consultation request within a few weeks. So the options are there. I sincerely wonder if the question, "is there clear regulation?" for many should not rather be "am I happy with the answer given to this?".

Still, people remain critical of the expiration of the enforcement moratorium because of market turmoil. However, the government and the Tax Administration indicate that the market is ready. How do you view this?

If the market is not ready for it, as far as I am concerned, that is mainly down to the market itself. The market has had a long time to prepare since the announcement in December 2022 that the moratorium would be lifted from January 1, 2025. Sure, sectors like education, healthcare and childcare are especially vulnerable given the staffing shortage; these sectors may find that reliance on self-employed workers has consequences. For some childcare sites, this may even mean temporary closure. But the flight to self-employment has been caused in part by poor employer practices. I call on employers, and actually social partners, to allow for certain desires of working people, such as some form of flexibility. This is what the Borstlap Commission already advocated: making permanent contracts less rigid and flexible contracts less precarious.

How do you listen to the Cabinet's ambition to come up with a clarification law like the Verduidelijking Beoordeling Arbeidsrelaties en Rechtsvermoeden (VBAR) Act, despite the legal clarity that you think is there?

Time has not stood still: the idea of the VBAR existed before the Supreme Court came out with the Deliveroo ruling. With this ruling, the Supreme Court took a clear line. Still, I can imagine quite well that people need such a clarification law , because it provides a framework and gives structure. Whether the VBAR fulfills that promise and is actually a clarification with respect to the Deliveroo viewpoints, I wonder. The Council of State itself has also ruled that the effectiveness of the VBAR in its current form will have little (positive) impact on the fight against false self-employment. Perhaps things will become a little more manageable, but perhaps we should not expect very big steps either. The practice wants certainty in advance, but that does not fit with how we in the Netherlands and Europe assess employment relationships: the actual situation takes precedence over the paper reality.

Finally, what was the highlight for you in the zzp file this year?

The announcement that the enforcement moratorium is really, really coming off as of Jan. 1, 2025. It has not been made easy for the Internal Revenue Service and SZW by continuing to extend the moratorium, but it seems we are taking a step in the right direction. The moratorium has lasted long enough.

And the low point?

The disinformation that is spread. This damages trust in the rules and in the executive agencies.

What in particular are you looking forward to in 2025?

I hope that we will have a more fundamental discussion about self-employed workers in, for example, partner structures and with specialists such as self-employed surgeons. Those legal (qualification) questions are much more interesting and complex than those about self-employed people in childcare or education. In addition, I would like to see the conversation start in society and in politics about a revision of the social security system and how employed and self-employed people contribute to it. And as an extension of my dissertation, it is still interesting that the focus might not only be on the differences in taxation and social security, but also be shifted to the civil law differences between employees and the self-employed. Of course, one might ask: shouldn't the conversation about these differences actually have been held much earlier, for example, when the enforcement moratorium was first announced?

*This interview is part of a series, in which in recent weeks the Public Affairs team has interviewed several experts closely involved in issues surrounding the self-employed and the labor market. The series consists of six interviews, which will be published in the coming weeks.

Request a free consultation

Questions about this? Please contact us.

Sem Overduin

Public Policy & Affairs Manager

Sem.Overduin@headfirst.nl

Oifik Youssefi

Public Affairs Officer

Oifik.Youssefi@headfirst.nl

Maaike van Driel

Head of Legal

Maaike.vanDriel@headfirst.group

Thomas ten Veldhuijs

Senior Legal Counsel

Thomas.tenVeldhuijs@headfirst.nl

Looking back at 2024: Bovib director Bart Smals on the limits of salaried employment and the 'right not to be salaried'

As a former VVD MP and now director of industry organization Bovib, Bart Smals is committed to the rights of the self-employed and the position of the intermediary industry within a rapidly changing labor market. In conversation with Sem Overduin, Corporate Affairs & Public Policy Manager at HeadFirst Group, Smals highlights the lack of a legal framework for modern working and shares his vision for the future. He advocates more freedom of choice: "Going into paid employment is a right, but the right not to do so should be better guaranteed." What does the expiring enforcement moratorium mean for the self-employed and intermediaries? And where will the Bovib be in five years? In this interview, Smals looks back at the zzp dossier in 2024, shares his insights and takes a critical look ahead to 2025.

You've been with the Bovib for a few weeks now. How do you like it so far?

Very good. There are actually two reasons why I like it so much. First of all, my interest in the labor market file has never gone away and at the Bovib I can take that further. In addition, the Bovib is an organization that is growing fast, building on that is fantastic. The organization is becoming more and more visible and I feel responsible to continue that line. There is a lot of work to do in the area of representing the self-employed, who often fall between the cracks. A clear legal framework for this is still lacking and I would like to contribute to that as director of the Bovib.

What was your main reason for joining Bovib?

The way the labor market is currently legally structured no longer reflects reality. The labor market is becoming more flexible, but there is no good legal framework to support that. Wage employment is no longer taken for granted for workers; the Bovib is responding well to this change.

What do you think is Bovib's role in that labor market and in the social playing field?

Simply put: connecting supply and demand, like an oil man. The Bovib fulfills a modern role within the coalition of industry associations that support the flexible labor market. The need for flexible work comes not only from companies, but also from workers themselves. Bovib members open up the labor market and support clients in complying with laws and regulations.

Under your leadership, where will the Bovib be in five years?

I hope that we will then have a solution to the need for modern and flexible working, and that false self-employment will have been effectively addressed. The Bovib will then play a crucial role in connecting supply and demand and supporting clients, suppliers and self-employed workers.

The enforcement moratorium expires on Jan. 1, 2025. Do Bovib members know what awaits them?

I don't think anyone really knows. Everyone is looking for clarity, but the various rulings and rules - such as the Deliveroo judgment and comments by the minister and state secretary - do complicate things. The goal is to prevent false self-employment, and Bovib members are doing their best to do so. The problem is that no one at the front end, from the ministry to the Tax Office, can really say when you are compliant. Ideally there would be a traffic light model that you can rely on, rather than a situation where you have to wait and see, but we have to deal with this situation.

What do you notice about members leading up to January 2025?

Members are busy having conversations with clients and trying to advise on hiring policies based on the Deliveroo ruling. It is good that these talks are now being held and that Bovib members are taking a proactive role. Bovib members are professional organizations and take that responsibility.

As a former House member, how do you view the House's response to the enforcement plans of the Cabinet and the Internal Revenue Service?

The Chamber is right to be critical. The enforcement moratorium was put in place in 2016 because there was no clear legislation, that still hasn't changed. The Supreme Court has further colored the case law with the Deliveroo ruling, but it is really up to the legislature to provide clear legislation. In the Netherlands you have the right to work as an employee, but also the right not to. That deserves a good legal framework.

Did the end of the enforcement moratorium play a role in your political work?

Sure. At my first debate, MP Senna Maatoug of GroenLinks asked why the VVD, nota bene the party of enforcement, was so against enforcement of the DBA law. My answer was simple: if there is no clear law, you can't enforce it. I am in favor of enforcement, but only if there is a good legal framework. When even the judiciary says "approach it holistically," the answer is often "it depends.

As a VVD MP, you were critical of the VBAR and the role of entrepreneurial criteria. How do you currently view the VBAR?

When I was in the Chamber, I thought it was important to stand up for the right to free choice: you should be able to choose to be an entrepreneur. That should be reflected in the VBAR. The Borstlap Commission stated: 'fixed less fixed and flex less flex' - more balance in the labor market by making fixed contracts more flexible and flexible contracts more secure. But the way the VBAR looks now, it hardly matches that vision anymore. That's a shame. The right to entrepreneurship must be guaranteed. The VBAR should not force people into being employees if people do not want to be.

You also spoke out as a member of parliament about the representation of zzp'ers in the polder, for example in the SER. Why is that important?

I am a great supporter of the polder model because it brings different interests together to then reach solutions. But the interests of some groups, such as the self-employed, are not sufficiently taken into account. For a well-functioning polder it is essential that all interests are represented. I am therefore pleased that the SER now has seats for the self-employed - so they finally get a voice in decision-making.

Would the Bovib benefit from greater zzp representation in the polder?

Yes, definitely. The Bovib is growing and becoming more visible. A greater representation of zzp'ers would be good. Of course, the Bovib is not a union for the self-employed, but the self-employed are an important part of the labor market and the services provided by our members.

2024 has been an eventful year for the self-employed. What was a highlight for you?

Then I would like to go back a little further than 2024. In late 2023, Josette Dijkhuizen became a crown member of the SER because of her expertise on the self-employed. That is a step in the right direction, to give the interests of the self-employed a better place in the polder. Within the SER, after all, important long-term decisions are made regarding socio-economic policy in our country.

And a low point?

That the VBAR, in almost unchanged form, was sent to the Council of State. As a member of Parliament, and several parties with me, I was critical of the content of the VBAR. In my opinion, too little was done with it at the time. The Internet consultation in the fall of 2023 also produced many critical - and at the same time valuable - responses. The Council of State has now come out with a critical opinion and is bouncing the ball back. This could have been prevented at an earlier stage by making changes to the bill.

What do you expect from 2025 in this area?

I hope that the enforcement on false self-employment will mainly tackle the rogue parties and will protect vulnerable self-employed people. Especially at the base of the labor market the problems occur. That segment deserves extra attention and hopefully enforcement on labor relations will contribute to that in a positive way.

*This interview is part of a series, in which in recent weeks the Public Affairs team has interviewed several experts closely involved in issues surrounding the self-employed and the labor market. The series consists of six interviews, which will be published in the coming weeks.

Request a free consultation

Questions about this? Please contact us.

Sem Overduin

Public Policy & Affairs Manager

Sem.Overduin@headfirst.nl

Oifik Youssefi

Public Affairs Officer

Oifik.Youssefi@headfirst.nl

Maaike van Driel

Head of Legal

Maaike.vanDriel@headfirst.group

Thomas ten Veldhuijs

Senior Legal Counsel

Thomas.tenVeldhuijs@headfirst.nl

Talent Monitor | ICT labor market in figures 2024 - 2025

ICT labor market in figures 2024 - 2025

Since the 1990s, ICT professionals have been at the forefront of the labor market. From introducing work-life balance to pioneering online platforms such as LinkedIn, ICT professionals have always been at the forefront of labor market innovations. Now the sector is in a critical transition phase that could affect not only the ICT market itself, but the broader labor market. Find out what this means for employers, employees and (self-employed) ICT professionals.

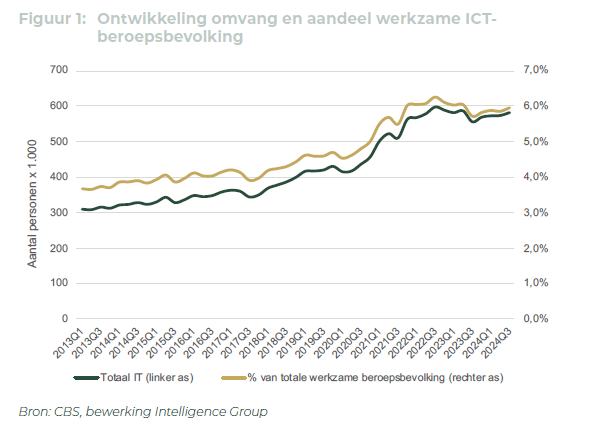

Cabinet goal unachievable: no 1 million ICT workers by 2030

While the government is aiming for one million ICT workers in the Netherlands by 2030, new research by labor market data specialist Intelligence Group and HR-tech service provider HeadFirst Group suggests that this goal is far out of reach. Even in a scenario of explosive growth, the Netherlands would have a maximum of 862,000 ICT workers by 2030. In more likely scenarios, the number is much lower still: between 628,000 and 783,000. Marion van Happen, CEO at HeadFirst Group nuances, "We don't have to meet the set target because AI can take over certain roles of ICT workers."

What will you learn from this report?

In this detailed Talent Monitor, we chart current trends in the ICT labor market:

- How the long-term growth in the number of ICT workers is slowing down and the role of AI in this change.

- The high employment rate of ICT workers, both salaried and self-employed.

- Declining Demand: The declining demand for ICT workers and how this affects recruitment strategies.

- What employers are doing differently now to attract ICT workers, including the impact of the DBA law.

- How specific ICT skills are key to both the current and future job market.

- What rising rates mean for freelancers in the industry.

- As AI and globalization change norms, what can we expect from industry dynamics?

Partner

Download Talent Monitor

By downloading the Talent Monitor, you agree that your data will be shared with co-initiator Intelligence Group.

Other reports...

Nothing found.

What is false self-employment and how do you prevent it?

In an ever-changing and dynamic legal landscape, it is critical that both self-employed individuals and clients have a clear understanding of what false self-employment entails and what consequences this can have. There is false self-employment when a worker works for a client as a self-employed person, while in the actual situation there is an employment contract. The client and contractor are jointly responsible for shaping the employment relationship correctly.

Here are the key points to consider if you want to position yourself as a self-employed person, or if you are a client working with self-employed people.

1. Legal definition of false self-employment

Sham self-employment occurs when a self-employed person is ostensibly self-employed, but when the facts and circumstances point to an employment contract. Whether an agreement should be regarded as an employment agreement depends on all relevant facts and circumstances taken together. These include (1) the manner in which the work and working hours are determined, (2) the embedding of the work and the worker in the organization, and (3) to what extent the worker runs entrepreneurial risk. In practice, there are other criteria and indications that weigh in determining the employment relationship. Should an assignment contract with a freelancer nevertheless be qualified as an employment contract, this will have tax and legal consequences for both the freelancer and the client.

The main testing framework for this comes from existing case law and, in particular, the Deliveroo judgment. The Supreme Court has formulated several points of view that are relevant when assessing the employment relationship. It is important for self-employed persons and clients to be aware of these criteria and indications. On Friday, November 1, the Tax Office published a document entitled 'Explanation of assessment of working relationships'. This document further explains which legal principles and case law are important when assessing a working relationship.

To enshrine these viewpoints in law, political Hague is working on the draft bill Verduidelijking Beoordeling Arbeidsrelaties en Rechtsvermoeden (VBAR).. The law aims to create a clearer distinction between employees and the self-employed and give vulnerable workers at the base of the labor market (under €33 per hour) a better legal position. Consideration of this bill in the House of Representatives and the Senate has yet to take place. You can read more about it here.

2. Risks to the worker in false self-employment

For the self-employed person themselves, the risks can be great if there is false self-employment. Consider:

- Recoveries of tax benefits: when the tax authorities correct the employment relationship, tax benefits such as the self-employment deduction and the SME profit exemption can be recovered;

- Fines and surcharges: the client may also face possible fines and surcharges of payroll taxes, as the self-employed person is subsequently considered an employee.Fines cannot be recovered from the zzp'er, after-tax payroll taxes can. However, in the Parliamentary letter of September 6, the government has announced that it will be lenient in the distribution of fines. For that reason, organizations that demonstrably take steps against false self-employment will not be fined in 2025.

3. Working on self-employment

To avoid false self-employment, it is essential to meet various criteria and elements associated with self-employment. These criteria include:

- Entrepreneurial risk: make sure you bear the financial risk for your business and the work you do. Commercial risk is part of entrepreneurship;

- As a self-employed person, make sure you make business investments of some magnitude. Consider investments in business equipment such as a laptop or investments in courses and training;

- Make sure that you actually behave as an independent entrepreneur in economic and social life. Consider the number of clients you have and an active role in acquiring new clients;

- It is important to actually implement contractual agreements in practice. Practice is leading, not agreements on paper. In legal jargon in legal jargon.

By meeting these criteria, self-employment can be demonstrated and prevent the Inland Revenue from qualifying the employment relationship as an employment contract.

4. All facts and circumstances count

It is important to understand that the assessment of self-employment is a weighing of all the facts and circumstances. There is no single decisive criterion; the employment relationship is looked at holistically, or in other words, the total context of the employment relationship is considered. This means that model agreements are useful, but only when they are actually observed in practice. As indicated above, the Inland Revenue and judges look beyond the paper reality: the facts and circumstances in the workplace are ultimately decisive in assessing the employment relationship.

Conclusion

Bogus self-employment is a complex and important issue. For both self-employed workers and clients, it is essential to be aware of the legal definition, the risks, and the steps that can be taken to ensure proper qualification of the employment relationship. Carefully considering all relevant facts and circumstances and encouraging entrepreneurial criteria are crucial to actually working as an independent contractor.

HeadFirst Group finds it important to inform clients and freelancers about the latest political-social developments. Watch our webinar back about the lifting of the enforcement moratorium and how to prevent false self-employment.

HeadFirst Group's Public Affairs team closely follows political and social developments. Our experts are ready for you - leave your details and we will contact you.

Questions about this? Please contact us.

Sem Overduin

Public Policy & Affairs Manager

Sem.Overduin@headfirst.nl

Oifik Youssefi

Public Affairs Officer

Oifik.Youssefi@headfirst.nl

Maaike van Driel

Head of Legal

Maaike.vanDriel@headfirst.group

Thomas ten Veldhuijs

Senior Legal Counsel

Thomas.tenVeldhuijs@headfirst.nl

How much weight does a warning actually carry?

A warning can be given as early as the first offense, but its impact depends on who gives the warning, the severity of the offense and even the external circumstances. You understand: there is no one-size-fits-all answer. This begs the question: what is the value of a warning from the Tax Office for clients who, often unknowingly, employ self-employed workers in the "wrong" way? Marion van Happen, CEO of HeadFirst Group, responds to the latest developments and the previously passed motion.

As of Jan. 1, 2025, the enforcement moratorium will expire, and with it "the designation," an instrument used by the Internal Revenue Service to give clients the opportunity to adjust the working relationship with a self-employed person within a certain period of time. During the debate on the zzp dossier on Sept. 12, several MPs expressed concerns about the expiration of this instrument. This led to an adopted motion by MP Aartsen (VVD), supported by several groups, on the 'warning' instrument. At first glance, this appears to be a new instrument, but it is important to realize that warnings have long been part of the inspectors' toolbox. The difference is that, thanks to the adopted motion, the warning is likely to play a more prominent role in enforcement policy.

The power of warnings

Although a uniform warning is difficult to define, warnings are always customized and contain reasonableness. Van Happen says the following about this: "The Tax Administration must give the market room to learn, adapt and engage in dialogue. Warnings should not degenerate into a purely bureaucratic tool, but should give organizations the opportunity to work seriously on improving the correct assessment of an employment relationship, without immediately being confronted with fines or additional taxes. Active cooperation with the market is therefore a key focus within the Enforcement Plan for Labour Relations of the Tax and Customs Administration. This cooperation between government and market is something we warmly welcome and we take our responsibility where we can."

Collaboration is key

The recently published document 'Explanation of Assessment of Labor Relations. Decision and consideration framework' makes it clear once again that the practical facts and circumstances on the shop floor are leading in assessing the employment relationship. All relevant facts and circumstances must then be considered and assessed as a whole. This is complex and does not always provide the clarity one is looking for. It is therefore not surprising that in recent weeks much has been about the so-called "soft landing," whereby the Tax Administration should not immediately "punish" organizations without first giving them the opportunity to improve the situation.

Van Happen: "The warning should in fact be an invitation to improvement, whereby clients can work step by step on compliance with the rules surrounding the hiring of self-employed workers. Not every violation requires harsh sanctions; often dialogue and adaptability is sufficient. When warnings are used to encourage this learning process, this instrument within the enforcement policy can contribute to a fairer, more transparent and workable market, with sufficient room for flexibility and independent entrepreneurship.

A constructive collaboration

At HeadFirst Group, we see the warning as an opportunity to work together with the tax authorities to create a market in which "mistakes" are part of the learning process, without immediately leading to financial consequences. By focusing on customization, reasonableness and communication, we can create a labor market in which both clients and intermediaries and self-employed are compliant and successfully cooperate with each other.

HeadFirst Group's Public Affairs team closely follows political and social developments. Our experts are ready for you - leave your details and we will contact you.

Questions about this? Please contact us.

Sem Overduin

Public Policy & Affairs Manager

Sem.Overduin@headfirst.nl

Oifik Youssefi

Public Affairs Officer

Oifik.Youssefi@headfirst.nl

Maaike van Driel

Head of Legal

Maaike.vanDriel@headfirst.group

Thomas ten Veldhuijs

Senior Legal Counsel

Thomas.tenVeldhuijs@headfirst.nl

Opinion of Advocate General De Bock: limited significance of entrepreneurial criteria in assessing employment relationship

"Important, but not decisive," is how Attorney General (AG) Ruth de Bock judges the importance of personal entrepreneurial criteria in assessing the employment relationship. Indeed, the first thing to consider is criteria within the employment relationship, not the person of the worker himself.

Entrepreneurial criteria outside employment relationship not decisive

In September 2024, De Bock issued an important opinion issued to the Supreme Court on the assessment of labor relations. This opinion may play an important role in the case between Uber and FNV. The opinion relates to the application of the so-called personal entrepreneurial criteria when assessing whether an employment relationship should be considered an employment contract. With the opinion that the AG gives is in line with the draft bill Verduidelijking Beoordeling Arbeidsrelaties en Rechtsvermoeden (VBAR), which is currently with the Council of State for advice. De Bock advises that the entrepreneurial criteria outside the employment relationship - such as the number of clients the worker has and actively making acquisitions to acquire orders - should should play only a limited role in qualifying a labor relationship. According to her, the key question should remain whether there is an employment relationship and therefore criteria within the employment relationship, such as a relationship of authority between the worker and the worker. The opinion of De Bock underlines that a formal reliance on self-employment may not be decisive if the actual working conditions point to an employer-employee relationship, after all, labor law is mandatory. Important to note: the AG's opinion is not binding and the Supreme Court therefore does not have to adopt it. In the judgment on Deliveroo the Supreme Court did not follow the advice of the AG either.

Supreme Court still to come up with final ruling

In the case between Uber and trade union FNV, the Amsterdam Court of Appeal postponed its ruling by asking May 2024 preliminary questions to the Supreme Court about the Deliveroo-ruling. In the Deliveroo-judgment of March 24, 2023, the Supreme Court mentioned several criteria and points of view that are relevant for determining whether a working relationship should be considered an employment contract. One of those criteria concerns the entrepreneurship of the person himself, in this case the drivers. The court now asks the Supreme Court to clarify this criterion. A literal interpretationhet Deliveroo-ajudgment it might be possible that in the case of two Uber drivers doing the same job, one has an employment contract and the other does not. The court wants to know from the Supreme Court whether this is indeed meantmeant by het Deliveroo-arrest.

Important ruling for the zzp file

The ruling of the Supreme Court, which may choose to adopt or disregard De Bock's opinion, will be decisive for the future and the role of self-employed persons in the labor market in the Netherlands. The Supreme Court's final answer to the preliminary questions may have major consequences for the position of self-employed persons in the labor market and the question of when an employment contract exists. The Supreme Court's opinion will also undoubtedly weigh in on the political debate on the draft VBAR law.

HeadFirst Group's Public Affairs team closely follows political and social developments. Our experts are ready for you - leave your details and we will contact you.

Questions about this? Please contact us.

Sem Overduin

Public Policy & Affairs Manager

Sem.Overduin@headfirst.nl

Oifik Youssefi

Public Affairs Officer

Oifik.Youssefi@headfirst.nl

Maaike van Driel

Head of Legal

Maaike.vanDriel@headfirst.group

Thomas ten Veldhuijs

Senior Legal Counsel

Thomas.tenVeldhuijs@headfirst.nl

Successful fourth edition of the Labor Market Gateway

On Tuesday, October 15, members of parliament, journalists, civil servants and experts gathered again in Nieuwspoort for the fourth edition of the Labor Market Gate. This time the topic on the agenda was 'the connection between education and the labor market'. Although the subject is of great importance to employers and educational institutions, it is not yet high on the political agenda. All the more reason to exchange views with all stakeholders.

Lifelong development

"We really need to accelerate on the Lifelong Development dossier," stated ROC Mondriaan board chairman Hans Schutte. Led by Hans Biesheuvel, former chairman of ONL for Entrepreneurs, Schutte entered into a conversation with Maurice Limmen, chairman of the Association of Universities of Applied Sciences. Two gentlemen with a clear vision on the issue and a rich career in the field of education. Limmen came with strong words towards the cabinet: "I call the education plans from the coalition agreement worrying. What strikes me is a lack of notion of retraining and upskilling from one sector to another, a vision on this is completely lacking."

Especially in professions where labor is in high demand - such as engineering, healthcare and ICT - it appears that there are too few qualified people to meet this demand. This problem is exacerbated by technological change and an aging workforce. All in all, this is putting increasing pressure on these sectors.

Educational institutions come along with difficulty

Long-term study penalty and labor shortages

Do you have questions about the Labor Market Gateway? Our experts are ready for you - leave your details and we'll get back to you.

Questions about this? Please contact us.

Sem Overduin

Public Policy & Affairs Manager

Sem.Overduin@headfirst.nl

Oifik Youssefi

Public Affairs Officer

Oifik.Youssefi@headfirst.nl

Maaike van Driel

Head of Legal

Maaike.vanDriel@headfirst.group

Thomas ten Veldhuijs

Senior Legal Counsel

Thomas.tenVeldhuijs@headfirst.nl