Rate development professionals 2025

Rate development professionals 2025

The Talent Monitor provides an in-depth analysis of trends and developments in the market for independent professionals and secondees. This report examines the impact of legislation, labor market movements and the scarcity of highly skilled self-employed professionals, with insights on rates, supply and demand, and expectations for 2025.

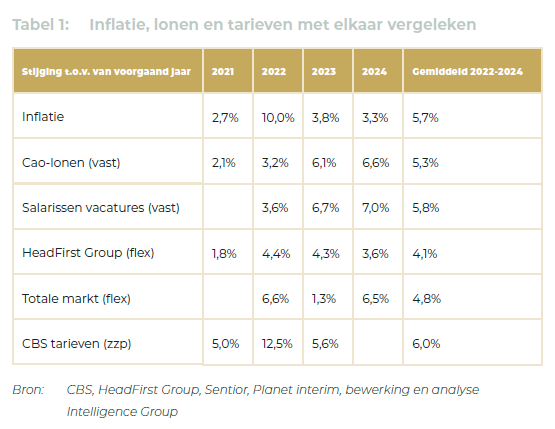

Hourly rates for self-employed and seconded workers continue to lag behind collective bargaining wages in 2024

The hourly rates of flexible workers, self-employed workers and professionals employed by secondment agencies, rose an average of 3.6 percent in 2024 compared to 2023. This increase lags behind average collective bargaining wage increases and rate increases for (practically skilled) self-employed workers. A limited rate increase is expected for 2025, between 1 and 1.5 percent. This is according to the latest Talent Monitor from labor market data specialist Intelligence Group and HR-tech service provider HeadFirst Group.

What to expect:

- Detailed analyses of labor market trends and rate changes.

- In-depth insights into the impact of legislation (such as the DBA Act) on the zzp market.

- Forecasts for the labor market in 2025, including forecasts for rates and the employment situation.

Summary of key findings:

- The number of self-employed workers rises slightly to nearly 1.1 million, with labor market activity increasing.

- Fees for independent professionals lag behind inflation and wage increases, with a projected increase between 0.5% and 1% in 2025.

- The demand for self-employed workers remains high, but the flexibility and choices of workers, especially self-employed workers, are determining trends.

Partner

Download Talent Monitor

By downloading the Talent Monitor, you agree that your data will be shared with co-initiator Intelligence Group.

Other reports...

Talent Monitor: The convergence of fixed and flex

We compile quarterly - based on recruitment data from...

Talent Monitor: Fixed is getting more mobile and flex is getting more sustainable

We compile quarterly - based on recruitment data from...

Talent Monitor: Rate development professionals 2023

We compile quarterly - based on recruitment data from...

Talent Monitor | ICT labor market in figures 2024 - 2025

ICT labor market in figures 2024 - 2025

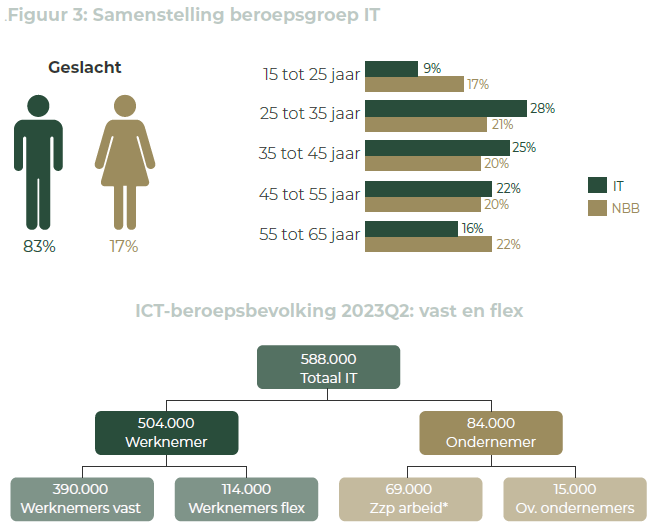

Since the 1990s, ICT professionals have been at the forefront of the labor market. From introducing work-life balance to pioneering online platforms such as LinkedIn, ICT professionals have always been at the forefront of labor market innovations. Now the sector is in a critical transition phase that could affect not only the ICT market itself, but the broader labor market. Find out what this means for employers, employees and (self-employed) ICT professionals.

Cabinet goal unachievable: no 1 million ICT workers by 2030

While the government is aiming for one million ICT workers in the Netherlands by 2030, new research by labor market data specialist Intelligence Group and HR-tech service provider HeadFirst Group suggests that this goal is far out of reach. Even in a scenario of explosive growth, the Netherlands would have a maximum of 862,000 ICT workers by 2030. In more likely scenarios, the number is much lower still: between 628,000 and 783,000. Marion van Happen, CEO at HeadFirst Group nuances, "We don't have to meet the set target because AI can take over certain roles of ICT workers."

What will you learn from this report?

In this detailed Talent Monitor, we chart current trends in the ICT labor market:

- How the long-term growth in the number of ICT workers is slowing down and the role of AI in this change.

- The high employment rate of ICT workers, both salaried and self-employed.

- Declining Demand: The declining demand for ICT workers and how this affects recruitment strategies.

- What employers are doing differently now to attract ICT workers, including the impact of the DBA law.

- How specific ICT skills are key to both the current and future job market.

- What rising rates mean for freelancers in the industry.

- As AI and globalization change norms, what can we expect from industry dynamics?

Partner

Download Talent Monitor

By downloading the Talent Monitor, you agree that your data will be shared with co-initiator Intelligence Group.

Other reports...

Talent Monitor: The convergence of fixed and flex

We compile quarterly - based on recruitment data from...

Talent Monitor: Fixed is getting more mobile and flex is getting more sustainable

We compile quarterly - based on recruitment data from...

Talent Monitor: Rate development professionals 2023

We compile quarterly - based on recruitment data from...

Talent Monitor | European self-employed under the microscope: Trends, growth & diversity

European self-employed under the microscope: Trends, growth & diversity

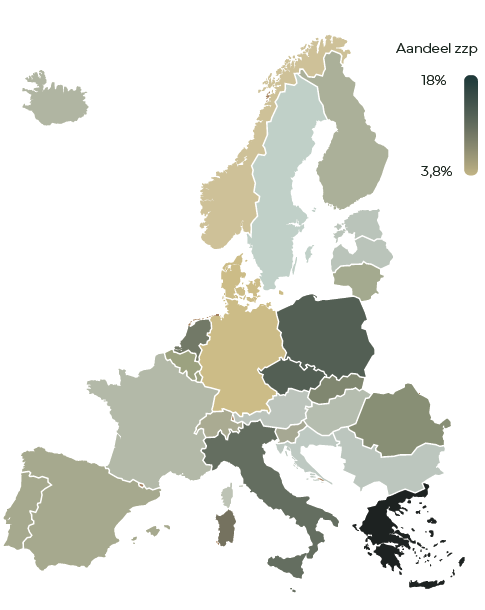

The European labor market is in flux. With nearly 20 million self-employed spread across several countries, there are big differences in how this group develops. The Netherlands leads the way with unique trends in flexible work, but how do we compare to the rest of Europe?

The Talent Monitor offers an in-depth analysis of the European self-employed market, sharing insights you shouldn't miss.

Increasing number of self-employed people under 30 in the Netherlands, Belgian numbers actually decreasing

Over the past five years, the number of self-employed people under 30 in the Netherlands has increased significantly, accounting for 12.7 percent of the total number of self-employed people in our country. This places the Netherlands among the top European countries, along with countries such as Malta, Slovakia and Lithuania. In contrast to the Netherlands, Belgium - at almost 4 percent - has actually seen a decline in the number of young self-employed people. This is shown in the most recent Talent Monitor, a joint study by labor market data specialist Intelligence Group and HR-tech service provider HeadFirst Group.

What can you expect in this report?

- A unique comparison between the Dutch labor market and the rest of Europe.

- Find out why older and highly educated self-employed people dominate, and why younger people are less likely to become self-employed.

- Analysis of the growing role of women in the self-employed market and its link to emancipation.

Who should read this report?

- Legislators: To place the Dutch labor market in a broader European perspective.

- Clients with international ambitions: To develop an effective European recruitment strategy.

- Zzp'ers: To understand how unique the Dutch zzp is compared to other European countries.

Partner

Download Talent Monitor

By downloading the Talent Monitor, you agree that your data will be shared with co-initiator Intelligence Group.

Other reports...

Talent Monitor: The convergence of fixed and flex

We compile quarterly - based on recruitment data from...

Talent Monitor: Fixed is getting more mobile and flex is getting more sustainable

We compile quarterly - based on recruitment data from...

Talent Monitor: Rate development professionals 2023

We compile quarterly - based on recruitment data from...

Talent Monitor | Labor market movements: the men versus the women

Labor market movements: the men versus the women

It is no surprise that there is (unconscious) bias among recruiters, clients or employers when it comes to attracting male and female workers. At least a few times a year, newspapers headline the huge salary gap between the two genders. However, as far as professionals are concerned, the difference in hourly rates has become very small and, more importantly, no longer statistically explainable by gender. Other factors, such as work experience and education level, now explain the difference. These and several surprising insights are presented in this Talent Monitor.

Success of female self-employed surpasses men in labor market

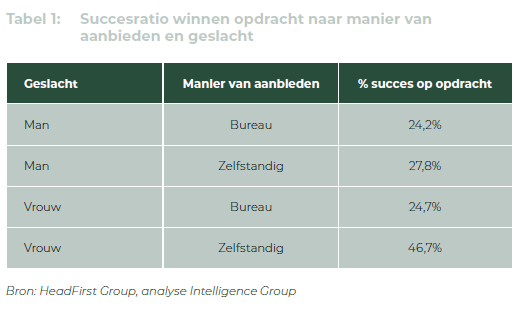

The latest Talent Monitor, a joint study by labor market data specialist Intelligence Group and HR-tech service provider HeadFirst Group, shows that female professionals - self-employed or employed by suppliers - are 68 percent more successful in obtaining assignments than their male counterparts. Moreover, the data analysis shows that female self-employed professionals no longer have a gender pay gap in hourly rates, whereas this was still the case before the corona pandemic.

Key findings

- Female professionals are not paid significantly less or more per hour for the same work compared to male professionals. What is striking is that women, not significantly but structurally, get or accept a lower rate than men for the same work. The average difference is 1 to 2 euros per hour.

- Factors such as work experience, area of expertise and level of education do determine different hourly rates, as does the extent to which being an independent professional is the main daily occupation. In other words, independent professionals who combine their work with other activities such as volunteering, being a househusband or housewife tend to receive lower hourly rates.

- Women are more successful than men in obtaining assignments. Female independent professionals without an agency are 68% more successful in scoring an assignment than male independent professionals without an agency.

- Independent professionals without an agency are more successful in scoring an assignment than if offered through an agency.

- Male professionals are much more active in the job market than women and are approached remarkably more than women.

Partner

Download Talent Monitor

By downloading the Talent Monitor, you agree that your data will be shared with co-initiator Intelligence Group.

Other reports...

Talent Monitor: The convergence of fixed and flex

We compile quarterly - based on recruitment data from...

Talent Monitor: Fixed is getting more mobile and flex is getting more sustainable

We compile quarterly - based on recruitment data from...

Talent Monitor: Rate development professionals 2023

We compile quarterly - based on recruitment data from...

Talent Monitor: Rate development professionals 2024

Rate development professionals 2024

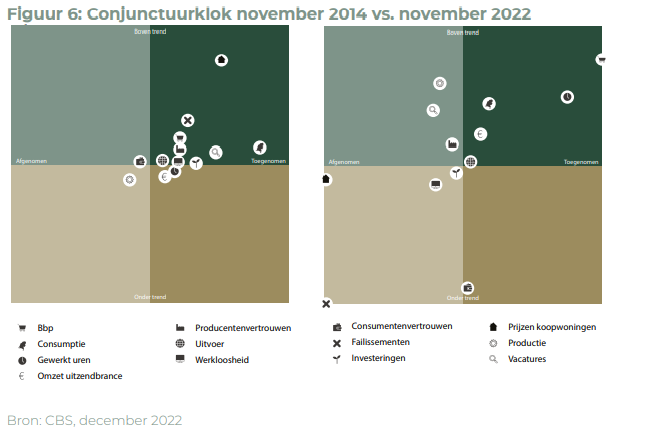

We are balancing between economic contraction and growth. After nine months of decline, we saw a modest rebound in our economy in the fourth quarter of 2023. Despite once again challenging market conditions such as inflation and "higher" market interest rates, we ventured another forecast for 2024 with this Talent Monitor. You can read about it in this report.

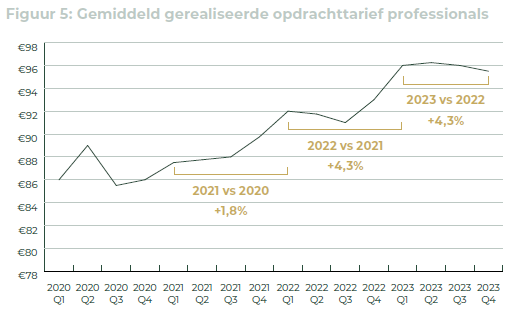

Hourly rates for self-employed and seconded workers lag behind collective bargaining wages

The hourly rates of flexible workers, self-employed workers and professionals employed by secondment agencies, rose an average of 4.3 percent in 2023 compared to 2022. This increase lags slightly behind the trend in collective bargaining wages. An average rate increase of one to two percent is expected for 2024. This is according to the latest Talent Monitor from labor market data specialist Intelligence Group and HR-tech service provider HeadFirst Group.

Key findings

- After three quarters of contraction in the Dutch economy, the fourth quarter of 2023 shows a slight increase of 0.3% compared to the third quarter. Compared to 2022, however, there is still a decline of 0.5%.

- Several signs indicate that there is some relief in the scarcity in the labor market. Demand for personnel is decreasing slightly and supply appears to be increasing slightly.

- Compared to a year ago, labor market activity among self-employed professionals - the extent to which they move from assignment to assignment - shows a slight increase from 20.1 to 21.7% in the fourth quarter of 2023, compared to the same quarter in 2022. There was also some growth in the group of latent professionals, who, while not actively seeking new assignments, are open to other options. At the same time, the number not moving at all decreased.

- There has been a sharp increase in the average number of offers per job. By the end of 2023, this number was almost at the same level as during the peak in the second quarter of 2020.

- The number of self-employed people who want to be employed (back) has increased slightly. At 11.6%, it is still far behind the percentage in 2021, when it was 17.0%. In addition, just 13.0% of employees indicate that they would like to work as a self-employed person (again).

- Sourcing pressure continues to grow unchanged: on average, self-employed individuals are approached about 18 times a year for a job. More than six in 10 are approached at least once a quarter.

- Data from HeadFirst Group shows that the rates of flexible workers - self-employed and professionals employed by secondment firms - who started a new assignment in 2023 rose an average of 4.3% compared to 2022.

Partner

Download Talent Monitor

By downloading the Talent Monitor, you agree that your data will be shared with co-initiator Intelligence Group.

Other reports...

Talent Monitor: The convergence of fixed and flex

We compile quarterly - based on recruitment data from...

Talent Monitor: Fixed is getting more mobile and flex is getting more sustainable

We compile quarterly - based on recruitment data from...

Talent Monitor: Rate development professionals 2023

We compile quarterly - based on recruitment data from...

Talent Monitor: ICT labor market in figures 2023-2024

ICT labor market in figures 2023-2024

Despite the fact that the market is turning, there is no sign of any relaxation or serious decrease in scarcity in the ICT labor market. This Talent Monitor focuses specifically on ICT professionals and provides insight into various aspects of the labor market. Such as development of vacancies/assignments, labor market activity, job changes, sourcing pressure, pull factors, employment conditions, the most desired employer, the most in-demand and fastest growing ICT skills and information on rates.

1 in 4 ICT workers switched jobs or employers in 2023

November 30, 2023 - The most recent Talent Monitor shows that 1 in 4 employed ICT professionals have changed jobs and/or employers in the past 12 months. While the ICT worker is by nature a latent job seeker, or in other words: they are open to another job, but do not actively search and apply themselves Where the mobility of ICT workers in recent years was fairly stable, this has increased sharply in the past year and the loyalty to the own manager and/or employer has decreased. These are some of the dozens of striking results from large-scale research into the current labor market for ICT professionals by Intelligence Group and HeadFirst Group.

Key findings

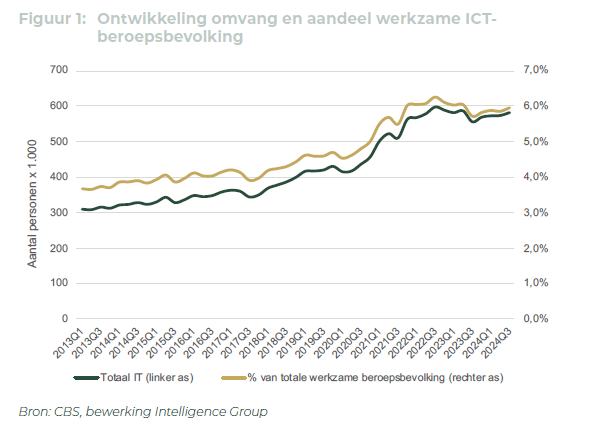

- Growth of the profession of I(C)T continues. Now it is at about 6% of the labor force. By 2030 it will be about 8.5%, is the expectation based on past growth and further development in the areas of automation, digitization, robotization and AI.

- IT and aging are not an issue within ICT workers or the IT sector. Legacy systems and skills are, however. It is therefore important to be well informed, especially about the fastest growing ICT skills among agencies and employers. This gives insight into the futureKey terms in this are: data, identity, Tmap, Vue.js, Apache and many more.

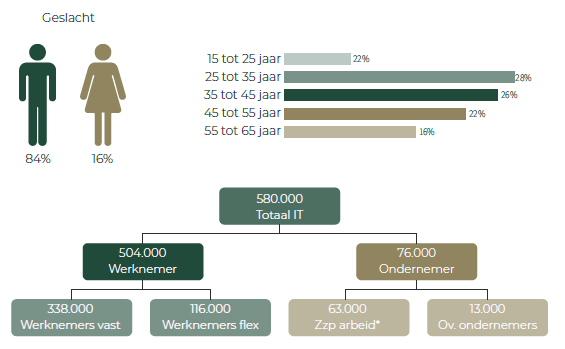

- The growth of the IT workforce over the past year is entirely due to the increasing number of self-employed workers. From 76 thousand in 2022 Q2 to 84 thousand in 2023 Q2, an increase of over 10%.

- The scarcity is huge and the recruitment feasibility is extremely difficult and will remain very to extremely difficult in the coming years.

- On average, ICT professionals move positions within their organizations or externally within 4 years. In particular, internal mobility and retention is a tricky phenomenon for ICT workers. Because of the high degree of specialization, growing internally or filling other roles is difficult. Therefore, a follow-up move outside is often more logical. Most ICT practitioners move when approached and do limited searching on their own.

- The target group is mostly latent which indicates greater recruitment complexity and implies a sustainably different recruitment strategy. Sourcing is the number one recruitment strategy, with LinkedIn being the base on the one hand and proving to be an increasingly difficult area where ICT talent leaves.

- More and more IT professionals are making sure they can no longer be hounded and are taking control of their own lives. That means they search for an interesting employer/client themselves or let their agency/account manager know they are available for a new job. Talent managers and talent pools are the success formulas for permanent and flex.

- In the Netherlands, between the hourly rate in salaried employment and the freelance or secondment rate, depending on experience level, is an average factor of 2.4 to 2.7. Not so for ICT workers. The average hourly rate factor for ICT professions is 3.78. There is a lot of extra margin and air in ICT freelance and secondment rates that cannot be explained by additional recruitment costs.

- ICT professionals go for a good salary/hourly rate and the work experience, whether in the office or not with nice colleagues. Flexibility is the norm already by definition for independent professionals.

- The State is again the most preferred employer among ICT workers in 2023, followed by ASML and Google. In Europe, they are Google, Microsoft and Amazon.

Partner

Download Talent Monitor

By downloading the Talent Monitor, you agree that your data will be shared with co-initiator Intelligence Group.

Other reports...

Talent Monitor: The convergence of fixed and flex

We compile quarterly - based on recruitment data from...

Talent Monitor: Fixed is getting more mobile and flex is getting more sustainable

We compile quarterly - based on recruitment data from...

Talent Monitor: Rate development professionals 2023

We compile quarterly - based on recruitment data from...

Talent Monitor: The convergence of fixed and flex

The convergence of fixed and flex

In this edition, we take the unique step of comparing rates for permanent and flexible staff, by target group. Which hired professionals are much more expensive than their permanent colleagues? And which ones, on the contrary, are not? An important development towards a full-fledged data model for Total Talent Management.

Tightness in flex market past peak

The scarcity in the labor market - for both permanent and flexible staff - has been severe for years, but in the flex market it seems to have passed its peak. The number of responses from professionals to assignments is rising and the number of assignments without bids is falling. Hourly rates are rising, but lag behind inflation with an average increase of 3.7 percent.

Key findings

- The worst of the tightness seems to be over in the market for highly skilled independent professionals and secondees. The number of offers on assignments is rising and is almost at the level before the corona crisis. The number of assignments without offers is decreasing and moving below 10%. At the same time, we see that labor market activity and sourcing pressure are picking up. All characteristics that "supply" is stirring and is available or coming.

- The number of highly educated independent professionals has increased by nearly 30% in the last five years. This is an explosive increase of about 325,000 people. In addition, over a hundred thousand seconded workers have been added during the same period.

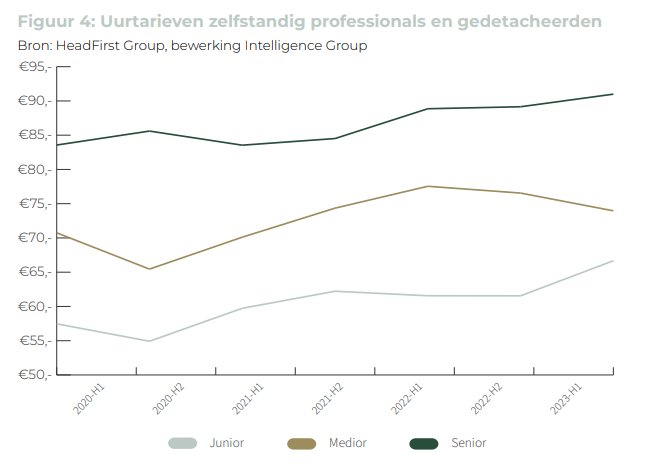

- In the first half of 2023, the rates of highly skilled self-employed professionals and secondment agencies increased by an average of 3.7% compared to the same period in 2022. With this, rates do not follow inflation, self-employed workers lose purchasing power and secondment agencies lose their margin.

- Junior professionals, a group predominantly provided by secondment agencies, became 8.3% more expensive. They are better able to pass on inflation to clients for these juniors, among other things. While clients are actually favoring medior and senior professionals more, due in part to AI innovations, the flattening of the economy and the challenges with Generation Z workers. Nevertheless, in the first part of 2023, mediors took off a "jacket" in terms of rates. This appears to be an offsetting effect from 2022, when an increase of more than 10% was seen. Over two years, this averages out.

- Flexible work has the image of being "expensive. But how much more expensive is flex really? Between the hiring rate and fixed salary (including vacation pay, social and employer expenses) is an average factor between 2.4 and 2.7. As the level of experience increases, the factor increases. In certain very scarce professional groups, such as gardeners or caregivers IG, the factor climbs to almost 4. For psychologists, policy officials and professional groups - where procurement is mostly through SLAs and tenders - the factor is lower to just near or below 2.

Partner

Download Talent Monitor

By downloading the Talent Monitor, you agree that your data will be shared with co-initiator Intelligence Group.

Other reports...

Talent Monitor: The convergence of fixed and flex

We compile quarterly - based on recruitment data from...

Talent Monitor: Fixed is getting more mobile and flex is getting more sustainable

We compile quarterly - based on recruitment data from...

Talent Monitor: Rate development professionals 2023

We compile quarterly - based on recruitment data from...

Talent Monitor: Fixed is getting more mobile and flex is getting more sustainable

Fixed is becoming more mobile and flex more sustainable

In this Talent Monitor, we took a closer look at the duration of jobs and assignments of workers. In doing so, we explicitly looked for the overlap and correlation between permanent and flex in the inflow and labor market activity and zoom in on retention and retention.

Staff retention is the new recruiting

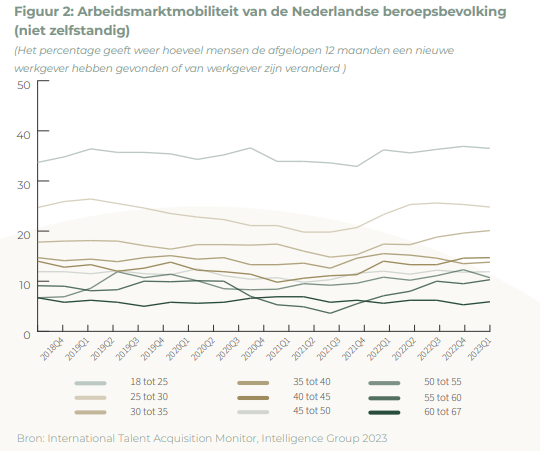

Labor market activity - which involves actively looking for a job/assignment yourself - is historically low for both permanent and flex workers. In contrast, external mobility is at a record high, which for salaried workers means they are almost twice as likely to change employers as in 2015. This is almost twice the rate of internal mobility. Employers are hardly betting on internal careers and advancement opportunities, instead focusing primarily on recruitment in the external labor market. This is a major driver of costs and the loss of productivity and job happiness.

Key findings

- Labor market activity (actively looking for a job/assignment yourself) is historically low for both permanent and flex, prompted by the tightness in the labor market. This puts more emphasis on sourcing and active mediation by intermediaries and secondments.

- In contrast, external mobility is at a record high, which for salaried workers means that they are changing employers almost twice as fast as in 2015. In early 2023, the duration of a salaried job for the entire Dutch labor force will be less than five years, down from eight years in 2015.

- It is almost twice as large as internal mobility. Which means, concretely, that employers are hardly betting on internal careers and advancement opportunities, but are concentrating mainly on recruitment in the external labor market. This is a major driver of costs and the loss of productivity and job happiness.

- Whereas employees are employed for shorter and shorter periods, the initial assignment duration of contractors - independent professionals and secondees - is steadily increasing to an average of 205 days. In the process, the percentage of assignments that are renewed after the initial assignment is also increasing again, to 61% in 2022.

- Not paying or charging a market-based labor market rate according to professional group and level of experience lowers the likelihood of renewing an assignment, both from the client and contractor's perspective. It also increases the need for greater transparency and increases the call for independent data-driven rate information.

- The probability of being renewed and the duration of the contract - in addition to the rate - also depends on type of position (embedding), type of project (head-to-head), initial duration (the longer, the lower the probability of being renewed) and the industry (tendered/not tendered).

Partner

Download Talent Monitor

By downloading the Talent Monitor, you agree that your data will be shared with co-initiator Intelligence Group.

Other reports...

Talent Monitor: The convergence of fixed and flex

We compile quarterly - based on recruitment data from...

Talent Monitor: Fixed is getting more mobile and flex is getting more sustainable

We compile quarterly - based on recruitment data from...

Talent Monitor: Rate development professionals 2023

We compile quarterly - based on recruitment data from...

Talent Monitor: Rate development professionals 2023

Rate development professionals 2023

In this edition of the Talent Monitor, we look back at developments in 2022 and express expectations for 2023.

Rate hike of four to six percent for self-employed and seconded workers in 2023

The hourly rates of flexible workers, self-employed and professionals employed by secondment agencies, rose an average of 3.8 percent in 2022. This is a lot less hard than predicted, under pressure from scarcity and inflation. This emerges from analysis by labor market data specialist Intelligence Group and HR-tech service provider HeadFirst Group. In 2023, they expect an average rate increase of four to six percent.

Key findings

- In the past year, 127,000 new zzp'ers entered the market. This makes them the fastest growing group of workers in the Dutch labor market, now accounting for over 10% of the Dutch labor force.

- Figures from Intelligence Group show that only 10.5% of highly educated self-employed people want to return to paid employment. In early 2021, this was still 17%.

- In 2023, the supply of professionals increases, in part because of the huge growth of highly skilled self-employed (independent professionals). Although the supply of active job seekers is still particularly low, the number of offers on assignments is expected to increase slightly, and the banks of secondments in early 2023 - in professional groups such as IT and marketing - will be slightly more filled than a year ago.

- Data from HeadFirst Group shows that the rates of professionals who started a new assignment in 2022 increased by an average of 3.8% compared to 2021. If extended agreements are also included in the average rate, the average rate increase is a small percentage point lower at 3.1%. This decrease is because renewals tend to go at the same rate, while new contracts go at a higher rate.

- The highest rate increase was seen in the first quarter of the year. In subsequent quarters, the increase was less, while scarcity and inflation continued to increase.

- If we assume the expected increase in collective bargaining agreements in 2023, the hourly rates of independent professionals will rise on average between 4 and 6% in 2023. The agreed wage increases for permanent staff and rate increases for independent professionals will not differ much from each other.

- Hourly rates follow and keep pace with collective bargaining developments. The annual average for 2022 now stands at 3.6%, although wage agreements accelerated to 6.4% in November 2022.

- Detachers will, if contracts and SLAs allow, raise rates slightly more to reflect current inflation.

- Clients do not take rigorous steps to widely index rates of professionals on current assignments. They take a performance-based approach: professionals whose rates are in line with performance are not indexed much, if at all, in the interim. Professionals with good performance and an hourly rate below the market average do get indexed - or at least sooner.

Partner

Download Talent Monitor

By downloading the Talent Monitor, you agree that your data will be shared with co-initiator Intelligence Group.

Other reports...

Talent Monitor: The convergence of fixed and flex

We compile quarterly - based on recruitment data from...

Talent Monitor: Fixed is getting more mobile and flex is getting more sustainable

We compile quarterly - based on recruitment data from...

Talent Monitor: Rate development professionals 2023

We compile quarterly - based on recruitment data from...

Talent Monitor: IT labor market in figures

Talent Monitor: IT labor market in figures

The labor shortage in the Netherlands is now present in all occupational groups, according to the UWV. Figures for the second quarter of 2022 show that with a tension indicator - number of open vacancies divided by the number of people receiving unemployment benefits for less than six months - the occupational group IT is classified as the most tight of sixteen groups. Therefore extremely interesting to further scrutinize in this Talent Monitor.

By 2030: 1 in 10 in Dutch labor market IT professional

Currently, one in seventeen people in the Dutch labor market is an IT professional. In ten years, this has nearly doubled. At the current growth rate of almost seven percent per year, by 2030 one in ten of the Dutch labor force will be an IT professional. That said, the battle for salaried and temporary IT professionals, self-employed and employed by secondment companies, is in full swing. At nearly 65%, the sourcing pressure is unprecedentedly high, especially given the 37.6% average for the entire labor force.

Key findings

- No surprise: IT workers are extremely scarce. Demand is increasing, but supply is also rising 6.9% year on year. In the past decade, the number of IT workers has almost doubled, and by 2030 there will be over 1 million of them in the Netherlands. By then, one in ten people in the labor market will be IT professionals.

- There remains a continued growing demand for IT professionals, both employed and self-employed. The latter group is growing more slowly and is more dependent on cyclical fluctuations.

- There is increasing competition among clients who more often use labor market communications to be attractive, resulting in some having offers and others having none. The latter can certainly be called a trend. The tightness in the self-employed market means that clients are investing more in "selling" their assignments.

- The number of active job seekers is very low. The battle for the latent job and assignment seeker takes place primarily on LinkedIn, networks, platforms and the company's own VMS/ATS systems. While salaried IT professionals are increasingly being hounded - nearly two in three are approached at least once a quarter - it is notable that active sourcing of IT professionals seems to be on its way out slightly. This may run parallel to slightly fewer assignments on the market, and we don't want to call it a trend either, since it is by far the most important sourcing channel, of both permanent and flex.

- One in five IT professionals manages to remain structurally under the radar. This is quite apart from the group that is found and approached but does not respond. The right to privacy and the right to be unreachable is certainly a trend - whether or not soon supported by legislation in the Netherlands - that IT professionals are leading the way in the job market.

- In terms of working conditions and pull factors, IT professionals have already seen many of their needs met. That is increasingly a hygiene factor. Selling the job, the assignment and the work, that's the emphasis. What am I going to do? With whom? For whom? And why? Three sentences won't get you there as an employer.

Partner

Download Talent Monitor

By downloading the Talent Monitor, you agree that your data will be shared with co-initiator Intelligence Group.

Other reports...

Talent Monitor: The convergence of fixed and flex

We compile quarterly - based on recruitment data from...

Talent Monitor: Fixed is getting more mobile and flex is getting more sustainable

We compile quarterly - based on recruitment data from...

Talent Monitor: Rate development professionals 2023

We compile quarterly - based on recruitment data from...