Overly rigid rules on hiring self-employed not desired

Last Thursday, Parliamentary questions about enforcement of the DBA law were answered by Minister Van Gennip and on Thursday, June 30, the SZW Committee will debate the zzp dossier. Ahead of this, ZiPconomy published the report "Employee, unless... 8 variants for replacing the DBA law.

A clear overview of all the different proposals made in recent years to replace the DBA law. More importantly, the pros and cons and consequences for the self-employed and clients are detailed. By combining these insights with the correct facts and figures about the self-employed, politicians in The Hague can come to a well-considered decision.

Take into account labor market situation

Two elaborated variants, the proposal of the Borstlap Commission and the ABC test from California, have heavy impact on the freedom of self-employed workers and clients. Given the current tight labor market, it is important not to underestimate these impacts. Employers and clients are crying out for talent and are pulling out all the stops to retain the current population.

I completely agree that there should be clear rules and frameworks for when someone can be hired as a self-employed person. However, too rigid rules are not desirable, because practice shows that the form of contract is becoming less and less decisive. It is therefore important to deal carefully with laws and regulations concerning work and not to restrict workers too much in their choices.

Belgian model good alternative

The report also highlights the Belgian model with the Labor Relations Act. In Belgium, the problem of false self-employment is effectively combated by (1) having a clear set of criteria as to whether someone can perform an assignment as a self-employed person, (2) looking more at the aspects of entrepreneurship and (3) having stricter rules in sectors where the risk of underpayment or vulnerable workers is high. This combination of factors works well in Belgium, so it is interesting to see if we can adopt the positive aspects and improve the less good ones in the Netherlands.

And now?

For now, it is not clear what the next step will be from Minister Van Gennip. Before the summer, an outline letter will go to the House of Representatives on the elaboration of the labor market package. Finally, there will be a response to the report of the Court of Audit before the debate on June 30. We are following developments closely and remain in close contact with MPs and policy staff.

The report "Employee unless... 8 variants for the replacements of the DBA law is available for download on the ZiPconomy website.

8 variants for replacing the DBA law

The hot topic: employee unless...

On Thursday, June 30, the Social Affairs and Employment Committee will debate the zzp dossier. Ahead of this debate, ZiPconomy published the report 'Employee, unless ... 8 variants for the replacement of the DBA law' this morning. Packed with interesting insights and a clear overview of the different variants on the table. "We hope that based on the contents of this report a substantive and qualitative debate will be held," said Marion van Happen, CEO of HeadFirst Group.

Different schools of thought brought together

The role and position of the self-employed on the labor market has long been the subject of debate in the Netherlands. The issue: when is someone who performs work for pay an employee or a self-employed person? Previous cabinets have failed to clarify this and several plans have failed for various reasons. In addition, several reports have been published with proposals to move the discussion forward. Ranging from enforcement of existing rules to sweeping legislative changes.

"This report offers a clear overview of all the different proposals made in recent years to replace the DBA law. More importantly, the advantages, disadvantages and consequences for the self-employed and clients are detailed. By combining these insights with the correct facts and figures about the self-employed, politicians in The Hague can come to a well-considered decision."

Take labor market situation into account

Two elaborated variants, including the Borstlap Commission's proposal to make "embedding in the organization" leading in the distinction between employee and self-employment and the ABC test from California, have heavy impact on the freedom of self-employed workers and clients. Given the current tight labor market, it is important not to underestimate these impacts. Employers and clients are crying out for talent and are pulling out all the stops to retain the current population. "That there should be clear rules and frameworks when someone can be hired as a self-employed person, I completely agree. On the other hand, too rigid rules are not desirable, because practice shows that the form of contract is becoming less and less decisive. It is therefore important to deal carefully with laws and regulations concerning work and not to restrict workers too much in their choices," says Van Happen.

Belgian model good alternative

The report also highlights the Belgian model with the Labor Relations Act. This model - also described in the report 'Independence, flexibility and social security. A look across the border.' - has many advantages. Van Happen says: "In Belgium, the issue of false self-employment is effectively combated by (1) having a clear set of criteria as to whether a person may perform an assignment as a self-employed person, (2) looking more at the aspects of entrepreneurship and (3) having stricter rules in sectors where the risk of underpayment or vulnerable workers is high. That combination of factors works well in Belgium, so it is interesting to investigate whether we can adopt the positive aspects and improve the less good aspects in the Netherlands."

The legislation in Belgium has now also been noticed in Dutch politics. During the debate on labor market policy on April 13, Minister Karien van Gennip explicitly referred to the situation in the South's neighbors, and MPs Smals (VVD) and Palland (CDA) earlier also called attention to it.

And now?

For now, it is not clear what the next step will be from Minister Van Gennip. Last Thursday, Parliamentary questions about enforcement of the DBA law were answered by the minister. Before the summer there will be an outline letter to the Lower House about the elaboration of the labor market package. Finally, there will be a response to the report of the Court of Audit before the ZZP debate on June 30. HeadFirst Group follows the developments closely and stays in close contact with MPs and policy staff.

The full report is available for free download here.

MSP providers in the Netherlands & Belgium, research report 2022

How would MSP players in the Netherlands and Belgium fare? How do they experience the many turbulences in the labor market and the unpredictable economy in (post) corona times? What are the challenges they face and how do they respond to them? Just some questions that NextConomy & ZiPconomy asked in preparation of the 5th research report on MSP providers in the Netherlands and Belgium. These included the HeadFirst Group brands Staffing MS and Sterken.

The report offers a detailed overview of the players in both countries, outlines recent trends and developments in this part of the labor market, and provides the Selector's Guide to help make an informed choice in a potential MSP partner with knowledge and insight. This information is preceded by a robust section on how the definition of an MSP is viewed, how an MSP relates to other services around hiring external talent and how the MSP market is evolving.

Within Europe, both the Netherlands and Belgium are among the early adopters and large users of MSP programs. Nevertheless, there appears to be a substantial difference in the interpretation of the various MSP programs. After all, MSPs are constantly adapting their services and evolving with changing client demands, technological applications and innovations. The report outlines the evolution from an MSP 1.0 to a mature, evolved MSP 4.0 - program. Supplemented by information on MSP consulting companies that support organizations with decision making and the so crucial implementation phase.

The participants

In addition to Staffing MS and Sterksen, 15 more MSP service providers participated in this edition. AgileOne, CXC Global, Hays Talent Solutions, Talent Solution, Brainnet, Randstad Sourceright, Pontoon, De Staffing Group, ProUnity, Solvus, Maandag Managed Services, Het Flexhuis, Flextender, OneStopsourcing and Profile Group. Together, these participating parties represent an estimated 80% of all spend managed by MSPs in the Netherlands and Belgium.

Where to find the report?

Are you looking for inspiration on whether or not to outsource the management of your hired talent to an MSP partner? If so, this unique research report is sure to give you plenty of insights and inspiration to get your bearings and start the conversation well prepared. Download for free on the website of ZiPconomy.

Zzp'ers should not lose sight of cyber risks

More and more people are experiencing data breaches due to cyberattacks, according to the "Data Breach Report 2021" from The Personal Data Authority (AP). The number of reports increased 88 percent in 2021 compared to the previous year.

Earlier, CBS also reported that by 2021, 17% of Dutch people aged 15 and older - nearly 2.5 million people - will have been victims of online crime, CBS reported. Reports of hacking (7%) and purchase fraud (10%) were the most common. People aged 15 to 25 were the most frequent victims of account or device hacking, followed by those aged 25 to 45.

Minimizing risks

For an assignment, highly skilled independent professionals perform many activities online on a computer, laptop or phone. As a result, they are at greater risk of becoming victims of online crime. To prevent sensitive information from falling into the hands of other parties, it is important to minimize the risk of being hacked as much as possible. For example, regularly backing up critical data, running monthly software updates and using two- or multi-factor authentication for access to e-mail and remote access.

Unfortunately, it is not always possible to completely shut out online crime. Fortunately, there is cyber risk insurance for this purpose. This helps in case of a security breach, cyber attack, cyber deception, cyber fraud or hacking. It also covers digital liability and costs such as further damage limitation, restoration of lost data, software, reputation and lost revenue. Thanks to our collaboration with insurance partner Alicia Benefits, we can facilitate the self-employed with such insurance. So they can keep their focus on entrepreneurship and work carefree.

Collective discounts on various insurances, including cyber risks, is one of the benefits of the Select Professionals & Partners services, HeadFirst Group's platform. In addition to the opportunity to acquire challenging assignments through HeadFirst Group, freelancers and suppliers of professionals can use the services for administrative support, accelerated payment of invoices and benefits in the field of personal development, among others, as they wish.

Labor market tightness: take care of your people

In everyday life, we are increasingly affected by labor market shortages. For example, the important Ketheltunnel in the highway from Rotterdam to The Hague was closed for hours, the NS runs fewer trains and classes are sent home because there are no teachers. Marion van Happen, CEO of HeadFirst Group, spoke with Luna van der Waarde, media specialist at ANP Expert Support, about another example: Schiphol Airport. What the airport is doing to keep people in, recruit and what is the thinking from unions and government about flex workers?

Quickly scaling up this type of profile in a tight labor market is a major challenge. In this situation, organizations sometimes forget to take good care of the people who are already working for you, to keep them close and can use them to train new colleagues. Despite this, better benefits and employer branding, among other things, are particularly used in recruitment. My advice: put retention first and recruitment second.

Flexibility & freedom of choice

The current image is that "fixed" is safe and "flex" is pathetic. While a flexible shell actually helps organizations to organize their business operations to the maximum. My message is therefore: let entrepreneurs do business freely. We cannot ignore the large group of self-employed people who consciously choose to do business in freedom, have a strong negotiating position and are very satisfied with their working conditions. If the new administration focuses on appropriate measures for occupations with lower hourly rates, we can successfully move toward clarity for all self-employed workers and their clients.

Listen to the full episode here.

About ExpertCast

ExpertCast, ANP Business' podcast, offers in-depth coverage of the news, by experts from various knowledge organizations. Each episode starts with a news item from ANP followed by an interview with an expert on that issue.

Scarce labor market forces organizations to be creative

NS currently has about 1,100 job openings. For on the train, but also for IT or in the office. One reason: tightness in the labor market. Not only is permanent staff scarce, but the limits for the flexible labor market have been reached. The number of offers on assignments for highly skilled work has plummeted and secondment agencies are selling out.

To recruit, engage and retain talent in this day and age, it is necessary for organizations to pull out all the stops. It forces them to look at the entire workforce in an integral way. The form of contract is less relevant; bringing in the right talent comes first. Weak employer branding is currently compensated by organizations by hiring hordes of recruiters. While the answer lies in data-driven recruitment methods and approaching alternative target groups, such as talent abroad or with a distance to the labor market.

Anyone who temporarily needs someone to test an application can be helped out very well by hiring a professional with autism externally. To this end, for example, we have collaborations with secondment agencies specializing in assisting autistic people with their work. We see it as our social responsibility as an HR service provider to create an inclusive and equal environment for professionals.

Self-employed need to invest more in continuing education

For several months now, working people have been able to take advantage of a STAP subsidy. Budget - up to € 1,000 per year - to follow a training, education or course. A very desirable development, according to the high demand. Both the first and second tranches were sold out in no time. Being able to decide on one's own career development is important because jobs are disappearing, processes are being automated and digitized. As a result, the skills required are changing rapidly.

It requires employed people to continuously invest in the targeted development of knowledge and skills in order to continuously add value to a work or client. However, self-employed workers who consciously choose entrepreneurship spend significantly fewer hours on training and development - compared to permanent employees.

Developing 'on the job'

Highly skilled self-employed workers are intrinsically motivated to develop themselves, but base this primarily on existing professional knowledge and experience. They have extensive work experience that they apply to clients' projects. Development 'on the job' is what they do every day, that is where the basis is formed, but supplementing knowledge with education and training is necessary.

That is why we facilitate personal development and continuous learning for the self-employed with our training platform Select Academy. Of course, the entrepreneur remains in charge - he or she became an entrepreneur for a reason - but we consider it our duty to make continuous learning as attractive as possible in order to steer professionals forward to their next dream role.

About Select Academy

The training environment, realized by HeadFirst Group in exclusive cooperation with the continuous learning platform MyCademy, offers professional training from 'world leading' providers in the fields of IT, management and finance, among others. Professionals can at any time, unlimited online training, virtual labs and knowledge sessions. The Select Academy subscription is one of the benefits of the Select Professionals & Partners services, HeadFirst Group's platform.

In addition to the opportunity to acquire challenging assignments through HeadFirst Group, zp'ers and suppliers of professionals can take advantage of services such as administrative support, accelerated payment of invoices, group discounts on various insurances and benefits in the area of personal development as they wish.

HeadFirst Group supports The Work Association

As of May 2022, HeadFirst Group has joined The Work Association as a mini associate. The parties find each other in the search for a labor market where flexibility and self-employment go hand in hand with collective security, solidarity and protection for the individual who needs it.

Interests within the labor market debate

More and more people want control over their own working lives. The current organization of the labor market and the conservative rules in labor law do not sufficiently address this and do not offer flexibility. The labor market debate has been deadlocked for years, and as yet there is little clarity on important dossiers within this debate, such as the replacement of the DBA law and compulsory disability insurance for the self-employed. The Werkvereniging wants to change this, we support them in pushing for renewal and modernization.

Our contribution to the labor market debate

As the largest HR service provider, we feel it is our responsibility, in cooperation with industry associations and interest groups, to enter into discussions with politicians and policymakers and provide them with alternative ideas and proposals. We are happy to share the knowledge, experience and expertise we have about the flexible labor market with The Work Association, so that together we can strive for a rational and factual political-social debate about the labor market and the role of the self-employed in this labor market.

As a supporter of The Work Association, we stand up for your interests. If you would rather have your own voice heard, become a member of The Work Association for one year free of charge. You can then attend lectures and information meetings and you increase the chance of The Work Association getting a seat on the SER. You can register via this link.

About The Work Association

The Work Association is an interest platform for all working people with a new vision of the labor market. It is actively committed to a fundamental reform of the labor market and the social system. The goal is for all working people to be assured of the same basis of security that moves with their lives, their work and the choices they make therein. This requires a social system in which securities are linked to people rather than to their formal relationship to the labor market.

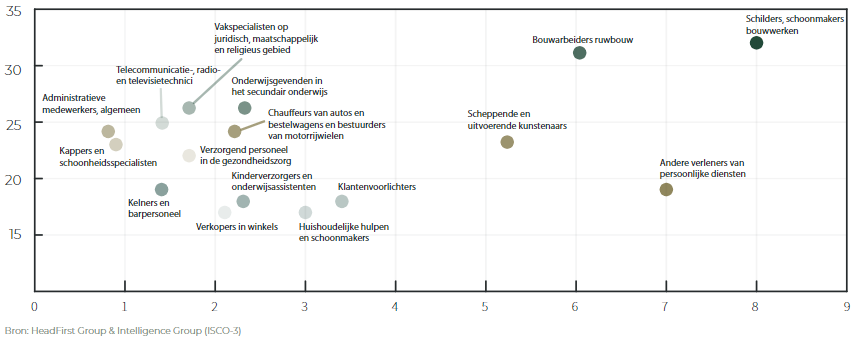

Only tens of thousands of 1.2 million self-employed work for hourly rate below 20 euros

Zzp'ers working as store salesmen, childcare workers, teaching assistants, waiters or bartenders work in the Netherlands on average at the lowest hourly rates. They also have a relatively low scarcity indication, which predicts that the prospect of rate increases is limited. On the other hand, relatively few self-employed workers are active in these occupational groups, compared to the total of nearly 1.2 million. These insights were published in the Talent Monitor by HR service provider HeadFirst Group and labor market data specialist Intelligence Group.

Focus on labor market base

Enforcement of the DBA law recently received attention due to a report by the Court of Audit. The conclusion: the tax authorities are unable to combat false self-employment effectively. Marion van Happen, CEO HeadFirst Group: "The most acute problems with false self-employment occur at the base of the labor market, where hourly rates are low. We therefore look with interest at the MLT advice of the SER, which proposes to apply a 'legal presumption of employment' at a rate below the maximum daily wage (30,- to 35,- euros per hour)."

The Talent Monitor zooms in on this group of self-employed workers. It shows that painters and cleaners of construction works and construction workers of structural work have an average hourly rate of €30 or higher and are very scarce. They therefore have a rosy financial perspective in the labor market. Creative and performing artists are also scarce, although their average hourly rate is much lower at €23. Occupations that have a harder time include waiters and bar staff, domestic helpers and cleaners, childcare and teaching assistants and salespeople in stores. They work for an average hourly rate of €20 or less and the scarcity indicator is low. Relatively few self-employed workers are active in these occupational groups, totaling only a few tens of thousands. Hairdressers are an exception: we have more than 25,000 freelance hairdressers in the Netherlands, albeit working at an average hourly rate of €23.

Let entrepreneurs do business freely

In addition, the report shows that self-employed professionals with an hourly rate of €70 or higher are overrepresented in professional groups such as software and application developers and analysts, lawyers and doctors. Specialists in sports & fitness and traditional & alternative medicine are largely found in the €35 to €70 rate group. All are (very) scarce professions, which is generally reflected in rising rates.

Van Happen: "More than half of all self-employed people in the Netherlands have an hourly rate of €35 or higher. This large group of self-employed people who consciously choose to do business in freedom, have a strong negotiating position and are very satisfied with their working conditions should not be ignored. If the new cabinet focuses on appropriate measures for occupations with lower hourly rates, we can successfully move toward clarity for all self-employed workers and their clients."

The Talent Monitor "Zzp'ers: protect or set free?" is available for free download here.

Talent Monitor: Zzp'ers: protect or set free?

Talent Monitor: Zzp'ers: protect or set free?

We believe that exploitation in the labor market must be countered with appropriate measures, while at the same time not ignoring the large group of self-employed people who consciously choose to do business in complete freedom and have control over their own work. With the insights in this report, we hope to make a new contribution to this.

Only tens of thousands of 1.2 million self-employed work for hourly rate below 20 euros

Zzp'ers working as store assistants, childcare workers, teaching assistants, waiters or bartenders work on average at the lowest hourly rates in the Netherlands. They also have a relatively low scarcity indication, which predicts that the prospect of rate increases is limited. On the other hand, relatively few self-employed workers are active in these occupational groups, compared to the total of nearly 1.2 million. These insights were published in the Talent Monitor by HR service provider HeadFirst Group and labor market data specialist Intelligence Group.

Main observations

- Self-employed people with an hourly rate of €35 or lower work mainly as domestic help and cleaners, waiters and bar staff or childcare and teaching assistants.

- In particular, the occupational groups of child care and teaching assistants and domestic helpers and cleaners seem to be the needy target groups based on the hourly rate and the prospect of rate increases.

- Specialists in the field of sports and fitness and authors, journalists and linguists can largely be found in the €36 to €70 rate group.

- Zzp'ers with an hourly rate of €70 or higher are overrepresented in professional groups such as lawyers, software and application developers and analysts, and doctors.

- At 28%, self-employed persons with an hourly rate of €35 or lower are slightly more actively looking for a (new) assignment than self-employed persons in the other two rate groups. The part that is not actively looking, but is keeping an eye on the market, at 49%, is actually smaller than the other two rate groups.

- Zzpp'ers with a lower hourly rate are more willing to go into paid employment (again) (18%). For self-employed people with an hourly rate of €70 or higher, that percentage is slightly lower, at 16%. For self-employed people with an hourly rate between €36 and €70, it stalls at 11%.

- Zzp'ers with an hourly rate of €70 or higher are approached most often by clients and intermediary agencies. Their sourcing pressure, the percentage who are approached at least once per quarter, is 67%. For freelancers with an hourly rate of €35 or lower, it is 63% and for freelancers with an intermediate hourly rate 61%.

- Zzpp'ers with an hourly rate of €35 or lower are less willing to travel far for an assignment. Half of the self-employed with an hourly rate of €70 or higher are willing to travel longer than an hour, compared with 37% of self-employed with an hourly rate of €35 or lower.

Partner

Download Talent Monitor

Previous editions

Nothing found.