Flex & politics in 2023: The year of deliberation and (un)clarity

The Netherlands currently has more than 1.6 million zzp'ers. It is the fastest growing group of workers in the Dutch labor market, accounting for over 17% of the Dutch working population. Driven by scarcity in the labor market, the call - from the younger generation in particular - for freedom and flexibility, and supported by platform technology, this development only seems to be accelerating. The proposed plans of Karien van Gennip, Minister of Social Affairs and Employment, seem diametrically opposed to this. How will they affect the (flexible) labor market in 2023? Sem Overduin, Public Affairs Officer HeadFirst Group, ventured a prediction at ZiPconomy.

"Until March 15, people in political The Hague will be busy with the Provincial Council elections. Logically, this will be an important moment for the mutual balance of power in The Hague. The CDA that may be decimated and a coalition that has even fewer seats in the Senate? This will have serious consequences for the strength of the current cabinet.

Regardless of the election results, the December 16, 2022 House of Representatives letter created movement. In 2023, there will be a lot of negotiation and debate about how all these plans will be worked out. Bovib needs to be at the right tables to provide input.

Clients will be scratching their heads and wondering what is and especially what is not allowed with regard to hiring self-employed workers. Our members will therefore receive many questions. The Bovib must constantly make the translation between the reality in The Hague and the reality on the work floor. An opportunity for the intermediary branch to develop further and act as a professional interlocutor towards The Hague and our clients."

Are you already familiar with the 3 tracks to restore balance in the current labor market? What do the developments surrounding the zzp dossier mean for you as a client? During the Webinar Week - an initiative of Werf& and ZiPconomy - Business Development Director Paul Oldenburg and Public Affairs Officer Sem Overduin will give a behind-the-scenes look at the House of Representatives and offer insight into what opportunities this leaves for your organization to work successfully and compliantly with freelancers. Sign up here to listen in on Tuesday, February 7 at 11:15 am.

Talent Monitor: Rate development professionals 2023

Rate development professionals 2023

In this edition of the Talent Monitor, we look back at developments in 2022 and express expectations for 2023.

Rate hike of four to six percent for self-employed and seconded workers in 2023

The hourly rates of flexible workers, self-employed and professionals employed by secondment agencies, rose an average of 3.8 percent in 2022. This is a lot less hard than predicted, under pressure from scarcity and inflation. This emerges from analysis by labor market data specialist Intelligence Group and HR-tech service provider HeadFirst Group. In 2023, they expect an average rate increase of four to six percent.

Key findings

- In the past year, 127,000 new zzp'ers entered the market. This makes them the fastest growing group of workers in the Dutch labor market, now accounting for over 10% of the Dutch labor force.

- Figures from Intelligence Group show that only 10.5% of highly educated self-employed people want to return to paid employment. In early 2021, this was still 17%.

- In 2023, the supply of professionals increases, in part because of the huge growth of highly skilled self-employed (independent professionals). Although the supply of active job seekers is still particularly low, the number of offers on assignments is expected to increase slightly, and the banks of secondments in early 2023 - in professional groups such as IT and marketing - will be slightly more filled than a year ago.

- Data from HeadFirst Group shows that the rates of professionals who started a new assignment in 2022 increased by an average of 3.8% compared to 2021. If extended agreements are also included in the average rate, the average rate increase is a small percentage point lower at 3.1%. This decrease is because renewals tend to go at the same rate, while new contracts go at a higher rate.

- The highest rate increase was seen in the first quarter of the year. In subsequent quarters, the increase was less, while scarcity and inflation continued to increase.

- If we assume the expected increase in collective bargaining agreements in 2023, the hourly rates of independent professionals will rise on average between 4 and 6% in 2023. The agreed wage increases for permanent staff and rate increases for independent professionals will not differ much from each other.

- Hourly rates follow and keep pace with collective bargaining developments. The annual average for 2022 now stands at 3.6%, although wage agreements accelerated to 6.4% in November 2022.

- Detachers will, if contracts and SLAs allow, raise rates slightly more to reflect current inflation.

- Clients do not take rigorous steps to widely index rates of professionals on current assignments. They take a performance-based approach: professionals whose rates are in line with performance are not indexed much, if at all, in the interim. Professionals with good performance and an hourly rate below the market average do get indexed - or at least sooner.

Partner

Download Talent Monitor

By downloading the Talent Monitor, you agree that your data will be shared with co-initiator Intelligence Group.

Other reports...

Nothing found.

Cabinet, consider all workers in the labor market

On Friday, Dec. 16, Minister Van Gennip (SZW) and State Secretary Van Rij (Taxation and Customs Administration) presented the "Progress Letter on Working with and as Self-Employed(s)" to the Lower House. Numerous topics are discussed in the letter, such as a legal presumption of employment below a certain hourly rate, the enforcement moratorium of the DBA law and the clarification of the authority criterion. Much remains to be worked out in the coming period, but in response to the proposed plans for the zzp dossier, I am happy to respond.

Recognition of self-employment

In the first pages of the letter, the importance of self-employment for the Dutch labor market is highlighted. I am pleased that the Cabinet recognizes the position and added value of the self-employed. With their knowledge and expertise, self-employed people make an important contribution to solving problems at numerous organizations. It is impossible to imagine our labor market without the self-employed IT professional or project manager. Time and again, research shows that the majority of the self-employed population is very satisfied with their working conditions, salary and sense of autonomy. This is a development we should cherish.

The search for the right balance of elements

At the same time, I am critical of some plans. For example, the cabinet plans to clarify the authority criterion by more explicitly embedding the criterion of 'embedding in the organization' when assessing the employment relationship. In an earlier column, I hinted that the clarification of the authority criterion remains a hot topic of discussion. I remain of the opinion that it becomes very complex to clearly define embeddedness in the organization. When is a worker "embedded in the organization"? And what tasks belong to "the regular work of an organization"? This discussion has been had before and was not settled at the time. Many freelancers work in IT, HR or project management and are more or less embedded in the organization. Will this soon no longer be possible? It is undoubtedly going to cause unrest among clients, intermediaries and zzp'ers. Given the shortage of - and at the same time the high demand for - specialist personnel, this unrest seems highly undesirable to me. What we need right now are rules that encourage and facilitate mobility in the labor market and self-employment. I therefore remain strongly in favor of a pluralistic labor market with different forms of contracts. A labor market where people are given the space to organize their work themselves. I am convinced that this will have a positive effect on the productivity and job happiness of workers and will result in a more innovative and better functioning labor market.

Another element that will receive more attention in determining the employment relationship is the self-employment of the worker. I read in the parliamentary letter that embedding in the organization does not necessarily mean an employment contract. That the government is seeking balance in determining the employment relationship is positive to me. In my opinion, we need to look not only at the task being performed, but also at the individual. Clear entrepreneurial criteria, such as the amount of the rate and specialized knowledge are pre-eminent criteria to include in the assessment of the employment relationship. By assessing the correct facts and circumstances, the distinction between employee and self-employed will automatically become clearer. Clear entrepreneurial criteria will also help the Inland Revenue to enforce effectively.

Opportunities for the intermediary industry

In the coming months the plans will be further elaborated in consultation with stakeholders, experts and social partners. I am pleased with the outstretched hand of the cabinet to take this up together with market parties. A strong coalition of industry associations (ABU, NBBU, I-ZO, VvDN, RIM and Bovib) seems to me to be a pleasant and expert discussion partner for the Cabinet, the Tax Administration and policy makers. By bringing daily practice to The Hague, clear and verifiable entrepreneurial criteria can be drawn up. The members of these industry associations are pre-eminently the specialists when it comes to organizing external hiring and contracting of zzp'ers. Therefore, use their knowledge and expertise!

There is also a great opportunity for intermediaries. The changes that lie ahead offer the opportunity to further professionalize the relationship with contractors, suppliers and clients. By advising and supporting both the supply and demand sides of the labor market in complying with changing laws and regulations. By helping them draft or further develop their hiring policies. At HeadFirst Group, we are aware of the challenges ahead. At the same time, this makes us indispensable in a dynamic, multiform and rapidly changing labor market. New rules force us to adapt. The trick is to successfully bring our relations along with us.

'Progress letter on working with and as self-employed(s)' - three outlines explained

Karien van Gennip, Minister of Social Affairs and Employment, released on December 16, 2022 the 'Progress letter working with and as self-employed(s).' shared with the House of Representatives. The letter builds on the outline letter labor market of July 5, 2022. The minister sets out all plans along three lines: a more level playing field, clarification of the assessment of employment relationships, and improvement of enforcement on false self-employment.

The labor market is in need of maintenance. The group of self-employed workers has grown in recent years and this growth is expected to continue. The government signals that this leads to limited protection against disability, less control over working conditions and inadequate supplementary pensions. Especially among vulnerable self-employed people. In addition, there is much uncertainty about the applicable rules. Therefore, the government wants to address the problem with measures along three lines:

- A more level playing field - Targets all forms of contract with respect to social security and taxation. To achieve this, the self-employed deduction will be accelerated, from €6,310 in 2022 to €900 in 2027. In addition, the minister proposes to phase out the fiscal old-age reserve (FOR). The fiscal reserve does not provide the certainty of actually enjoying one's retirement income. Phasing out also prevents the use of the FOR for tax deferral and forces the self-employed to place real old-age provisions outside their company. If it is up to the cabinet, there will also be mandatory disability insurance (AOV) for the self-employed. More information on this will follow in the first quarter of 2023.

- Clarifying the assessment of employment relationships - The clarification of the assessment should make it easier to agree on the correct legal form of an employment relationship right from the start. The Cabinet therefore wants to give substance to the open norm of "working in the service of" (Art. 7:610 BW). The emphasis is on the classic elements of subordination, such as giving instructions and supervising. The Cabinet adds that 'working in the service of' is also at issue if the work is organizationally embedded in the employer's company. In addition, whether there is self-employment becomes important. The element of self-employment may be an important contraindication to the existence of an employment contract. These three main elements and their interrelationships will be further elaborated in the coming period.Furthermore, a rebuttable legal presumption of an employment contract must be established to support the bargaining position of employed persons. The civil law presumption of employment will be based on an hourly rate to be determined. It will be up to the worker to prove that there is no employment contract. If the worker and employer cannot agree, the worker can go to court. Also, the web module labor relations assessment will be further developed to comply with the new laws and regulations.

- Improve enforcement on false self-employment - On January 1, 2025 at the latest, the enforcement moratorium must be lifted. The Cabinet considers enforcement necessary for a future-proof labor market and a sustainable tax and social security system. The central premise of the Tax and Customs Administration's strategy will be that citizens and businesses "comply with rules of their own accord as much as possible, without compelling and costly actions on the part of the Tax and Customs Administration." In this regard, the Tax Administration considers good cooperation between the market and the Service to be of great importance. An important part of the new approach is the streamlining of internal and external communication regarding enforcement. In addition, the possibility of organizing preliminary consultations at branch level is being explored, so that the situation becomes workable for the branches and the Service.

Details will be worked out in the coming months. In doing so, there will be room for the social partners and the market to contribute ideas. The plan is to schedule a debate on this parliamentary letter in the first quarter of 2023. Then a draft bill will be presented to the market through an Internet consultation. After the summer, the minister plans to send it to the Council of State so that the final proposal can be presented to the House in early 2024. The aim is to publish the legislation by January 1, 2025. This fits well with the lifting of the enforcement moratorium on the same date.

Self-employed must remain flexible with mandatory disability insurance

Wednesday, Dec. 7, during the Committee on Disability debate, mandatory disability insurance (AOV) was discussed. Plans that only a third of the highly educated self-employed support. However, almost half are in favor if self-insurance is allowed as an alternative. HeadFirst Group supports the principle of an AOV for all self-employed, but choice is a crucial success factor.

AOV with proper choices important

By Jan. 1, 2025, there must be a law for self-employed persons to be compulsorily insured against disability. A simple AOV can be implemented by 2027, more customization means postponement to 2029. Minister Karien van Gennip of Social Affairs and Employment is investigating customization in the form of an opt-out scheme.

Mandatory AOV is significant to protect vulnerable self-employed workers and provide security. At the same time, we must keep an eye on the diversity of the self-employed population with different assignments, starting motives and hourly rates. The option for self-insurance, at least equal in content to the public AOV, can count on support because it fits well with the different wishes and needs of this group of workers.y

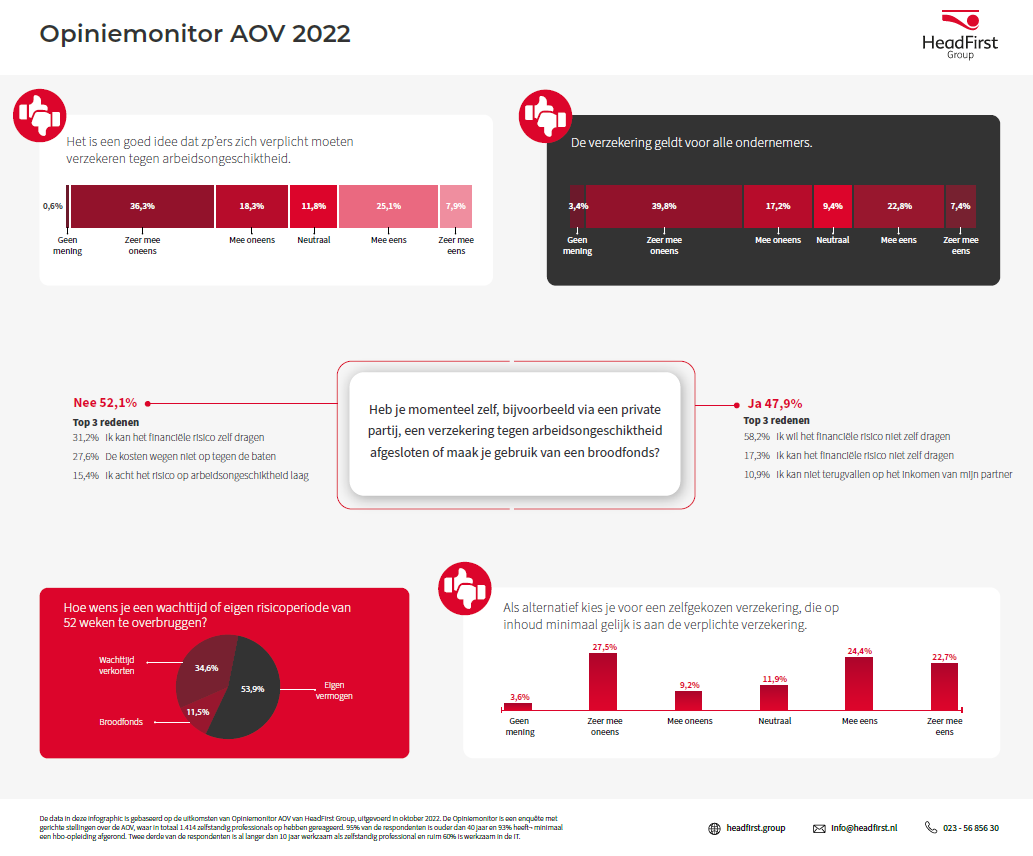

Half of self-employed people have nothing arranged yet

Currently, just under half of self-employed people have covered the risks of occupational disability themselves - for example, through a private party or a mutual fund. The most important reasons for highly educated self-employed workers to take out insurance is that they are unwilling (58 percent) or unable (17 percent) to bear the financial risk themselves. Another 11 percent cannot fall back on their partner's income.

Of the self-employed who have not taken out disability insurance, 31 percent say they can bear the financial risk. Furthermore, over a quarter feel the costs do not outweigh the benefits and 15 percent consider the risk of disability low.

For self-employed people who have not yet arranged anything if they become disabled, HeadFirst Group has a low-threshold provision: Select iCommunity Crowdsurance (SiCC). This is a provision based on a donation circle. This also matches the desire of self-employed workers to bridge the 52-week own risk period with a bread fund - desired by 12 percent of research participants - or to shorten the waiting period (35 percent).

Documents:

InfographicOpinionMonitorAOV2022.pdf

Note to editors:

The results of the 'AOV Opinion Monitor 2022' have been compiled in an infographic, which is attached. For more information, contact Natasja Spooren, Teamlead Communications at HeadFirst Group, reachable on 06 - 151 924 85 or natasja.spooren-wassenaar@headfirst.nl.

Self-employed want flexibility in mandatory disability insurance

A third of highly educated self-employed support plans for mandatory disability insurance (AOV). However, almost half are in favor if self-insurance is allowed as an alternative. So says research by HR-tech service provider HeadFirst Group among more than 1,400 participants. CEO Marion van Happen shares the opinion about this opt-out: "We support the principle of an AOV for all self-employed people, but choices are a crucial success factor in this."

Opt-out scheme

By January 1, 2025, there should be a law to make it mandatory for self-employed workers to have insurance against disability. With the aim of preventing large income risks for individuals and countering unfair competition on working conditions. The rules and conditions of the intended law were recently discussed again during the Labor Market Policy Committee debate. In it it was announced that a simple AOV can be implemented by 2027, more customization means postponement to 2029. Minister Karien van Gennip of Social Affairs and Employment is investigating customization in the form of an opt-out arrangement.

Van Happen - along with the SER - stresses the importance of introducing an AOV with the right choices. "Mandatory disability insurance is important to protect vulnerable self-employed people and offer security. At the same time, we must keep in mind the diversity of the self-employed population with different assignments, starting motives and hourly rates. The option for self-pay insurance, which is at least equal in content to the public AOV, can count on support because it fits well with the different wishes and needs of this group of workers," Van Happen said.

Half of self-employed have nothing arranged

Last year HeadFirst Group also surveyed the opinion of self-employed people in the field of AOV. The results are virtually unchanged. Currently just under half of the self-employed have covered the risks of disability themselves - for example through a private party or a mutual fund. The most important reasons for highly educated self-employed workers to take out insurance is that they are unwilling (58 percent) or unable (17 percent) to bear the financial risk themselves. Another 11 percent cannot fall back on their partner's income. Of the self-employed who have not taken out disability insurance, 31 percent say they can bear the financial risk. Furthermore, over a quarter feel the costs do not outweigh the benefits and 15 percent consider the risk of disability low.

For self-employed people who have not yet made any arrangements should they become disabled, HeadFirst Group offers a low-threshold provision: Select iCommunity Crowdsurance (SiCC). This is an endowment-based provision. It is a net benefit for up to two years. In line with the need for an affordable, flexible solution that does not pay out until retirement age, but for a framed period. This provision also matches the desire of self-employed workers to bridge the 52-week self-risk period with a bread fund - desired by 12 percent of research participants - or to shorten the waiting period (35 percent).

Check out the survey results in this infographic.

HeadFirst Group acquires successful IT talent sourcer StarApple

HR technology service provider HeadFirst Group Adds StarApple Group, consisting of the brands StarApple and StackOps, to its organization. Both companies are specialized in sourcing IT and digital specialists. HeadFirst Group thus takes another step in deepening its portfolio of solutions for labor market issues in the professionals segment: the current high-tech solutions of HeadFirst Group are enriched with the services with a great human touch of StarApple Group.

StarApple Group, is an ambitious and young organization, founded in 2008 and has since grown into a successful IT talent sourcer. StarApple Group has already successfully connected more than 10,000 specialists to a variety of organizations. Caner Hamamioglu, General Director at StarApple Group: "Growing talent is our mission. We do this by carefully connecting professionals from our network to assignments, where professionals not only do what they have done before with other clients, but are also challenged to take a step forward in their development. Design your career, we call that. With the cooperation with HeadFirst Group we can do this on an even larger scale and we are looking forward to that enormously."

Responding to dynamic market

HeadFirst Group foresees that combining various services is necessary to continue to solve all the issues of clients in today's dynamic labor market. Marion van Happen, CEO at HeadFirst Group: "The scarcity in the labor market will not disappear in the coming years. This requires creativity in opening up the market. We believe that combining high-tech solutions with services with a great human touch is the key to customer success. For us, those customers are both clients - whom we continuously provide with mission critical talent - and professionals, whom we actively help from assignment to assignment with the most attractive clients."

StarApple Group remains independent

StarApple will become an independent brand within HeadFirst Group, maintaining its own identity. The current management will continue to lead the organization in its growth strategy into the future. Hamamioglu: "HeadFirst Group will be the driving force behind StarApple. With our enthusiastic team of over eighty colleagues, we will continue to offer a full service recruitment solution for our clients and professionals. And we get access to the group's platform, which gives us extra power to realize our growth ambitions."

Authority criterion remains a hot topic in labor market file

The Labor Market Policy Committee debate took place last Thursday. The Parliamentary Committee on Social Affairs and Employment spoke with Minister Van Gennip (SZW) about the announced plans to reform the labor market. In the debate, she indicated that she was committed to clarifying the authority criterion to determine whether an employee or self-employed person is involved. That the Cabinet recognizes this and is working toward replacing it is crucial.

Embedding in the organization

The Borstlap Commission proposes to modernize the authority criterion by making "embeddedness in the organization" more central to the assessment of the employment relationship. I am not in favor of giving this criterion more weight, because there is already enough debate about the interpretation of when authority exists. When is a worker "embedded in the organization"? And what tasks are part of "the regular work of an organization"?

In practice, we see just the opposite happening. Hybrid teams with different specialists working on a project basis on solutions and issues of importance to the organization at that time. These are often teams where there are different forms of contracts. The results of the recently published CBS survey support this picture: employers consider the "type of contract" much less important than previously thought. Factors such as knowledge, expertise and work experience are much more important. Will this soon no longer be possible if we deal too rigidly with authority and embedding in the organization?

Great diversity zzp population

In addition, I question the modernization of one general authority criterion. After all, in the Netherlands we are dealing with a very diverse self-employed population. This group of workers has diverse assignments, works for different hourly rates and the duration of assignments is also very different. One authority criterion for this entire target group will therefore not work. We need more customization.

What next?

Currently, the minister is working with the social partners to further develop the proposals. She aims to have the next letters ready before Christmas so that they can be shared with the House of Representatives in January. These letters will clarify how the minister intends to further clarify the authority criterion and form the basis for the debate in February 2023, after which the bills can be shared with the market through an Internet consultation in the summer of 2023.

All in all, it is clear that all parties feel the urgency to tackle false self-employment quickly and keep up the pace. As the largest HR-tech service provider, we will of course remain in dialogue with our stakeholders in The Hague and will act together with our partners.

Note to editors:

For more information: Natasja Spooren, PR & Content Specialist at HeadFirst Group, reachable at 06 - 151 924 85 or natasja.spooren-wassenaar@headfirst.nl.

What will be Minister Van Gennip's next move?

Tomorrow afternoon the Labor Market Policy Committee debate is scheduled. On the parliamentary agenda are a number of important topics, such as the report of the Borstlap Commission and the Labor Market Outline Letter of July 5. Ahead of the debate, Marion van Happen is happy to share her views on the current proposals on the table in political The Hague.

First of all, I would like to emphasize that I am positive about the first outline letter from the Minister of Social Affairs and Employment. The three tracks mentioned - the level playing field, regulatory clarification and improving enforcement - are the right knobs to turn. If seen and dealt with in conjunction, I see the contents of this letter as a step in the right direction.

Established criteria supplemented by sectoral approach

I welcome the attention given to the Belgian Labor Relations Act in the outline letter. The thinking and underlying principles offer an opportunity to replace the DBA law. The Labor Relations Act establishes clear legal criteria for determining whether one is an employee or a self-employed person. Criteria have also been established at the sectoral level for sectors and professions where the likelihood of underpayment or vulnerable entrepreneurship is greatest. This approach increases the effectiveness of enforcement and does more justice to the diversity of self-employed workers.

What also makes enforcement more effective and targeted is the SER's MLT recommendation to introduce a legal presumption of employment below the hourly rate of €35. The SER's proposal thus distinguishes between vulnerable self-employed people and self-reliant self-employed people. This allows the tax authorities to focus on the sectors and professions where self-employed workers are hired under this rate. Clear and legally defined criteria plus a sectoral approach are a good starting point as far as I am concerned.

Embedding in the organization

Then I'll jump to the authority criterion, surely a hot topic in this dossier. In my opinion, this is the crux of the discussion: when can an organization hire a self-employed person for a particular job and when is it an employee? For various reasons, the DBA law has failed to provide this clarity. That the Cabinet recognizes this and is working toward replacing it is crucial.

The Borstlap Commission proposes to modernize the authority criterion by making "embeddedness in the organization" more central to the assessment of the employment relationship. I am not in favor of giving this criterion more weight, because there is already enough debate over the interpretation of when authority exists. When is a worker "embedded in the organization"? And what tasks belong to "the regular work of an organization"? In practice, I see just the opposite happening. Hybrid teams with different specialists working on a project basis on solutions and issues of importance to the organization at that time. These are often teams where there are different forms of contracts. The results of the recently published CBS survey support this picture: employers consider the "type of contract" much less important than previously thought. Factors such as knowledge, expertise and work experience are much more important. Will this soon no longer be possible if we deal too rigidly with authority and embedding in the organization?

Great diversity zzp population

In addition, I question the modernization of one general authority criterion. After all, in the Netherlands we are dealing with a very diverse self-employed population. This group of workers has diverse assignments, works for different hourly rates and the duration of assignments is also very different. One authority criterion for this entire target group will therefore not work in my view. We need more customization.

The web module, in its current form, also does not sufficiently take this diversity into account. It only tests for the aspects of being an employee and does not sufficiently take into account aspects of being self-employed. As a result, the arrow can only move in one direction and that is the direction of "indication of employment.

In the recent budget of the Ministry of Social Affairs and Employment, I read back that the web module is being further developed to provide clarity on the nature of the employment relationship. To make the web module somewhat operational and reliable, I recommend that the questions and assessment also take self-employment into account. This will result in more balance in the answers.

Clear rules first, then enforcement

With regard to enforcement, I read back that enforcement will resume on January 1, 2025. I agree that enforcement needs to be started. The way in which and how this will be rolled out, I still see some bumps in the road. The coalition of industry associations states in their joint letter - quite rightly, by the way - that enforcement will only be effective if the ground rules and criteria are clearly established at the front. For all parties involved - the Tax Office, intermediaries, principals and zzp'ers - this must be clear. My appeal to The Hague is therefore: take the outstretched hand of the industry associations and enter into discussions with implementing organizations about enforceable criteria. Let us as intermediaries be an extension of the implementers. We are pre-eminently the parties in the labor market with knowledge and expertise.

In the coming months we will keep a finger on the pulse and remain involved in relevant developments. At the end of this year I expect more clarity about the next step with the second outline letter and a progress letter 'Working on a self-employed basis'. As the largest HR-tech service provider, we will of course remain in dialogue with our stakeholders in The Hague and will pull together with our partners.

Talent Monitor: IT labor market in figures

Talent Monitor: IT labor market in figures

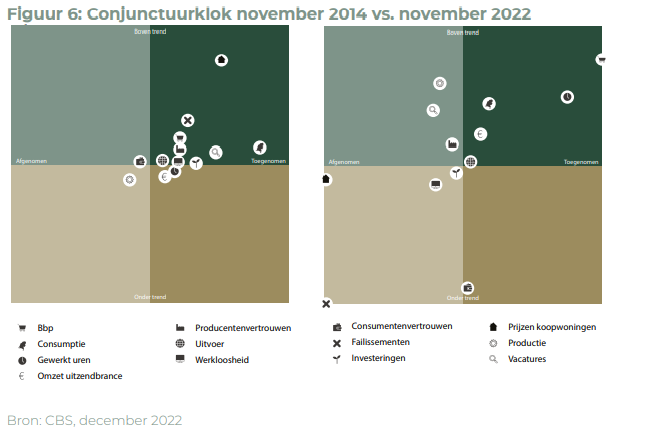

The labor shortage in the Netherlands is now present in all occupational groups, according to the UWV. Figures for the second quarter of 2022 show that with a tension indicator - number of open vacancies divided by the number of people receiving unemployment benefits for less than six months - the occupational group IT is classified as the most tight of sixteen groups. Therefore extremely interesting to further scrutinize in this Talent Monitor.

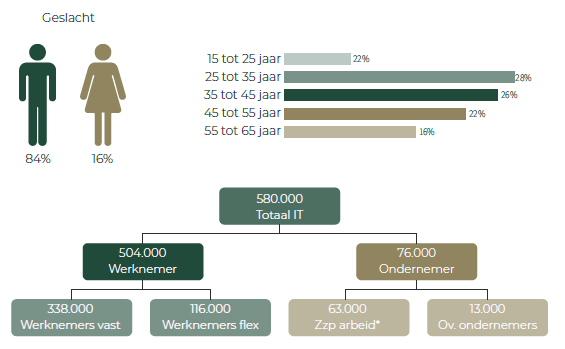

By 2030: 1 in 10 in Dutch labor market IT professional

Currently, one in seventeen people in the Dutch labor market is an IT professional. In ten years, this has nearly doubled. At the current growth rate of almost seven percent per year, by 2030 one in ten of the Dutch labor force will be an IT professional. That said, the battle for salaried and temporary IT professionals, self-employed and employed by secondment companies, is in full swing. At nearly 65%, the sourcing pressure is unprecedentedly high, especially given the 37.6% average for the entire labor force.

Key findings

- No surprise: IT workers are extremely scarce. Demand is increasing, but supply is also rising 6.9% year on year. In the past decade, the number of IT workers has almost doubled, and by 2030 there will be over 1 million of them in the Netherlands. By then, one in ten people in the labor market will be IT professionals.

- There remains a continued growing demand for IT professionals, both employed and self-employed. The latter group is growing more slowly and is more dependent on cyclical fluctuations.

- There is increasing competition among clients who more often use labor market communications to be attractive, resulting in some having offers and others having none. The latter can certainly be called a trend. The tightness in the self-employed market means that clients are investing more in "selling" their assignments.

- The number of active job seekers is very low. The battle for the latent job and assignment seeker takes place primarily on LinkedIn, networks, platforms and the company's own VMS/ATS systems. While salaried IT professionals are increasingly being hounded - nearly two in three are approached at least once a quarter - it is notable that active sourcing of IT professionals seems to be on its way out slightly. This may run parallel to slightly fewer assignments on the market, and we don't want to call it a trend either, since it is by far the most important sourcing channel, of both permanent and flex.

- One in five IT professionals manages to remain structurally under the radar. This is quite apart from the group that is found and approached but does not respond. The right to privacy and the right to be unreachable is certainly a trend - whether or not soon supported by legislation in the Netherlands - that IT professionals are leading the way in the job market.

- In terms of working conditions and pull factors, IT professionals have already seen many of their needs met. That is increasingly a hygiene factor. Selling the job, the assignment and the work, that's the emphasis. What am I going to do? With whom? For whom? And why? Three sentences won't get you there as an employer.

Partner

Download Talent Monitor

By downloading the Talent Monitor, you agree that your data will be shared with co-initiator Intelligence Group.

Other reports...

Nothing found.