The job market is normalizing. "But sitting still is not an option."

The job market is normalizing. "But sitting still is not an option."

In the podcast ZiPtalk, we spoke with Simone Groeneveld (HeadFirst Group) and Geert-Jan Waasdorp (Intelligence Group) about what insights data can provide to achieve a more integrated talent acquisition strategy.

The tightness around the labor market is easing slightly, the growth in the number of self-employed workers is declining, the number of responses to assignments is rising slightly again, and rates of interim workers are rising less rapidly than wages.

These are relevant and interesting figures, but it does not mean that the labor market is turning around. The shortage remains, the situation remains that workers have the choice. So employers will not be able to sit still, according to Simone Groeneveld (HeadFirst Group) and Geert-Jan Waasdorp (Intelligence Group) in an episode of ZiPtalk on the occasion of the tenth Talent Monitor that both companies publish every quarter.

Waasdorp speaks of a "normalization" of labor market. "All data points are at the historical, highest or lowest level. Take, for example, the number of responses to an assignment. That was at the lowest point ever measured. Now there are some more responses again." Still, tightness remains, according to Waasdorp: "We are going from an extremely tight market to a very tight market."

Groeneveld does see important differences in sector. "In the corner of energy transition, of course, an awful lot is happening. There the demand for talent is enormous. And that will only increase in the coming years." In governments, demand is decreasing somewhat. In healthcare, she sees organizations struggling to balance 'permanent and flex' more.

Total talent

That also brings the conversation right to the different forms of work and contract types. The tight labor market is forcing employers to look beyond traditional permanent jobs. Now that the very sharpest edges of the shortage are off, employers may be able to regain a little more control.

Waasdorp and Groeneveld do think it is a must to develop a "total talent strategy. Waasdorp: "An integral, holistic view of organizing human resources, I still see much, much too little of that." The extreme shortage meant that recruiters (permanent) and hiring (flex) did have to work together. Waasdorp does not hope that the slightly decreasing tightness will cause everyone to go back to "their own island."

Data

No strategy without understanding data. Both agreed on that as well. In practice, Groeneveld sees a number of organizations taking steps to have an integrated view of their "talent intelligence.

According to Waasdorp, it can be done. There is more than enough data. But you have to work with it. He advises making someone in the organization responsible for that talent intelligence who does not come from the 'silos' of HR or hiring, but is just outside them. And who understands data analysis.

Listen or watch

Listen/view the episode of ZiPtalk for more tips on 'talent data' and how to use it for a total talent strategy. And catch this week's news as well:

Source: ZipConomy

Who do you need in the future? Convince with data.

Who do you need in the future? Convince with data.

As an HR manager, data analytics can help you in many ways. Paul Oldenburg and Ton Sluiter of HR tech service provider HeadFirst Group shared tips, insights and their own labor market data during Webinar Week.

Without suitable employees, an organization cannot grow. As logical as that sounds, it is often difficult for HR managers to convey that urgency to management. Data can help you do this. How? Paul Oldenburg and Ton Sluiter of HR tech service provider HeadFirst Group told us during Webinar Week.

Methodology from Gartner Group

"You can use data to discover talent risks to business strategy execution and then take action," Oldenburg says. "Based on your strategic goals, you can assess what talent you need to grow your business. Then you map out what your employee base and job market look like, now and in the long term. In this way, you will discover whether you will soon be short of people, what problems that poses, and how to solve them."

HeadFirst Group, for example, uses a methodology from consultant Gartner Group to use data to define, identify and mitigate key risks around strategic workforce planning. "Make it measurable," Oldenburg says. "That helps you speak the language of the board: risk management. That is how you become more relevant as an HR manager, because then it becomes clear that you are talking about concrete steps to secure the future of the company."

Talent risks for organizations

A talent risk is a shortage of suitable personnel to meet your organization's goals, Oldenburg explains. In the webinar, he shows a so-called "risk catalog" of the biggest talent risks for organizations.

Some of the most common risks are:

- Lack of supply of talent

- Labor market competition

- Talent Development

- Pipeline risk (a lack of competencies for the future)

Your organization probably faces several risks. Once you've mapped out the opportunities and impact for each risk, you'll be able to set priorities. Next, you will work to mitigate the most important risks for your organization.

Analysis from HeadFirst Group

Data manager Sluiter then shows in a few slides what data HeadFirst Group analyzes itself. For example, he has an interactive overview of rates for professionals (self-employed or employed by suppliers) in various professional groups. "We have a database containing the rates agreed upon for all assignments," he says. "As a result, we know what a java developer costs on average. We use this kind of insight to inform recruiters. We can also show clients whether they are paying a market-based rate."

HeadFirst Group can also make predictions, as deals are already being signed for future quarters. "For example, we see that the rate for certain professional groups will increase soon," says Sluiter. "In addition, we look at recruitment feasibility. When we put out an assignment, how many people are interested? For example, we know that a full-stack developer is currently less scarce than a java developer."

Meanwhile, HeadFirst continues to expand its database and analyses. "Permanent positions are becoming less relevant, for example, which is why we are developing a method to analyze skills supply and demand," Oldenburg says. "That way we can search and train people even more specifically to be ready for the future."

Want to know more?

Watch the video below. After this webinar, you will know:

- How to convince your organization to invest in workforce planning.

- How to use data to make risk measurable.

- How to compare your organization's workforce planning with others in your industry.

Furthermore, HeadFirst Group invites you to an interactive working lunch at the head office in Hoofddorp. There you will exchange ideas and learn from experts and peers in the field of talent management and risk management. Components of the workshop:

- Set up sample risk catalog

- Establish indicators to make likelihood and impact of these risks measurable

- Identify data sources to report to Business leaders in own organization

Would you like to participate? Share your interest at marketing@headfirst.nl

Source: ZipConomy

Minister Van Gennip comes up with new criteria for hiring zzp

Friday, October 6, the bill 'clarifying assessment of employment relationships and the legal presumption' was made public through an internet consultation. With this bill, outgoing minister Van Gennip (Social Affairs and Employment) wants to replace the DBA law and further clarify the legislation around 'working in the service of'.

Three criteria for self-employment

The minister aims to achieve this clarification with three criteria:

- Work content management

- Organizational embedding

- Working at your own expense and risk

Together, these three criteria determine whether an assignment can be performed by a self-employed person, or whether it is still an employment contract.

Legal presumption of employment contract

In addition, as part of the overall bill, a legal presumption of employment contract is also introduced under the €32.24 rate. This proposal should strengthen the position of vulnerable workers at the base of the labor market. This is a civil law legal presumption that can be invoked by the worker himself. It is not about a minimum rate, but the legal presumption should make it easier for workers to claim an employment contract. The response to this is generally positive.

Reaction to legislative proposal

As an organization, we have good contact with the major zzp organizations and relevant industry associations (ABU, NBBU, VvDN, Bovib and RIM). On Tuesday, October 10, we met directly to discuss the latest developments. Several zzp organizations have already criticized the bill. HeadFirst Group will also respond to this bill itself, by preparing a position paper. Read our reaction to the bill here.

The Internet consultation runs until November 10, 2023. If the cabinet then sticks to this plan, a discussion in the Lower House will follow. Naturally, we will keep you informed of relevant developments.

Bill zzp dossier: repeat of moves

At the beginning of October, outgoing Minister Van Gennip (Social Affairs and Employment) made public the bill "clarifying assessment of employment relationships and legal presumption. The legal presumption of employment under a rate of €32.24 is going to improve the position of vulnerable workers at the base of the labor market. A good proposal that specifically targets the group of working people who deserve more protection. But the proposal to replace the DBA law and the three proposed criteria are not going to provide the needed clarity. In fact, we are heading for the same impasse as in 2016 with the DBA law.

The minister proposes three criteria: 1) what is the work content management like, 2) is there organizational embedding, and 3) does the self-employed person work for his own account and risk. This is merely a ranking of existing case law. The criteria are not sufficiently clearly defined. And it is a missed opportunity that entrepreneurial criteria are not more firmly anchored in the new proposal, even though the House of Representatives has previously expressed a positive opinion on them.

The embedding criterion, which dictates that in principle a self-employed person cannot fill a position that a colleague in permanent employment also performs, is not going to provide the desired clarity. Or worse: many workers who consciously choose self-employment end up in an uncertain situation. The result: a repetition of moves, a gray area and a lot of ambiguity. And if clients, freelancers and intermediaries do not want anything in the current tight labor market, it is unrest.

Tightness in flex market past peak

Rate increase for self-employed and seconded workers lags behind inflation

The scarcity in the labor market - both for permanent and flexible staff - has been severe for years, but in the flex market it seems to have passed its peak. The number of responses from professionals to assignments is rising and the number of assignments without bids is falling. Hourly rates are also rising, but lagging behind inflation with an average increase of 3.7 percent. This is according to the latest Talent Monitor from labor market data specialist Intelligence Group and HR-tech service provider HeadFirst Group.

Increase in flex supply finally squeezes scarcity

The total number of highly skilled self-employed workers has increased by 325,000 since 2018 (+30 percent). In that time, over a hundred thousand seconded workers have also joined the workforce, which together represents a sharp increase in the supply of "flex. From 2020 to 2022, this did not result in less scarcity because demand was enormous. Since this year, that has changed.

Labor market activity, the figure that tells how actively people offer themselves in the labor market, has been rising since the summer of 2022 and even faster since the beginning of 2023. This is reflected in the number of offers per job: it has returned to pre-corona crisis levels. The number of assignments without offers has fallen sharply to below 10 percent.

Geert-Jan Waasdorp, CEO Intelligence Group, explains, "The tightness in the flex market is easing but remains as great as ever. Although the first professional groups are now noticing this turn, the current market is still a huge opportunity for employees to make the step to self-employment - with decent income security. For many organizations, flexible employment remains a solution to the tightness in the permanent labor market."

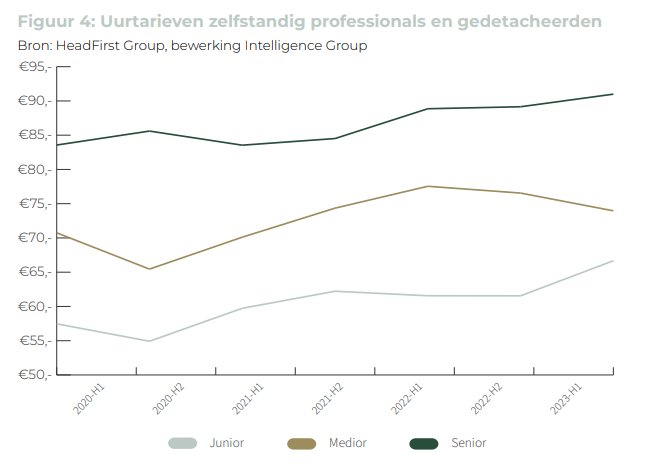

Rate increase lags behind inflation

Rates for highly skilled self-employed and seconded workers continue to rise, up 3.7 percent from the first half of 2022. This falls far short of the rise in inflation. This is another indication that the labor market is becoming less tight.

Rates for junior professionals rose relatively sharply in percentage terms, by 8.3 percent. Motivated, on the one hand, by starting salaries that are rising broadly and, on the other, by the fact that these rates - because they are lower - can rise percentage-wise faster. Marion van Happen, CEO at HeadFirst Group, finds this a striking development: "The trend is precisely that there is proportionately more demand for professionals with experience. Due in part to AI innovations and the flattening of the economy - not to mention the challenges with Generation Z workers - clients prefer mediors and seniors."

More insights into developments in the permanent and flexible labor market? Download the latest Talent Monitor here.

Talent Monitor: The convergence of fixed and flex

The convergence of fixed and flex

In this edition, we take the unique step of comparing rates for permanent and flexible staff, by target group. Which hired professionals are much more expensive than their permanent colleagues? And which ones, on the contrary, are not? An important development towards a full-fledged data model for Total Talent Management.

Tightness in flex market past peak

The scarcity in the labor market - for both permanent and flexible staff - has been severe for years, but in the flex market it seems to have passed its peak. The number of responses from professionals to assignments is rising and the number of assignments without bids is falling. Hourly rates are rising, but lag behind inflation with an average increase of 3.7 percent.

Key findings

- The worst of the tightness seems to be over in the market for highly skilled independent professionals and secondees. The number of offers on assignments is rising and is almost at the level before the corona crisis. The number of assignments without offers is decreasing and moving below 10%. At the same time, we see that labor market activity and sourcing pressure are picking up. All characteristics that "supply" is stirring and is available or coming.

- The number of highly educated independent professionals has increased by nearly 30% in the last five years. This is an explosive increase of about 325,000 people. In addition, over a hundred thousand seconded workers have been added during the same period.

- In the first half of 2023, the rates of highly skilled self-employed professionals and secondment agencies increased by an average of 3.7% compared to the same period in 2022. With this, rates do not follow inflation, self-employed workers lose purchasing power and secondment agencies lose their margin.

- Junior professionals, a group predominantly provided by secondment agencies, became 8.3% more expensive. They are better able to pass on inflation to clients for these juniors, among other things. While clients are actually favoring medior and senior professionals more, due in part to AI innovations, the flattening of the economy and the challenges with Generation Z workers. Nevertheless, in the first part of 2023, mediors took off a "jacket" in terms of rates. This appears to be an offsetting effect from 2022, when an increase of more than 10% was seen. Over two years, this averages out.

- Flexible work has the image of being "expensive. But how much more expensive is flex really? Between the hiring rate and fixed salary (including vacation pay, social and employer expenses) is an average factor between 2.4 and 2.7. As the level of experience increases, the factor increases. In certain very scarce professional groups, such as gardeners or caregivers IG, the factor climbs to almost 4. For psychologists, policy officials and professional groups - where procurement is mostly through SLAs and tenders - the factor is lower to just near or below 2.

Partner

Download Talent Monitor

By downloading the Talent Monitor, you agree that your data will be shared with co-initiator Intelligence Group.

Other reports...

Nothing found.

Budget Day 2023: what's in store?

Last Tuesday was the third Tuesday of September and that means Prince's Day! This year it was a Budget Day in special times. This is because the Rutte IV government is outgoing and for that reason is not allowed to announce grand plans and throw money around. Also, government finances are coming under increasing pressure and most political parties are already gearing up for the Lower House elections in November. In Hague terms: a "policy-poor" budget without too many major decisions. On this page an overview of the most relevant plans and measures.

- SME profit exemption further reduced

The SME profit exemption will be reduced from 14% to 12.7% as of Jan. 1, 2024. The SME profit exemption is a scheme that reduces taxable profits after the entrepreneurial deduction. Entrepreneurs who make use of this scheme will thereby start paying taxes on a larger portion of their profit or income. Entrepreneurs with the highest profits lose the most financially.

- Reduction in self-employment deduction continues

Since 2020, the self-employed deduction has been reduced in steps. In 2024, the deduction will be reduced by an amount of €1280. The self-employed deduction will then come to an amount of €3750. Until 2027, this reduction continues to an amount of €900. This fits into the broader policy of the government to create a more level playing field between employees and the self-employed.

- Increase in untaxed travel reimbursement

The untaxed mileage allowance goes up from €0.21 to €0.23 in 2024. As an entrepreneur, you may deduct this amount from the profit for business trips with a private car, motorcycle or bicycle. As an employer, you may also give your staff a tax-free reimbursement of €0.23 per kilometer. This applies to commuting and other business travel by private vehicle.

- Austerity of Energy Investment Deduction

If you invest in energy-saving measures and sustainable business assets, you may be eligible for the Energy Investment Allowance (EIA). A percentage of the costs of that investment can then be deducted from the profit. As a result, less tax is paid. The EIA for entrepreneurs will be extended until 2028. The percentage that may be deducted does drop from 45.5% to 40% in 2024. The investment is minimum €2500 and maximum €136 million. So it may be wise to make another large investment in 2023 to take advantage of the 45.5% rate.

- Box 1 income from employment, benefits or home ownership

Your income in box 1 is taxed in two brackets. In 2024, you will pay 36.97% tax on your income up to 75,624 euros. That is 0.04 percentage points more than in 2023. On your income above 75,624 euros you will pay 49.5% income tax next year, the same as in 2023. The amount of the bracket limits went up other years by the rate of inflation. This year, the increase is 3.55%. That's less than the inflation rate of 9.9%. You're more likely to pay the higher rate of the second bracket because of this.

- Box 2 stock ownership income

If you own 5% or more of the shares in a company, you have a "substantial interest. You may then receive profit distributions, also called dividends. In 2023, you paid 26.9% tax on this. In 2024, dividends received from substantial interest will be taxed in a two-tier system. On income up to 67,000 euros, you pay 24.5% tax. On everything above that, the rate is 31%.

In 2024, you pay less tax in Box 2 on profit distributions up to about €106,000. On higher profit distributions, you will pay more tax in 2024 than in 2023. So it may be interesting for you to distribute accumulated profits in the company still in 2023. It may be interesting for you to distribute accumulated profits in your company still in 2023. Consult with your advisor. Note: After a dividend distribution, you have money and investments in private. It is then capital in box 3. There is a tax-free capital of 57,000 euros in box 3. If the value exceeds this exemption, you pay tax on this in box 3.

- Income-related health insurance law contribution

As an employer, you pay an employer healthcare insurance law levy on employees' wages. In 2024, this contribution is 6.57% over a maximum of €71,624. In 2023, the contribution was still 6.68% over a maximum of €65,952. This income-related healthcare insurance law contribution is part of the payroll tax.

On the entrepreneurial income, you pay the income-related health insurance law contribution yourself. For this, a rate of 5.32% on the maximum contribution income of €71,624 applies in 2024. The rate in 2023 was 5.43%. You will receive the (provisional) assessment for the income-related healthcare insurance act contribution at the same time as the (provisional) tax assessment.

- Further develop legislation and strengthen enforcement

Officials at the Ministry of Social Affairs and Employment continue to work on the bill to have a clearer distinction between self-employed workers and employees. This bill covers the criteria of "authority," "embedding," and "self-employment. It is expected that within now and a few weeks the draft bill will be published through an Internet consultation. The Tax Administration will also continue to work towards lifting the enforcement moratorium in order to improve the enforcement on false self-employment.

Finally, work continues on the legal presumption of employment below a certain hourly rate (between €30 and €35 per hour). Should a worker earn less than this hourly rate, there is a legal presumption of employment. It is then up to the worker to prove that this is not the case.

IRS puts an end to 'free substitution' model agreement

Earlier this week, the Internal Revenue Service shared the notice that the approval of model agreements based on free substitution will be withdrawn as of Jan. 1, 2024. This decision is in response to their interpretation of the Supreme Court's ruling in the Deliveroo case. The Supreme Court ruled that only 'free substitution' can constitute employment. Clients and contractors should reassess the employment relationship before then if model agreements based on free substitution are used.

There are different types of model agreements that have been approved by the tax authorities in recent years. The use of an (approved) model agreement is not mandatory, it gives parties a certain degree of certainty that - if parties also behave in accordance with what is agreed in the model agreement - there is no question of false self-employment.

The Inland Revenue's decision does not affect working on an assignment through any of HeadFirst Group's labels. We use approved model agreements based on intervention. The criterion 'free substitution' is part of this model agreement, but not leading.

Duration of salaried employment grows toward duration of flex assignments

Whereas employees are employed for shorter and shorter periods, the length of the first assignment contract of independent professionals and secondees is actually increasing. Thereby, the percentage of assignments that are extended after this first contract is also growing. This is evident from the latest Talent Monitor of labor market data specialist Intelligence Group and HR - tech service provider HeadFirst Group.

Fixed more mobile, flex more sustainable

The number of years people are employed by the same organization is decreasing rapidly. On average, a person works for an employer for less than five years. Compared to 2015, this is a decrease of more than three years, when people stayed with an employer for an average of eight years. Looking at the flexible labor market, the average duration of an initial assignment of independent professionals and secondees was 205 days in 2022. For secondees, this was just slightly lower at 202 days, while for assignments of independent professionals it was a week longer at 209 days. For both groups, initial assignment duration has been increasing since 2020 and is now almost 3 weeks longer on average.

Geert-Jan Waasdorp, director and founder of Intelligence Group: "In the trade-off between permanent and flex, the differences in duration are getting smaller, but the differences in risk are getting bigger. Especially because of the greatly increased mobility and absenteeism. In some cases, job security for employers has become greater at the point when they turn to the flexible labor market than when they fall back on employed people, with or without a permanent contract."

Assignments increasingly extended

In addition, more than the majority of assignments are extended, with an average extension often around 6 months. In 2020, 63 percent of assignments were extended. That dropped to 56 percent in 2021, before "recovering" to 61 percent in 2022. Extensions, especially more frequent ones, also show an increase in the length of extensions compared to previous years.

Assignments - with or without extension - averaged 395 days in 2020. This duration is getting closer to the declining average of the duration that a young person up to 25 years is employed by an employer, which is now well under three years. Marion van Happen, CEO HeadFirst Group: "Never before in our Talent Monitors have we seen permanent and flex come closer together so concretely AND never before have we seen that substantiated, data-driven Total Talent Management is not just a trendy term, but a business-critical necessity."

The full Talent Monitor 'Fixed is getting more mobile and flex is getting more sustainable' can be read here.

HeadFirst Group strongest grower in Flex Market Turnover Ranking 2023

HeadFirst Group has again taken the second spot in the prestigious Flexmarkt Turnover Ranking Top-100 in 2023. In fact, with revenue growth in the Netherlands for the year 2022 of €298.8 million, the HR-tech service provider is, in absolute numbers, the biggest grower in the list. "The fact that we achieved this largely organically by successfully serving existing and new clients makes me very proud," said CEO Marion van Happen.

For the year 2021, HeadFirst Group still recorded a Dutch turnover of 1,627.2 million euros. In 2022, that rose to 1,926 million, a growth of over 18%.

Van Happen: "We are accelerating our digital transformation. By deploying tech smartly, we create that colleagues have personal contact at the times when it really adds value for our customers (clients, suppliers and professionals alike). In this way we are working towards the ultimate customer journeys with high customer satisfaction. This has already visibly borne fruit in 2022. In 2023 and the years after, we will continue full steam ahead with this strategy."

All annual figures

Earlier this year, HeadFirst Group presented its annual results, including foreign divisions, presenting record revenues of 2.2 billion. HeadFirst Group's annual report can be read and downloaded on the Investor relations page.

About Flexmarkt Turnover Ranking Top-100

The Flexmarkt Turnover Ranking Top-100 is a leading ranking of flex companies, from small to large, offering a variety of services in staffing and hiring. In addition to staffing agencies, it includes numerous payroll companies, as well as secondment companies, zzp intermediaries and MSP service providers. The list is published annually by Flexmarkt in cooperation with Corporate Finance International (CFI). In terms of turnover, it covers more than half of the total Dutch flex industry and thus provides a clear, representative picture of developments in the market.