Talent Monitor | European self-employed under the microscope: Trends, growth & diversity

European self-employed under the microscope: Trends, growth & diversity

The European labor market is in flux. With nearly 20 million self-employed spread across several countries, there are big differences in how this group develops. The Netherlands leads the way with unique trends in flexible work, but how do we compare to the rest of Europe?

The Talent Monitor offers an in-depth analysis of the European self-employed market, sharing insights you shouldn't miss.

Increasing number of self-employed people under 30 in the Netherlands, Belgian numbers actually decreasing

Over the past five years, the number of self-employed people under 30 in the Netherlands has increased significantly, accounting for 12.7 percent of the total number of self-employed people in our country. This places the Netherlands among the top European countries, along with countries such as Malta, Slovakia and Lithuania. In contrast to the Netherlands, Belgium - at almost 4 percent - has actually seen a decline in the number of young self-employed people. This is shown in the most recent Talent Monitor, a joint study by labor market data specialist Intelligence Group and HR-tech service provider HeadFirst Group.

What can you expect in this report?

- A unique comparison between the Dutch labor market and the rest of Europe.

- Find out why older and highly educated self-employed people dominate, and why younger people are less likely to become self-employed.

- Analysis of the growing role of women in the self-employed market and its link to emancipation.

Who should read this report?

- Legislators: To place the Dutch labor market in a broader European perspective.

- Clients with international ambitions: To develop an effective European recruitment strategy.

- Zzp'ers: To understand how unique the Dutch zzp is compared to other European countries.

Partner

Download Talent Monitor

By downloading the Talent Monitor, you agree that your data will be shared with co-initiator Intelligence Group.

Other reports...

Talent Monitor: update forecast rate development professionals 2022

We compile quarterly - based on recruitment data from...

Talent Monitor: Zzp'ers: protect or set free?

We compile quarterly - based on recruitment data from...

Talent Monitor: Forecast rate development professionals 2022

We compile quarterly - based on recruitment data from...

Talent Monitor: Hyperscarcity in the labor market

We compile quarterly - based on recruitment data from...

Increasing number of self-employed people under 30 in the Netherlands, Belgian numbers actually decreasing

Over the past five years, the number of self-employed people under 30 in the Netherlands has increased significantly, accounting for 12.7 percent of the total number of self-employed people in our country. This places the Netherlands among the top European countries, along with countries such as Malta, Slovakia and Lithuania. In contrast to the Netherlands, Belgium - at almost 4 percent - has actually seen a decline in the number of young self-employed people. This is shown in the most recent Talent Monitor, a joint study by labor market data specialist Intelligence Group and HR-tech service provider HeadFirst Group.

Older people dominate self-employed market in Europe

In the European Union (EU-27), nearly one-third of self-employed workers are 55 or older (31.7 percent). This group is more than three times larger than the group under 30. The percentage of over-55s is especially large in Sweden (55.1 percent), Germany (47.5 percent) and Ireland (46.9 percent). Geert-Jan Waasdorp, director and founder of Intelligence Group, explains, "In these countries, where traditional permanent jobs are often associated with high status, being self-employed may be a final career step or a way to make room for a new generation. This trend is partly explained by an aging population, but cultural factors also play a role."

Over the past decade, the number of 55-plus self-employed has grown 1.4 percent annually. The growth of self-employed people under the age of 30 was slightly faster in the last five years: 1.7 percent annually. At 0.7 percent, the increase in the Netherlands was below that average. During this period, the number of young self-employed people declined rapidly in Belgium (-3.8 percent). A decrease was also visible in Bulgaria, Estonia, Latvia and Slovenia, there even by more than 6 percent. The highest percentage of young self-employed can be found in Malta (14.7 percent), followed by Slovakia, Lithuania, Iceland and the Netherlands (12.7 percent). Despite the increase, the number of young people opting for self-employment in Europe remains relatively small relative to the total labor force.

Stable self-employed market in Europe

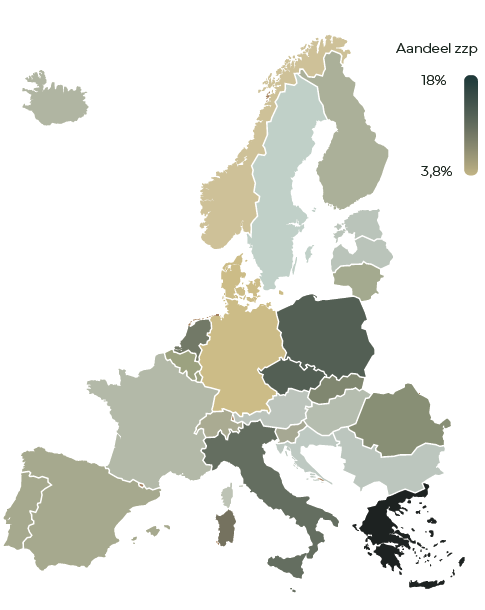

Europe currently has nearly 20 million self-employed workers, representing 8.8 percent of the total labor force. Whereas the Dutch self-employed market has been growing by at least 1.4 percent for years, the share of self-employed in Europe remains fairly stable. Countries such as Hungary and Switzerland have seen significant growth, while countries such as Romania and Germany have seen a decline in the number of self-employed. Greece has the highest percentage of self-employed, with nearly 18 percent of the labor force. Norway has the lowest percentage, with only 3.8 percent. Differences in percentages include cultural preferences for self-employment and tax schemes that encourage entrepreneurship in certain countries.

Marion van Happen, CEO of HeadFirst Group, says: "These figures confirm that the Dutch labor market has a unique position within Europe. This insight helps international clients who want to fine-tune their recruitment strategies and freelancers who want to gain insight into the unique characteristics of their field in the Netherlands compared to other European countries. But also for policymakers and politicians to put the labor market in a broader European perspective, which we also recently mappedspecifically for zzp legislation."

The full report is available for download at headfirst.group.

Tighter, frugal, fast: what will change for the self-employed in 2025?

Anyone who listened to the Speech from the Throne live will undoubtedly have noticed King Willem-Alexander's length and tone. For example, he summarized the cabinet plans for 2025 as "strict, austere and fast. The labor market was also mentioned: the cabinet wants to make efforts to solve the shortage in various ways. Wage employment must become more attractive and everyone must have the opportunity for lifelong development through retraining and further education. But what about the self-employed? We list the most important plans and changes.

Taxes for the self-employed

Self-employed people will pay slightly more tax on average in 2025 if their profits remain the same. This is due to a number of changes in taxes. For example, the self-employment deduction will be further reduced to €2,470 per year in 2025. In 2024, this was the self-employment deduction was still €3,750. Reducing the self-employment deduction is intended to ensure a fiscally level playing field between the self-employed and employees.

Furthermore, as an entrepreneur in the income tax, you are entitled to the SME profit exemption. This exempts part of your profits from income tax. The plan was to reduce the exemption from 2025 to 12.07% (previously this percentage was 13.31). Nevertheless, the percentage in 2025 drops slightly less, to 12.7%.

These adjustments ensure that entrepreneurs have to pay taxes on a larger portion of their profits. At the same time, the cabinet is trying to support low incomes by, for example, increasing the rent allowance and the child-related budget.

Box 1: Income from employment, benefits and home ownership

The classification of Box 1 will be changed to three brackets instead of two. The distribution of the brackets and percentages is as follows:

- On income up to €38,441, you will pay 35.82% tax, which is lower than in 2024.

- On income between €38,441 and €76,817 you will pay 37.48%, a slight increase from 2024.

- For income above €76,817, the rate remains 49.5%.

Lower incomes benefit from the lower rate in the first bracket, while higher incomes pay more tax due to the higher rate in the second bracket.

Box 2: Income from stock ownership

Are you operating in a private limited company? If so, the bv must pay corporate income tax each year. Do you have more than 5 percent of the shares and also work in this bv? Then you are a director-large shareholder (DGA). As a DGA, you face taxation in box 2 of the income tax. In 2025, the following changes will be made:

- On dividends up to €67,804, you pay 24.5%, equal to 2024.

- On dividends above €67,804, the rate drops from 33% to 31%.

If the rate in Box 2 goes down in 2025, it may be more attractive for entrepreneurs to wait to pay dividends.

Box 3: Income from savings and investments

Do you have savings or investments? Then you will pay no tax on your assets up to €57,684 in 2025. Do you have more assets? Then, just like this year, you will pay 36 percent tax on the return the tax authorities expect you to make in 2025. We call this a notional return.

No deductibility of donations in corporate taxes

As of Jan. 1, 2025, donations to charities are no longer deductible from corporate income tax (vpb). This applies to donations to non-profit organizations (ANBIs) or support foundations SBBI. Gifts by a company to an ANBI at the request of a shareholder with a substantial interest are considered a profit distribution, on which income tax (box 2) and dividend tax must be paid.

Emission-free cars: discount on road tax

The government is encouraging the switch to emission-free cars with rebates on motor vehicle tax (mrb) until 2029. The scheme is as follows:

- From 2026 to 2029, a 25% discount applies;

- Starting in 2030, this discount will expire.

Evaluation of tax entrepreneurial schemes

Over the past six months, an evaluation of several tax entrepreneurship schemes, such as the self-employment deduction and SME profit exemption, has been conducted. Research firms SEO and Dialogic, commissioned by the Ministries of Finance and Economic Affairs, concluded that these schemes have limited effectiveness in stimulating entrepreneurship and social benefits. While no firm conclusions on effectiveness could be drawn, they found that the cost of the schemes is relatively high relative to their effectiveness. This raises questions about possible reforms of these schemes.

Status of legislative proposals

The above cabinet plans are part of the 2025 Tax Plan. The measures are contained in several bills. The Lower and Upper Houses must still approve the bills before the plans can take effect. They will vote on the Tax Plan 2025 in November and December.

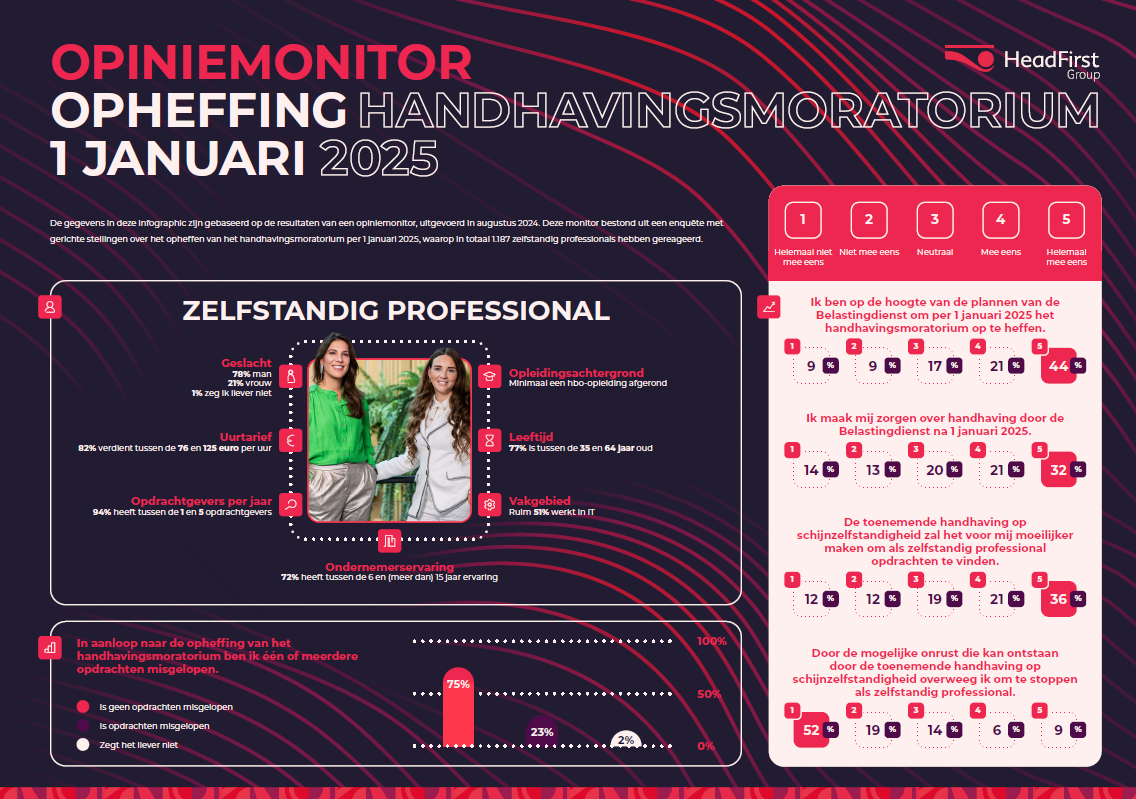

Quarter of zzp'ers are already missing out on orders due to approaching enforcement of false self-employment

Highly educated self-employed people expect it to become increasingly difficult to find assignments and already experience that they miss out on assignments due to the approaching enforcement on false self-employment. This is evident from research by HR-tech service provider HeadFirst Group, to which 1,187 self-employed workers shared their experiences and opinions. On Thursday, September 12, a zzp-debate is planned in the Lower House, in which enforcement on false self-employment is an important item on the agenda.

The Cabinet sent a letter to the House of Representatives on Friday, Sept. 6, announcing, among other things, that it intends not to impose penalty fines on principals for the first year. Marion van Happen, CEO of HeadFirst Group, calls this a small step in the right direction: "Just like us, the government notices that clients - both in the profit and non-profit sector - are becoming more cautious in hiring self-employed workers and is taking the first measures to that end. It is positive that they are picking up these signals, taking them seriously and taking action on them, but this is still insufficient to restore and maintain peace in the labor market. We therefore recommend retaining the instrument 'indications' after January 1, 2025, so that client and contractor have time to adjust the employment relationship after advice from the Tax Office."

Reticence among clients

The survey found that about 25 percent of highly educated self-employed workers lost one or more assignments in the run-up to the lifting of the enforcement moratorium. In addition, 57 percent expect it to become more difficult to find assignments in the future due to stricter enforcement.

Van Happen says: "This confirms that clients are becoming more cautious in hiring self-employed workers. We experience in practice that clients have difficulty in properly assessing when a self-employed person may be hired. This leads to risk-averse behavior and fewer assignments for self-employed workers. That should not be the side effect of enforcement on false self-employment."

Awareness and need for greater clarity

The survey also shows that the 65 percent of respondents are (very) aware of the lifting of the enforcement moratorium. At the same time, in their open-ended responses, hundreds of respondents expressed a need for more consistent and specific information that would help them properly prepare for these changes. "It is now up to the parties involved to provide clear information and properly inform both principals and self-employed workers. Fortunately, the September 6 parliamentary letter shows that the cabinet recognizes the importance of clear communication and that a government-wide public campaign is in preparation, to be launched at the end of September. As a leading market party, we will also take our role in communication," Van Happen concludes.

Mandatory disability insurance for self-employed workers

The Internet consultation on the bill Basic Disability Insurance for the Self-employed (BAZ) generated a flood of responses. What should you know about the plans to introduce compulsory disability insurance for self-employed workers?

Why will there be a mandatory AOV?

The introduction of a mandatory AOV for self-employed workers stems from a proposal by the Labor Foundation. In fact, in June 2019, an agreement was reached between trade unions, employer organizations and the Cabinet. Part of this agreement was the introduction of a compulsory AOV for self-employed workers. i The purpose of this scheme is to protect self-employed workers against loss of income in case of disability. What many people do not know is that the compulsory AOV is a condition for receiving financial resources from the European corona recovery fund. The legislation must be passed by 2025, but implementation is not expected until between 2027 and 2029.

What does mandatory AOV entail?

The mandatory AOV is likely to have the following features:

- The compulsory AOV will cost a maximum of €195 per month; One year waiting period before benefits start100% of the legal minimum wage in case of full disability, with a maximum of 70% of last earned income or profit.

- Until state pension age for permanent disability.

- A stability contribution will be collected from private insurers (solidarity premium)

- Disability is assessed based on residual earning capacity in all occupations, not just one's own.

For whom will the AOV become mandatory?

The mandatory AOV will apply to all entrepreneurs who pay income tax, also known as IB entrepreneurs, including collaborating partners. Exceptions are likely for director-major shareholders (DGAs) and part-time entrepreneurs who work as self-employed workers in addition to salaried employment. Having employees or sufficient assets are not reasons not to participate in mandatory AOV.

What if the self-employed person already has an AOV or prefers to take out one himself?

There have been long discussions in the polder about an "opt-out arrangement" for self-employed persons who prefer to take out their own private insurance. The bill includes this possibility, but under the condition that the private insurance has at least the same conditions as the compulsory public insurance. Other provisions such as endowment circles or Brood Funds will not be sufficient to obtain exemption from compulsory AOV.

"Put entrepreneurship and desire of self-employed and client central"

What the Netherlands can learn from other countries about zzp legislation

The distinction between a zzp'er and an employee is not only an issue for the Netherlands, the discussion also plays out in other countries. In a new report, HR-tech service provider HeadFirst Group, ONL for Entrepreneurs and independent platform ZiPconomy present valuable lessons that the new cabinet and Dutch politicians can learn from other Western countries. "There are countries where the 'will of the parties' plays an important role and where entrepreneurial criteria outweigh circumstances during the assignment. It is a missed opportunity for the Netherlands if we do not value these factors," said Marion van Happen, CEO at HeadFirst Group.

Developing new laws and regulations around self-employment in the Netherlands is an urgent task for Eddy van Hijum, the new Minister of Social Affairs and Employment (SZW). When are organizations allowed to hire self-employed workers and when must they offer an employment contract? This question occupies policymakers and governments worldwide. The research report 'International perspective on zzp legislation. What the Netherlands can learn from other countries' offers in-depth insight into the solutions and approaches used in other countries.

Greater focus on entrepreneurial criteria and the individual

The Netherlands can learn a lot from the experiences of countries such as Belgium, Germany, Canada and the United States (US). "As an international HR-tech service provider, we are confronted daily with a variety of laws and regulations," says Marion van Happen, CEO of HeadFirst Group. "These experiences offer the Netherlands valuable insights. In Belgium and Germany, for example, the focus is first on entrepreneurial criteria and the identity of the worker. That is a fundamentally different approach than the one we know in the Netherlands."

No one-size-fits-all

"The report shows that there is no one-size-fits-all solution," said Erik Ziengs, president of ONL for Entrepreneurs. "It is important to learn from the experiences and solutions in other countries. This report invites a robust political-social discussion about the role of the self-employed in the labor market and our perception of this group of workers."

In doing so, there must be sufficient room for the wishes of the workers themselves, according to Ziengs and Van Happen. After all, several studies show that the vast majority of self-employed people consciously choose entrepreneurship, driven by autonomy and control over their own working day. Van Happen: "In Canada and Belgium, the 'will of the parties' plays an important role in assessing the employment relationship. It would be a missed opportunity if we do not value this factor in the Netherlands."

Ziengs adds: "If self-employed people charge a solid hourly rate, keep good financial records and proactively recruit new business, they deserve the freedom that entrepreneurship offers."

The new report can be downloaded here.

From VAR, through DBA to VBAR: what clients need to know in 2025

As a client, do you hire self-employed workers? Then pay attention! As of 2025 something is going to change: the so-called enforcement moratorium will expire on January 1, 2025. What does this mean? You can read it here.

From January 1, 2025, the Tax Administration will enforce more stringently on false self-employment. It will also be possible for the Tax Office to immediately impose additional levies and corrections on both client and self-employed person if there is false self-employment. But why is the enforcement moratorium coming to an end? And after the abolition of the VAR and DBA, how did we get to this point?

The DBA law

The Deregulation of Assessment of Employment Relationships Act (DBA) replaced the VAR and aims to address false self-employment and provide clarity about the employment relationship between client and contractor. Both parties are responsible for the tax consequences in case of employment. However, the DBA law did not bring the expected peace and clarity, leading to an enforcement moratorium. Previous cabinets have decided to replace the DBA law.

What was the Declaration of Employment Relationship (VAR) again?

The VAR, introduced in 2005, exempted clients from employer obligations when hiring self-employed workers. Due to concerns about false self-employment, the VAR was abolished in 2016 and replaced by the DBA law.

Why is the DBA Act so important?

The DBA Act prevents self-employed workers from actually working as employees without the rights and obligations of employees. As a client, you must be able to prove that the self-employed person works independently and is not under your direct management or supervision.

What does this mean for you as a client?

Laws and regulations are constantly changing. Find out how this affects your external hiring. Our experts are ready for you - leave your details and we'll get back to you.

Questions about this? Please contact us.

Sem Overduin

Public Policy & Affairs Manager

Sem.Overduin@headfirst.nl

Oifik Youssefi

Public Affairs Officer

Oifik.Youssefi@headfirst.nl

Maaike van Driel

Head of Legal

Maaike.vanDriel@headfirst.group

Thomas ten Veldhuijs

Senior Legal Counsel

Thomas.tenVeldhuijs@headfirst.nl

Self-employed must remain flexible with mandatory disability insurance

On Tuesday, June 11, outgoing Minister Van Gennip (SZW) put the Basic Disability Insurance Act for the Self-employed (BAZ) online for consultation, so everyone can give their opinion on the bill. HeadFirst Group supports the idea of a disability insurance (AOV) for all self-employed people, but stresses that choices are very important in this.

The mandatory AOV for the self-employed is going to cost a maximum of 195 euros per month and offers a benefit of 70% of earnings before disability, up to a maximum of the minimum wage. This benefit continues until the state pension age. The law also offers the possibility of an opt-out, allowing the self-employed to choose to insure themselves privately, as long as that insurance meets a few minimum conditions.

Opt-out option in bill

HeadFirst Group is pleased that the bill offers this option. In previous conversations with stakeholders and in our communications, we have emphasized that self-employed people really appreciate this opt-out. Mandatory AOV is important to protect vulnerable self-employed workers and offer them security. At the same time, we should not forget the diversity of the self-employed population, with their diverse assignments, motivations and rates.

It is good to see that outgoing Minister Van Gennip and her policy staff have taken this into account. We hope that the new Minister of SZW and his team will continue in the same way. We also want to emphasize that the desire for an opt-out option among the self-employed comes from the fact that more and more self-employed (41%, ZEA 2023) have, on their own initiative, built up or invested a financial reserve for their old age. This shows that the self-employed are aware of the balance between autonomy and responsibility: they value freedom and flexibility, but also know that they need to think ahead financially.

Anyone can comment on the bill until July 23, 2024. After that, all reactions will be analyzed and adjustments will be made where necessary. The bill will then go to the Council of State and then to the House of Representatives.

Compulsory disability insurance bill in Internet consultation

Outgoing Minister Van Gennip (SZW) earlier this week launched the Basic Disability Insurance for Self-Employed Workers Act (BAZ) into Internet consultation. The BAZ originated from a proposal by the Labor Foundation and is part of a broader labor market reform package. Lengthy negotiations took place on the desirability, feasibility and criteria of this disability insurance for the self-employed. Van Gennip has now decided to take the next step in the process by putting the bill into Internet consultation so that stakeholders, market participants and self-employed organizations can provide their feedback.

The AOV is based on three principles: affordability, comprehensibility and enforceability. The law is designed as follows:

- The new insurance will be mandatory for all self-employed people who enjoy "profits from business" for income tax purposes.

- Self-employed people who have been sick for a year (called the waiting period) may be eligible for disability benefits.

- Self-employed people receive this benefit if they are no longer able to earn the minimum wage due to illness. This is different from workers' compensation insurance, which looks not only at what a person is still able to do, but also at what a person previously earned.

- The benefit amounts to 70% of earnings before disability, up to a maximum of the minimum wage. This benefit continues until the state pension age.

- Self-employed people pay about 6.5% of their business profits in premiums, with a maximum of about €195 per month, based on the 2024 minimum wage. The premium is tax deductible.

- Self-employed persons who find this safety net insufficient, prefer private insurance or already have disability insurance can opt out. The private insurance must meet a number of minimum conditions: the disability benefit may not be lower than that of the public insurance, the premium must be at least equal to that of the public insurance, and the insurance must continue until the state pension age. There will be transitional law for existing insurance.

HeadFirst Group is pleased with the possibility in the current bill to take out private insurance for themselves. In previous conversations with stakeholders and in our external communications, we have emphasized that self-employed people value this opt-out. It is positive to see that Van Gennip and her policy staff have taken this into account.

Interested parties can comment on the bill here until July 23, 2024. After that, all reactions will be analyzed and, where necessary, incorporated into adjustments. The bill will then go to the Council of State and will then be debated in the House of Representatives.

'There's no way half of self-employed people are sham self-employed'

Recently the Financieele Dagblad paid attention to the abolition of the enforcement moratorium and the fiscal and employment risks for zzp'ers and clients. These concerns are justified, because also at HeadFirst Group we notice an increasing number of questions from clients about this issue. Labor law and tax are significant risks, so good information is crucial. At the same time, we need to keep the peace, support each other, keep hiring genuine self-employed workers and encourage compliant behavior. I noticed in the FD article that there are misunderstandings about the number of false self-employed and that wrong figures are presented. As the CEO of an HR-tech service provider, I feel compelled to respond based on facts and objective research. This is because the claim that "half of all self-employed people may be a false self-employed person" is unfounded.

Dutch politicians and politicians have been working for quite some time on policies to make a clearer distinction between employees and the self-employed. It is important to conduct this discussion on the basis of facts and figures, because only then can we together arrive at feasible policies that really work. We contribute to this discussion by conducting research with partners such as ZiPconomy, ONL for Entrepreneurs and SEO Economic Research.

Facts and figures on self-employed population

In our recently published 'Grip op het zzp-dossier' we describe the zzp-population working in the Netherlands. This group is heterogeneous, diverse and active in the labor market in all shapes and sizes. Based on these figures, I can tell you one thing: it is impossible that half are sham self-employed. Of the approximately 1.2 million self-employed in the labor market, over 270,000 sell products. By definition, these fall off as sham self-employed. In addition, a large group of self-employed workers, about 329,000, offer their labor to individuals. They also fall off as sham self-employed.

Zooming in further on the self-employed who offer labor to organizations, we see a large group that has many clients per year and does short-term assignments. This group is actually growing compared to the group doing longer assignments with few clients per year. In 2023, 65% of the self-employed who provide their own labor had more than four clients per year. In 2021, this percentage was still at 58%. That leaves about 210,000, which is about 17.35% of the total. Even in this group, not everyone is a sham self-employed person.

In addition, I continue to be puzzled by the discussion about the sustainability and affordability of the social security system. Earlier we commissioned SEO Economic Research to map the social and economic value of independent professionals (those who fall into the category with fewer clients per year). The figures do not lie: government, business and workers themselves all see positive results. Although less premiums are paid, this is more than offset by higher tax revenues.

Road to a workable solution

Finally, I am aware of the different interests and perspectives regarding the self-employed dossier. At the same time, surveys show time and again that the majority of self-employed people choose entrepreneurship very consciously, are satisfied with their working conditions and are happy to dedicate themselves to the Dutch labor market and economy. Although there are free birds and outlaws among them, it does not help to state that half of them are pseudo self-employed; this does not contribute to a constructive discussion or workable solution. The legal presumption of employment below an hourly rate of €32.24 is an excellent proposal to better position vulnerable workers at the base of the labor market. In an earlier opinion piece I already called for the bill 'clarification of assessment of labor relations and legal presumption' to be cut up and for the legal presumption to be dealt with quickly in the Lower House. After all, there is broad support for it in both the polder and the field. In addition, we must sit down together to formulate clear entrepreneurial criteria, so that self-employed workers and clients get the clarity and recognition they deserve.